Franklin Ohio Depreciation Schedule refers to a document that outlines the depreciation rates of various assets in the city of Franklin, Ohio. It is an essential tool used by businesses, individuals, and organizations to accurately calculate the loss in value of their assets over time for tax and accounting purposes. The schedule provides valuable information on the expected lifespan of different assets and the corresponding depreciation percentages. The Franklin Ohio Depreciation Schedule is divided into multiple categories based on the types of assets, each having its own unique depreciation rates. The most common categories include: 1. Real Property: This category encompasses land, buildings, and other permanent structures. The Franklin Ohio Depreciation Schedule for real property outlines the useful life and depreciation rate of these assets, considering factors such as wear and tear, maintenance, and market conditions. 2. Personal Property: Personal property includes equipment, machinery, vehicles, furniture, fixtures, and other tangible assets. The depreciation schedule for personal property provides guidelines on how long these assets can be utilized effectively and the percentage of their value that will decrease annually. 3. Intangible Assets: Intangible assets are non-physical assets such as patents, copyrights, trademarks, software, and intellectual property rights. The Franklin Ohio Depreciation Schedule for intangible assets outlines the useful life of each asset and how their value should be depreciated over time. It is important to note that the Franklin Ohio Depreciation Schedule may vary depending on federal and state regulations, as well as industry-specific guidelines. Therefore, it is crucial for businesses and individuals in Franklin, Ohio, to stay updated with any changes or revisions in the depreciation rates to ensure accurate financial reporting and compliance with tax laws. By referring to the Franklin Ohio Depreciation Schedule, businesses can make informed decisions regarding asset management, budgeting, and forecasting. It helps in determining the true value of assets over time and assists in estimating future replacement or upgrade costs. Additionally, the depreciation schedule plays a crucial role in tax planning as it allows businesses to claim depreciation deductions, thereby reducing their taxable income. In conclusion, the Franklin Ohio Depreciation Schedule is a comprehensive document that outlines the depreciation rates for various assets in Franklin, Ohio. It is crucial for businesses and individuals to utilize this schedule to accurately calculate and account for the gradual loss in value of their assets. Staying up-to-date with the applicable depreciation rates is essential for financial planning, tax compliance, and effective asset management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Programa de depreciación - Depreciation Schedule

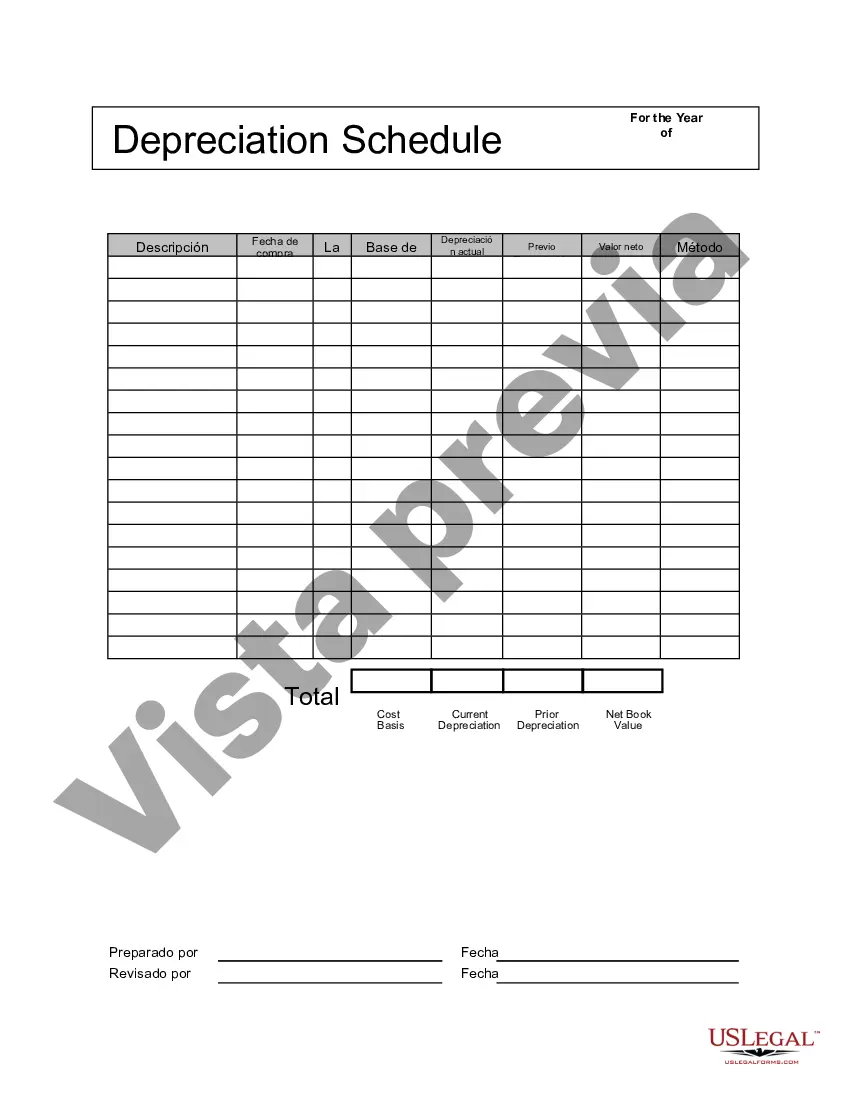

Description

How to fill out Franklin Ohio Programa De Depreciación?

If you need to get a reliable legal paperwork supplier to find the Franklin Depreciation Schedule, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to get and complete different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to search or browse Franklin Depreciation Schedule, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Franklin Depreciation Schedule template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or execute the Franklin Depreciation Schedule - all from the convenience of your sofa.

Join US Legal Forms now!