Nassau New York Daily Accounts Receivable refers to the financial records of money owed to a business or organization on a daily basis within Nassau County, New York. It involves tracking the amounts receivable from customers or clients for goods sold or services rendered. This crucial financial function helps gauge the company's cash flow, manage outstanding balances, and ensure timely payment collection. Keywords: Nassau New York, Daily Accounts Receivable, financial records, money owed, business, organization, Nassau County, tracking, receivable, customers, clients, goods sold, services rendered, cash flow, outstanding balances, payment collection. Different types of Nassau New York Daily Accounts Receivable: 1. Customer Invoices: These are issued to customers or clients for goods or services provided on credit. The invoices detail the quantities, prices, payment terms, and due dates, serving as a formal request for payment. 2. Payment Processing: Accounts receivable personnel handles the processing of customer payments received, including checks, credit card transactions, or electronic fund transfers. They ensure the accurate and timely recording of received payments. 3. Aging Reports: These reports categorize customer balances based on the number of days outstanding. They provide a snapshot of accounts receivable as per their age, helping identify overdue or high-risk accounts that require additional attention for collection. 4. Customer Communication: Maintaining regular communication with customers is vital for managing accounts receivable effectively. This includes sending payment reminders, following up on outstanding balances, resolving disputes or discrepancies, and negotiating repayment plans when necessary. 5. Bad Debt Management: When customers default on payment or become uncollectible, it leads to bad debt. Accounts receivable professionals need to identify and handle such cases, categorize them appropriately, and potentially seek legal or collection agency assistance for recovery. 6. Reconciliation and Reporting: Regular reconciliation of customer accounts, ensuring all payment records match the invoices and other documents, is necessary to maintain accuracy. Additionally, generating reports summarizing accounts receivable status, aging trends, and collection performance is essential for financial analysis and decision-making. Keywords: Customer Invoices, Payment Processing, Aging Reports, Customer Communication, Bad Debt Management, Reconciliation, Reporting, collection performance, payment reminders, uncollectible, legal assistance, financial analysis. Nassau New York Daily Accounts Receivable play a critical role in maintaining the financial stability of businesses or organizations in Nassau County, New York. By efficiently tracking, managing, and collecting receivables, companies can optimize their cash flow, minimize bad debt, and ensure a healthy financial position.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Cuentas por cobrar diarias - Daily Accounts Receivable

Description

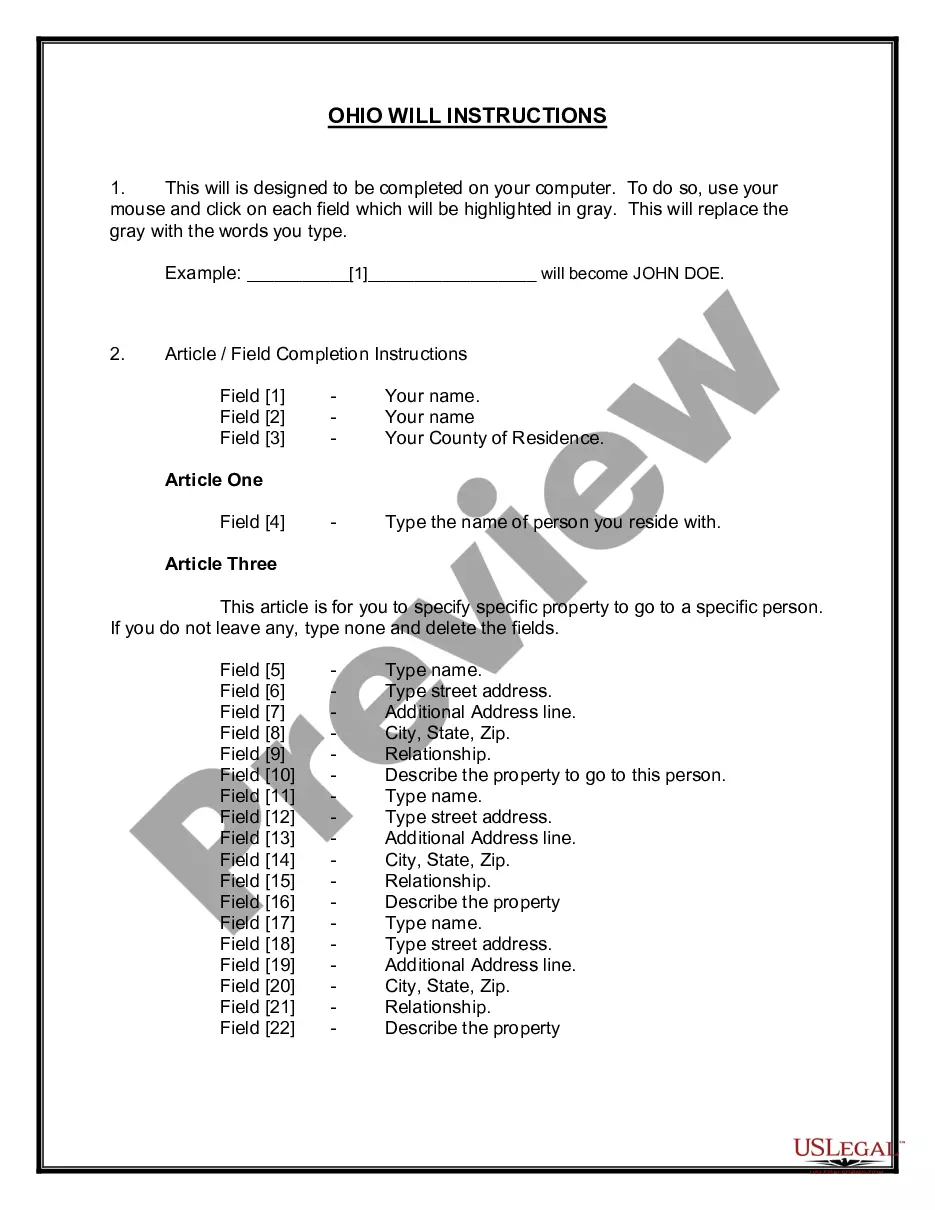

How to fill out Nassau New York Cuentas Por Cobrar Diarias?

Do you need to quickly draft a legally-binding Nassau Daily Accounts Receivable or maybe any other document to take control of your personal or business matters? You can select one of the two options: contact a legal advisor to draft a legal document for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Nassau Daily Accounts Receivable and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, carefully verify if the Nassau Daily Accounts Receivable is adapted to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Nassau Daily Accounts Receivable template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the paperwork we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!