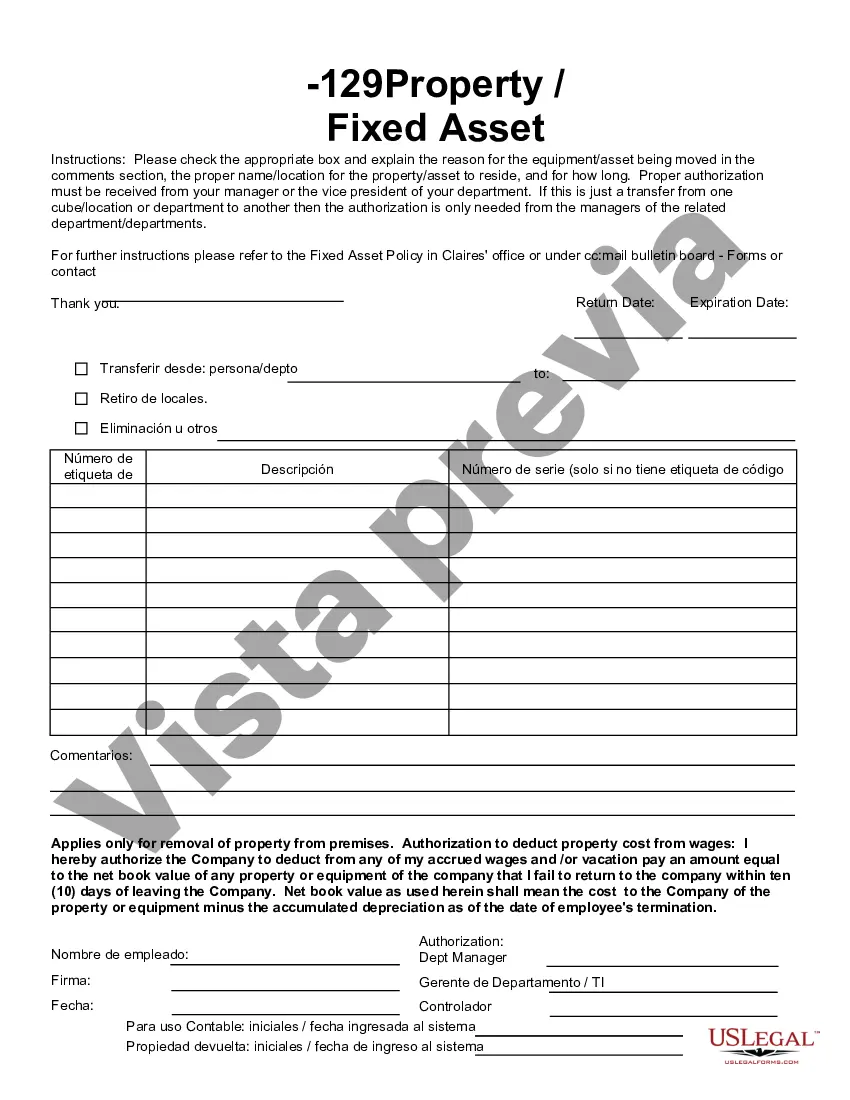

The Harris Texas Fixed Asset Removal Form is a crucial document used in Harris County, Texas, for the removal of fixed assets from a company's inventory or fixed asset register. This form serves as an official record of the disposal, sale, transfer, or scrapping of fixed assets and ensures compliance with the county's rules and regulations. The Harris Texas Fixed Asset Removal Form requires detailed information about the asset being removed, including its description, identification number, date of acquisition, book value, disposal method, and justification for removal. The form also includes sections for the responsible party's signature and date, the recipient's signature (in case of transfers), as well as approving authorities' signatures. This ensures accountability and appropriate authorization throughout the asset removal process. Keywords: 1. Harris County Texas: The Harris Texas Fixed Asset Removal Form is specific to Harris County, Texas, and complies with the county's guidelines and procedures. 2. Fixed asset removal: This form is used to document the removal of fixed assets from a company's inventory or fixed asset register. 3. Disposal of fixed assets: The form encompasses the process of disposing of fixed assets through sales, transfers, scrapping, or any other authorized means. 4. Compliance: The Harris Texas Fixed Asset Removal Form assists in adhering to the county's rules and regulations regarding fixed asset management and disposal. 5. Inventory management: The form helps maintain accurate inventory records by documenting the removal of fixed assets. 6. Asset identification: The form collects information such as asset description, identification number, and acquisition date, which aids in asset tracking and management. 7. Book value: The form includes the book value of the asset being removed, facilitating accurate financial reporting of asset disposals. 8. Approval process: The form includes sections for required signatures, ensuring appropriate authorization by responsible parties and approving authorities. 9. Accountability: The Harris Texas Fixed Asset Removal Form promotes transparency and accountability by creating an official record of asset removals. 10. Asset transfers: In cases of asset transfers, the form facilitates the documentation of transfers and recipient signatures, ensuring proper ownership transfer. Different types of Harris Texas Fixed Asset Removal Forms may include variations specific to different categories of fixed assets, such as equipment, vehicles, machinery, furniture, or computer hardware. These variations help tailor the form for specific asset types, streamlining the removal process and ensuring accurate record-keeping.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Harris Texas Formulario De Retiro De Activos Fijos?

Do you need to quickly draft a legally-binding Harris Fixed Asset Removal Form or probably any other form to manage your personal or corporate affairs? You can select one of the two options: hire a professional to write a legal document for you or draft it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including Harris Fixed Asset Removal Form and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, carefully verify if the Harris Fixed Asset Removal Form is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the template isn’t what you were seeking by using the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Harris Fixed Asset Removal Form template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!