Salt Lake City, Utah Depreciation Schedule: Everything You Need to Know A Salt Lake City, Utah depreciation schedule is a document that outlines the depreciation of assets over time in the context of Salt Lake City. It is a vital tool used by businesses and real estate investors to track and account for the wear and tear or obsolescence of their assets. The Salt Lake City depreciation schedule provides a systematic approach to determine the value loss of assets, which helps businesses plan for replacement or upgrade costs, calculate tax deductions, and accurately report the asset's value on financial statements. It plays a crucial role in budgeting, financial analysis, and overall asset management in Salt Lake City. There are various types of Salt Lake City depreciation schedules depending on the assets they cover. The most common types include: 1. Straight-Line Depreciation: This method spreads the depreciation expense evenly over the useful life of an asset. It is the simplest and most commonly used method, where the asset is assumed to have an equal reduction in value each year. 2. Declining Balance Depreciation: This method allocates a higher depreciation expense during the earlier years of an asset's life and gradually reduces it over time. It accounts for the accelerated wear and tear or obsolescence that usually occurs in the initial years. 3. Sum-of-Years' Digits: This method follows a similar principle to the declining balance method but allocates depreciation based on the sum of the asset's years of life. It assigns a higher depreciation expense in the early years and gradually reduces it. 4. Units of Production: This method is specifically applicable to assets that are utilized based on their output or production capacity. It calculates the depreciation based on the asset's usage or production, allowing for more accurate tracking of depreciation in relation to its actual use. Salt Lake City businesses and real estate investors must carefully choose the depreciation method that best suits their specific circumstances and asset types. They should consider factors such as the asset's useful life, salvage value, and current tax regulations to ensure compliance and accurate reporting. In summary, a Salt Lake City, Utah depreciation schedule is a crucial financial tool used by businesses and real estate investors to track and account for the depreciation of assets in Salt Lake City. It helps in planning for replacement or upgrade costs, determining tax deductions, and managing overall asset portfolio effectively. Choosing the appropriate depreciation method is essential to ensure accurate financial reporting and compliance.

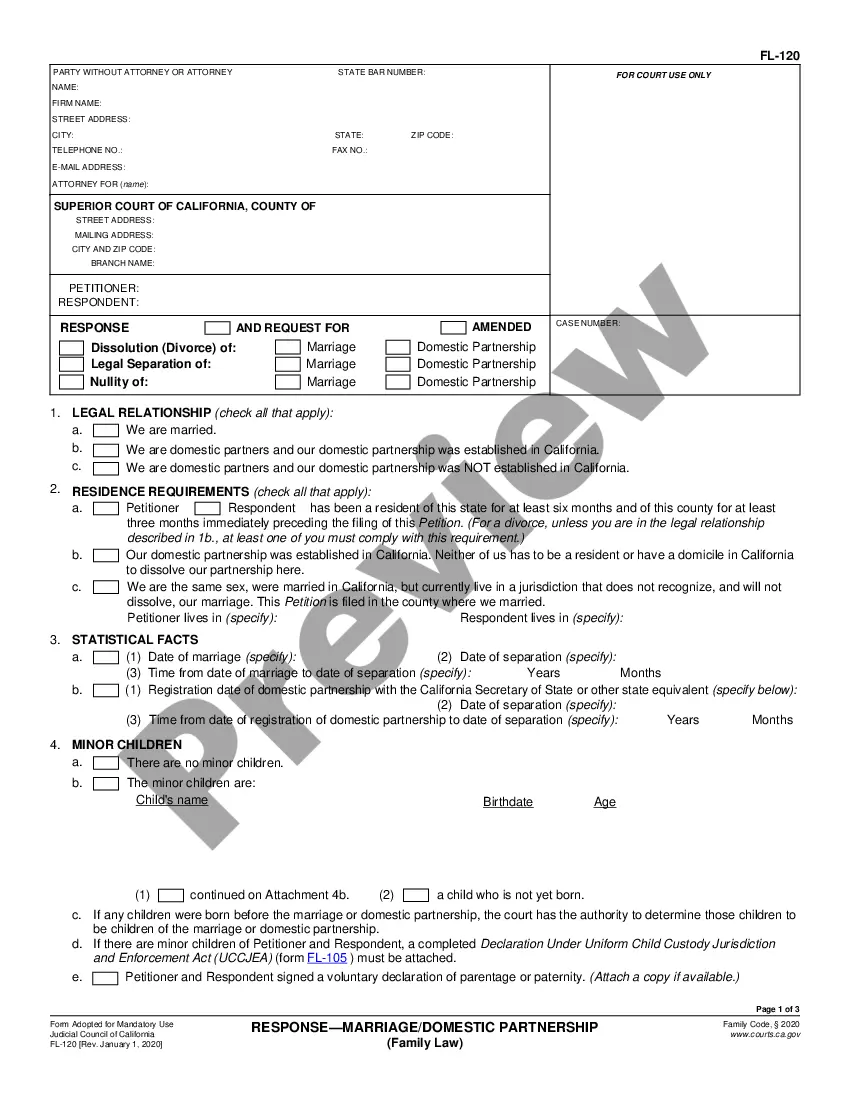

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Programa de depreciación - Depreciation Schedule

Description

How to fill out Salt Lake Utah Programa De Depreciación?

If you need to find a reliable legal paperwork supplier to get the Salt Lake Depreciation Schedule, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Salt Lake Depreciation Schedule, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Salt Lake Depreciation Schedule template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Salt Lake Depreciation Schedule - all from the comfort of your home.

Sign up for US Legal Forms now!