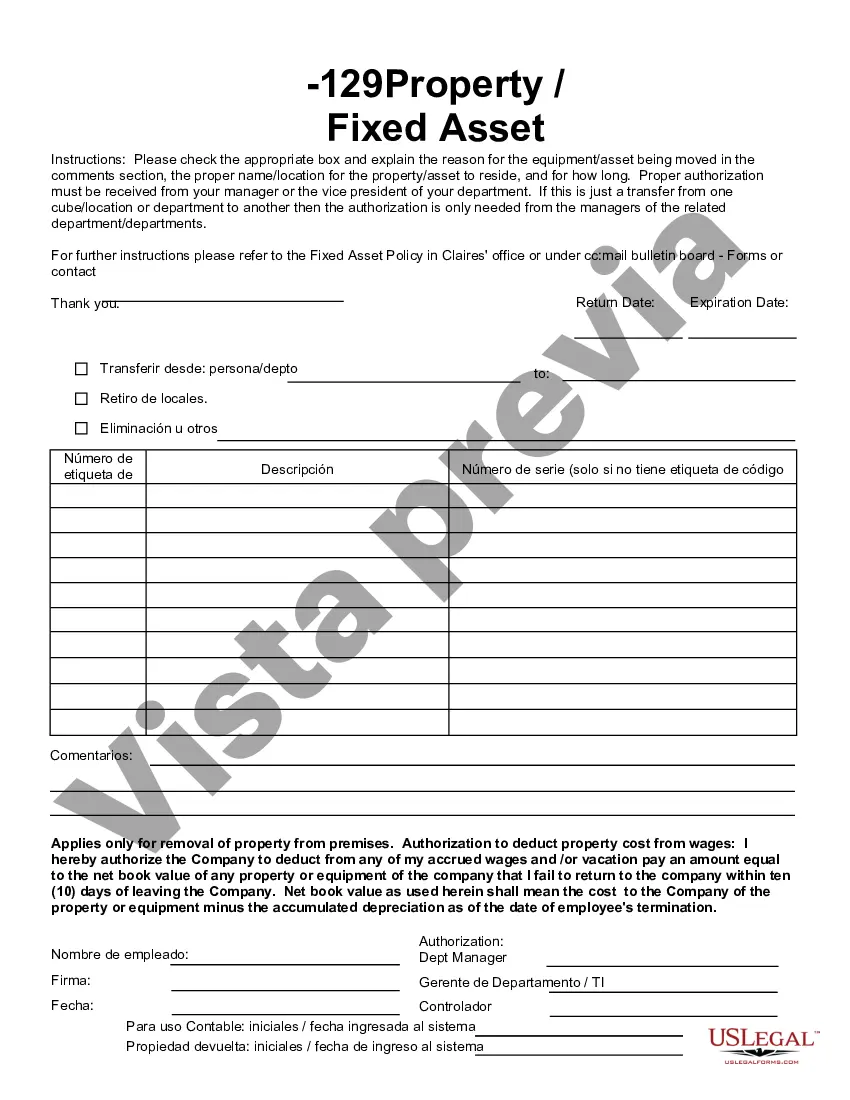

Fairfax Virginia Fixed Asset Removal Form is a formal document used by the Fairfax County government in Virginia to initiate the process of removing fixed assets from its inventory. This form aids in tracking and managing fixed assets owned by the county, which includes tangible items like equipment, furniture, vehicles, and infrastructure. The Fairfax Virginia Fixed Asset Removal Form is an essential tool in the asset management process, ensuring accurate documentation and accountability. It allows the county authorities to record the reasons for removing a fixed asset, such as disposal, sale, transfer to another department, or donation. By collecting relevant information, the form helps prevent unauthorized removals, loss, or misuse of fixed assets. This form typically contains fields for important details regarding the fixed asset, including the asset's description, identification number, condition, current location, and its assigned department or team. Additionally, it prompts the user to provide a justification for removing the asset, specifying whether it has reached its useful life, is non-functional, or no longer required for operation. In circumstances where multiple types of Fairfax Virginia Fixed Asset Removal Forms are used, they can include specific categories to differentiate between different classes of assets. These variations of the form may include specialized fields for particular items like vehicles, IT equipment, machinery, or buildings. Moreover, certain forms may be designed to handle rare or highly valuable assets that require special handling, such as artwork or historical artifacts. Using the Fairfax Virginia Fixed Asset Removal Form is crucial for maintaining accurate records and ensuring transparency throughout the asset management process. It assists the county authorities in making informed decisions regarding the disposal, reallocation, or replacement of fixed assets while adhering to relevant regulations and policies. Keywords: Fairfax Virginia, Fixed Asset Removal Form, asset management, fixed assets, inventory, disposal, sale, transfer, donation, equipment, furniture, vehicles, infrastructure, documentation, accountability, identification number, condition, location, useful life, non-functional, justification, specialized fields, vehicles, IT equipment, machinery, buildings, artwork, historical artifacts, records, transparency, regulations, policies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Fairfax Virginia Formulario De Retiro De Activos Fijos?

