Mecklenburg North Carolina Depreciation Schedule is a comprehensive document outlining the depreciation rates of various assets in Mecklenburg County, North Carolina. It specifies the depreciation values applicable to different types of property, including residential, commercial, industrial, and personal assets. This schedule serves as a valuable resource for property owners, businesses, and individuals to determine the reduction in value of their assets over time. The Mecklenburg North Carolina Depreciation Schedule takes into account the specific economic conditions and market trends prevalent in the county. It is regularly updated to reflect changes in property values and any modifications in tax laws or regulations. Property owners and tax professionals can rely on this schedule to calculate accurate depreciation figures for property tax purposes, insurance claims, financial reporting, and investment analysis. The schedule includes a variety of depreciation methods, such as straight-line, declining balance, and accelerated depreciation, depending on the asset type. Each method has its own formula and applicable rates, designed to accurately represent the asset's wear and tear, obsolescence, and market fluctuations. Specific types of Mecklenburg North Carolina Depreciation Schedules may include: 1. Residential Depreciation Schedule: This schedule outlines the depreciation rates for single-family homes, townhouses, condominiums, and other residential properties in Mecklenburg County. It considers factors such as property age, location, condition, and amenities to calculate the accurate value reduction over time. 2. Commercial Depreciation Schedule: Designed for commercial real estate properties, this schedule includes depreciation rates specific to retail spaces, office buildings, warehouses, and other commercial assets in Mecklenburg County. It considers factors such as property size, location, market demand, and functional obsolescence. 3. Industrial Depreciation Schedule: This schedule focuses on the depreciation rates for manufacturing facilities, industrial buildings, warehouses, and other industrial assets in Mecklenburg County. It considers factors such as machinery and equipment lifespan, technological advancements, and market demand for specific industries. 4. Personal Property Depreciation Schedule: This schedule covers the depreciation rates applicable to personal assets such as vehicles, boats, aircraft, furniture, and machinery in Mecklenburg County. It considers factors such as asset age, condition, maintenance, and market value fluctuations. By referring to the Mecklenburg North Carolina Depreciation Schedule, property owners and individuals can accurately estimate the decline in value of their assets over time. It helps them make informed decisions regarding property investments, insurance coverage, tax planning, and financial reporting. The precise calculations provided in this schedule ensure fair and consistent assessments of property values while adhering to the local tax laws and regulations governing Mecklenburg County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Programa de depreciación - Depreciation Schedule

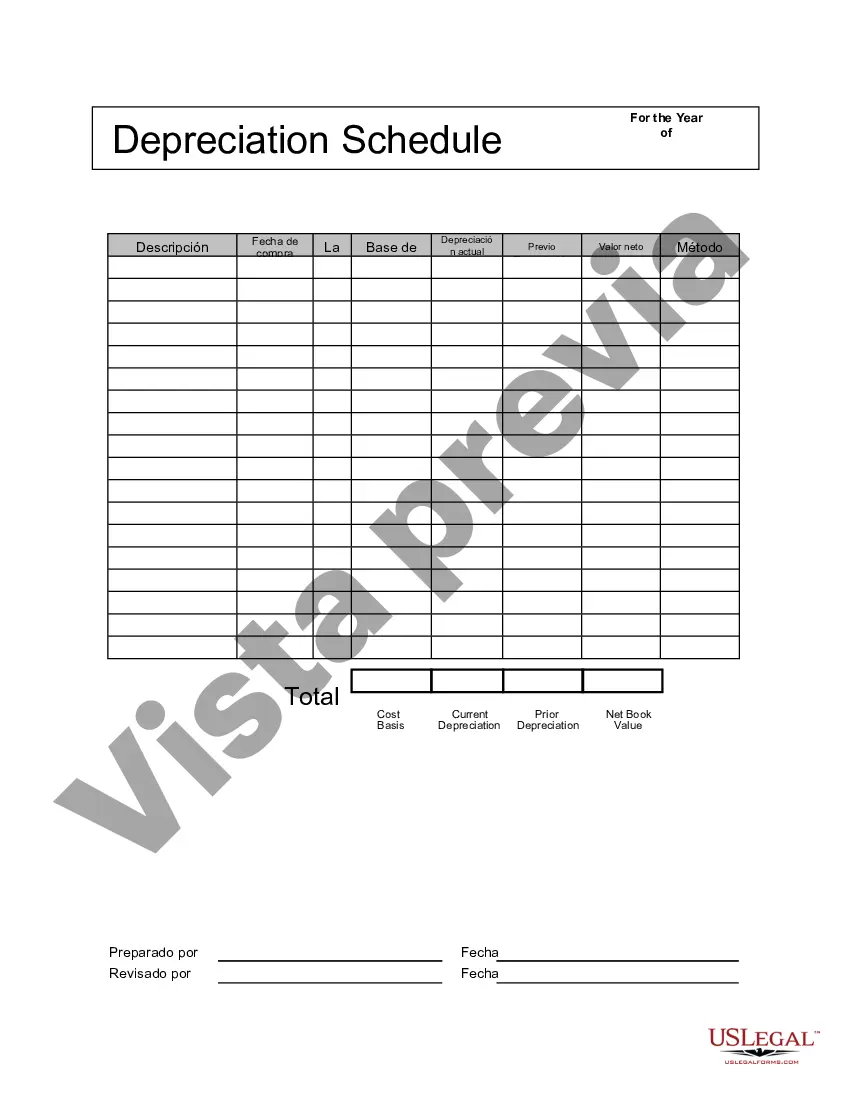

Description

How to fill out Mecklenburg North Carolina Programa De Depreciación?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Mecklenburg Depreciation Schedule, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any tasks associated with paperwork completion straightforward.

Here's how to purchase and download Mecklenburg Depreciation Schedule.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Mecklenburg Depreciation Schedule.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Mecklenburg Depreciation Schedule, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to cope with an extremely difficult case, we recommend getting a lawyer to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-specific documents effortlessly!