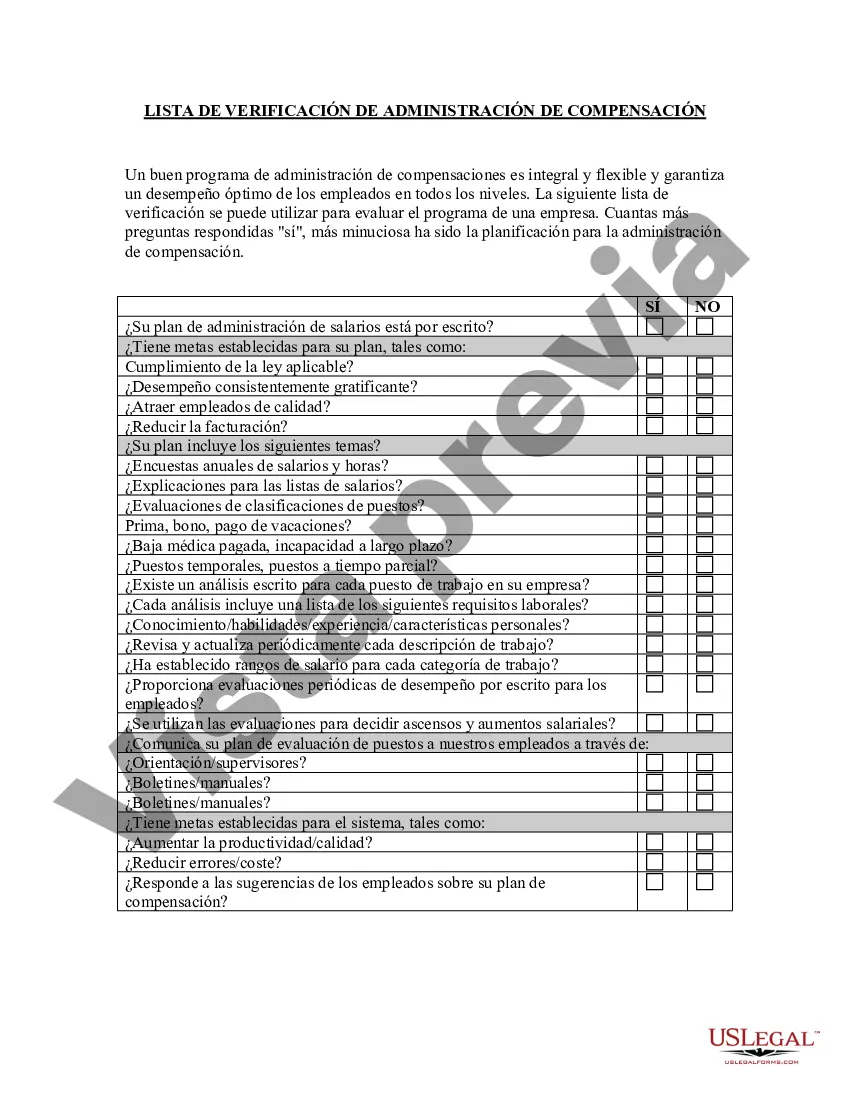

Queens New York Compensation Administration Checklist serves as a comprehensive guideline for businesses and organizations operating in Queens, New York to effectively manage and administer employee compensation plans. This checklist ensures compliance with local laws, regulations, and best practices, helping businesses establish fair and competitive compensation structures while ensuring employee satisfaction and legal adherence. Keywords: Queens New York, compensation administration, checklist, employee compensation, businesses, organizations, compliance, laws, regulations, best practices, fair compensation, competitive compensation, employee satisfaction, legal adherence. Different Types of Queens New York Compensation Administration Checklists: 1. Minimum Wage Compliance Checklist: This checklist outlines the guidelines set forth by the New York State Department of Labor regarding minimum wage requirements, including the current minimum wage rates for different industries and employee categories. 2. Overtime Pay Compliance Checklist: Ensuring adherence to state and federal regulations, this checklist guides businesses in Queens, New York to accurately calculate overtime hours and rates, maintain proper payroll records, and comply with wage and hour laws. 3. Payroll Tax Withholding Checklist: This checklist assists businesses in correctly deducting payroll taxes from employees' wages, addressing requirements such as federal income tax, Social Security tax, Medicare tax, and state income tax, while comprehensively addressing tax compliance obligations in Queens, New York. 4. Salary Structure and Compensation Review Checklist: Aimed at helping businesses create fair and competitive compensation structures, this checklist focuses on salary benchmarking, job evaluation, performance appraisals, and compensation review to ensure equitable and consistent pay practices in Queens, New York. 5. Employee Benefits Checklist: Covering different benefit programs such as health insurance, retirement plans, paid time off, and other non-monetary perks, this checklist assists businesses in effectively administering employee benefits in compliance with local laws and regulations of Queens, New York. 6. Compensation Communication Checklist: Providing guidance on communicating compensation policies effectively to employees, this checklist emphasizes transparency and clarity in sharing information, handling employee inquiries, and addressing concerns related to compensation administration in Queens, New York. 7. Compliance Audit Checklist: This checklist aims to assess an organization's overall compliance with local, state, and federal laws related to compensation administration in Queens, New York. It covers various aspects, including record keeping, wage and hour compliance, tax obligations, and reporting requirements. By utilizing these different types of Queens New York Compensation Administration Checklists, businesses can streamline their compensation processes, ensure legal compliance, maintain fairness, and enhance employee satisfaction within the local regulatory framework.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Lista de verificación de administración de compensación - Compensation Administration Checklist

Description

How to fill out Queens New York Lista De Verificación De Administración De Compensación?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Queens Compensation Administration Checklist.

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Queens Compensation Administration Checklist will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Queens Compensation Administration Checklist:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Queens Compensation Administration Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!