Do you need to quickly create a legally-binding Fairfax Fixed Asset Removal Form or maybe any other form to manage your personal or business matters? You can select one of the two options: contact a legal advisor to write a valid paper for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get professionally written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant form templates, including Fairfax Fixed Asset Removal Form and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Fairfax Fixed Asset Removal Form is tailored to your state's or county's regulations.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the document isn’t what you were seeking by using the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Fairfax Fixed Asset Removal Form template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Cuando se produce el retiro de un activo, por hechos que afectan el uso y explotacion del bien, como por ejemplo, destruccion, incendio, hurto, inutilidad, entre otros, la contabilidad debe reconocer ese retiro como una perdida (cuenta 5310 del PUC para comerciantes) del ejercicio en que se autorice la baja del bien.

Los activos fijos que son adquiridos en fecha que no coincida con el ano fiscal, su depreciacion se calculara en base al 50% del del porcentaje correspondiente a la categoria, pero los anos subsiguientes se aplicara la tasa correspondiente a cada categoria.

Acta y resolucion de baja. Es el documento soporte necesario que sera suscrito por el Comite de Inventarios para que el Representante Legal o su delegado autoricen mediante la Resolucion de baja el destino final que debe darsele a los bienes tipificados como inservibles.

El cargo de depreciacion se calcula del siguiente modo: Costo Historico Original menos valor de desecho, todo eso entre la vida util (tiempo dado de vida del activo) = Cargo por depreciacion de la vida estimada de servicio.

El metodo mas usado para calcular la depreciacion de los activos es el lineal, ya que este considera que el activo se gasta o deteriora uniformemente con el paso del tiempo. Este ejemplo nos dice que el bien adquirido se depreciara de manera mensual un aproximado de 416.66 pesos, y de forma anual, 5,000.00 pesos.

El porcentaje aplicable para la depreciacion corresponde a un 5% a la categoria 1, un 25% a la categoria 2 y un 15% a la categoria 3.

Resumiendo, se tiene que el costo fiscal esta constituido por el precio de adquisicion mas los costos en que se incurran hasta que el activo este disponible para su uso. Forman parte del costo fiscal las adiciones, mejoras, reparaciones e inspecciones que deban ser capitalizadas y no tratadas como gasto.

Vida util para efectos fiscales. ActivoTasa de depreciacion anualVida util equivalenteMuebles y enseres10,00%10 anosEquipo medico cientifico12,50%8 anosEnvases, empaques y herramientas20,00%5 anosEquipo de computacion20,00%5 anos12 more rows ?

Baja de activos: Es la salida definitiva de aquellos bienes que no se encuentran en condiciones de uso o que la entidad ya no requiere para el normal desarrollo de sus actividades.

Dar de baja un activo fijo Selecciona Opciones > Todas las opciones > Contabilidad > Baja de activo fijo de la barra de menu. Captura la informacion solicitada. Selecciona Guardar de la barra de opciones y se calculara la perdida y generara la poliza contable por baja de activo fijo. Facebook. Comentarios. 0 comentarios.