Suffolk New York Credit Inquiry is a process by which lenders or financial institutions access an individual's credit report to evaluate their creditworthiness and determine if they qualify for a loan or credit. It helps lenders assess the risk associated with lending money to an applicant and make informed decisions. There are primarily two types of Suffolk New York Credit Inquiries: hard inquiries and soft inquiries. 1. Hard Inquiries: A hard inquiry occurs when an individual applies for credit, such as a loan or credit card. These inquiries are initiated by the individual and are visible to other lenders on their credit report. Multiple hard inquiries within a short time period may negatively impact the individual's credit score as it may indicate a higher credit risk. 2. Soft Inquiries: Soft inquiries occur when an individual checks their own credit report, or when a potential employer or current creditor reviews their credit history. These inquiries do not impact the credit score and are not visible to other lenders. Credit inquiries play a significant role in determining an individual's credit score. It is essential to manage and monitor credit inquiries to maintain a healthy credit profile and ensure favorable lending decisions in the future. In Suffolk New York, individuals can check their credit reports from various credit bureaus, including Equifax, Experian, and TransUnion. It is advisable to regularly review credit reports to identify any unauthorized inquiries or errors that could negatively impact creditworthiness. Whether it is a hard or soft inquiry, individuals should be aware of their rights and confidentiality regarding credit inquiries. Lenders must follow the Fair Credit Reporting Act guidelines while accessing an individual's credit information, ensuring privacy and protection from unauthorized access. In conclusion, the Suffolk New York Credit Inquiry process determines an individual's creditworthiness, helping lenders assess the risk associated with providing credit. Understanding the different types of credit inquiries and monitoring credit reports are crucial for maintaining a good credit score and making informed financial decisions.

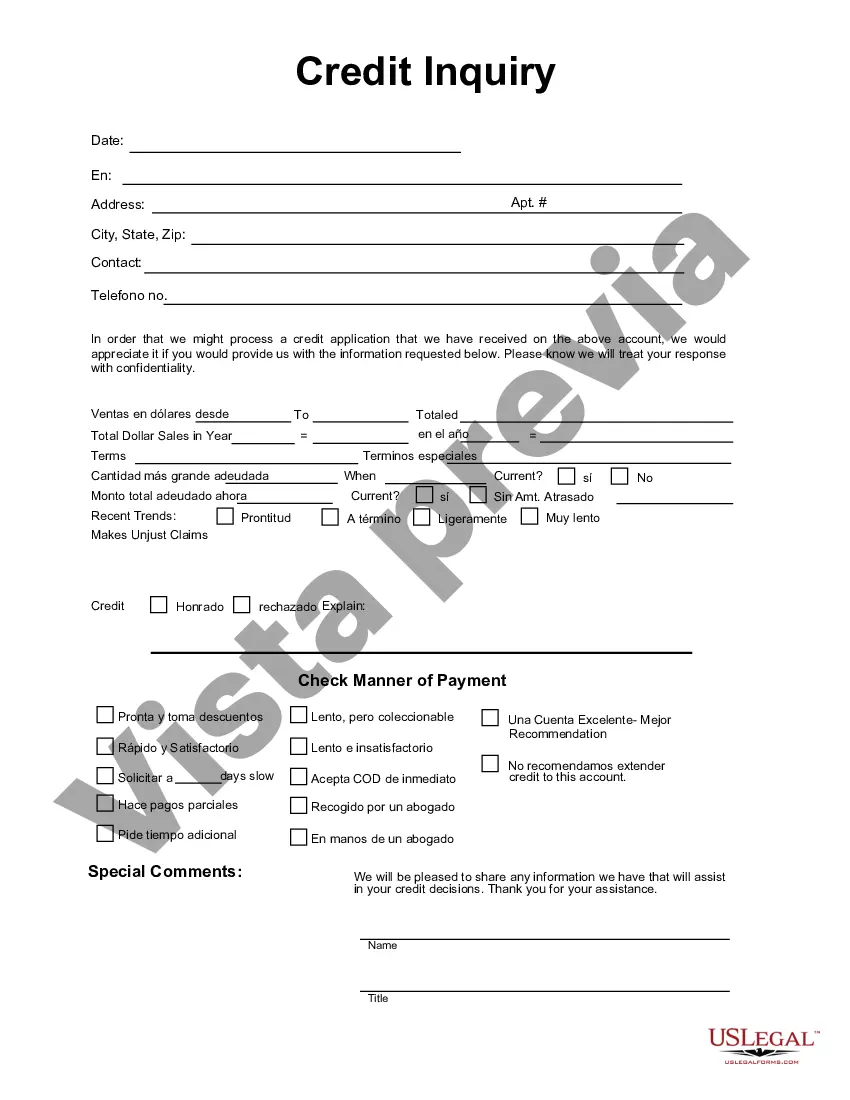

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Consulta de crédito - Credit Inquiry

Description

How to fill out Suffolk New York Consulta De Crédito?

Draftwing forms, like Suffolk Credit Inquiry, to take care of your legal affairs is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. However, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various scenarios and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Suffolk Credit Inquiry template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Suffolk Credit Inquiry:

- Make sure that your form is specific to your state/county since the rules for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Suffolk Credit Inquiry isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start using our service and download the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!