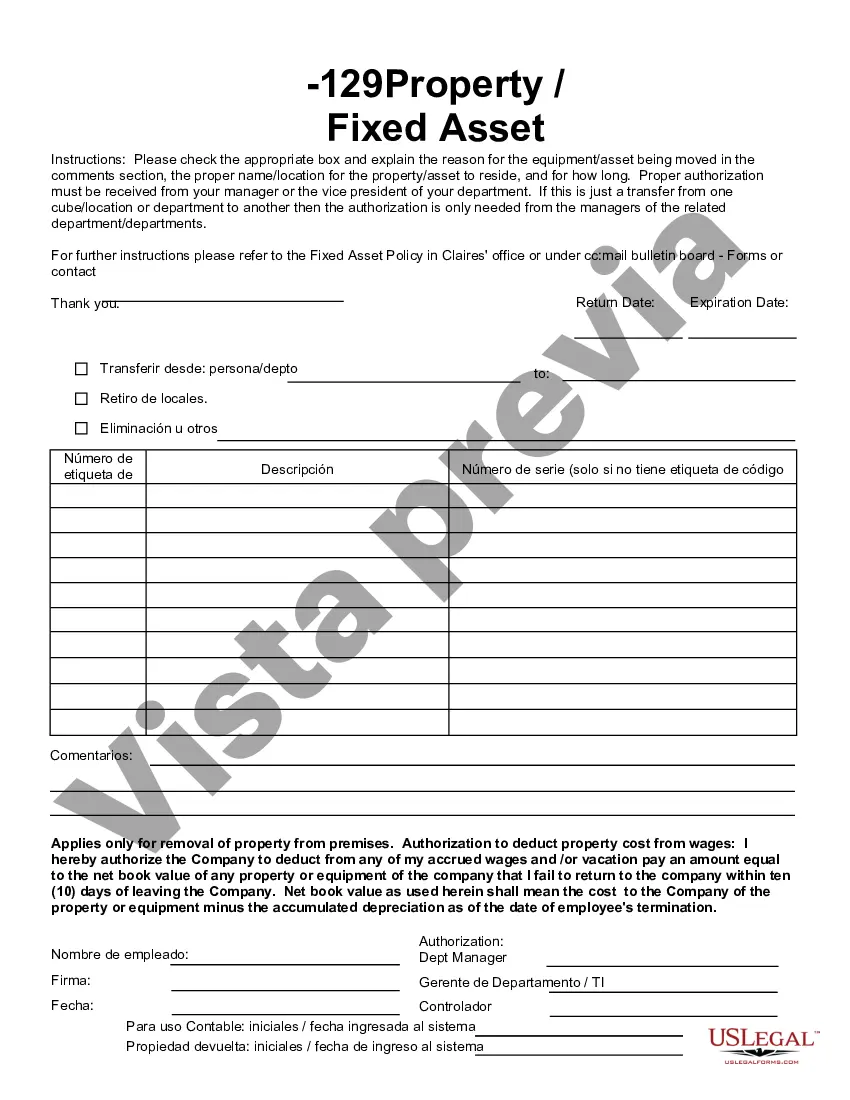

The Miami-Dade Florida Fixed Asset Removal Form is a document used by the Miami-Dade County government in the state of Florida to manage and track the removal of fixed assets. Fixed assets refer to tangible property and equipment owned by the county, such as vehicles, machinery, furniture, and computers. This form serves as an essential tool to ensure the accurate recording and account of fixed asset removals. It includes relevant sections that capture crucial information, such as the asset description, identification number, acquisition date, and current condition. Additionally, the form may also require the reason for removal, details of the responsible party, and any necessary approvals or signatures. The Miami-Dade Florida Fixed Asset Removal Form plays a vital role in maintaining proper inventory control and accountability within the county. By using this form, the government can keep track of fixed assets that are no longer in use, either due to disposal, transfer to another department or agency, or retirement. There are different types of Miami-Dade Florida Fixed Asset Removal Forms to cater to specific removal scenarios. These may include: 1. Disposal Form: This form is used when a fixed asset is no longer usable or needed, and it requires proper disposal, such as scrapping or selling through auction. 2. Transfer Form: When a fixed asset is being moved or transferred to another department, agency, or location within Miami-Dade County, a transfer form is utilized to document the asset's movement. 3. Retirement Form: In cases where a fixed asset has completed its useful life or is no longer viable, the retirement form is used to acknowledge its removal from the active inventory. 4. Repurposing Form: This type of form is used when a fixed asset is repurposed within the county, such as equipment being reassigned from one task or location to another. It is crucial for Miami-Dade County employees involved in fixed asset management and removal to understand the specific types of forms required for different situations. Proper completion and submission of the Miami-Dade Florida Fixed Asset Removal Forms ensure transparency, compliance with regulations, and the accurate maintenance of the county's fixed asset records.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Formulario de retiro de activos fijos - Fixed Asset Removal Form

State:

Multi-State

County:

Miami-Dade

Control #:

US-142-AZ

Format:

Word

Instant download

Description

Descargar en formato PDF o Word rellenable.

The Miami-Dade Florida Fixed Asset Removal Form is a document used by the Miami-Dade County government in the state of Florida to manage and track the removal of fixed assets. Fixed assets refer to tangible property and equipment owned by the county, such as vehicles, machinery, furniture, and computers. This form serves as an essential tool to ensure the accurate recording and account of fixed asset removals. It includes relevant sections that capture crucial information, such as the asset description, identification number, acquisition date, and current condition. Additionally, the form may also require the reason for removal, details of the responsible party, and any necessary approvals or signatures. The Miami-Dade Florida Fixed Asset Removal Form plays a vital role in maintaining proper inventory control and accountability within the county. By using this form, the government can keep track of fixed assets that are no longer in use, either due to disposal, transfer to another department or agency, or retirement. There are different types of Miami-Dade Florida Fixed Asset Removal Forms to cater to specific removal scenarios. These may include: 1. Disposal Form: This form is used when a fixed asset is no longer usable or needed, and it requires proper disposal, such as scrapping or selling through auction. 2. Transfer Form: When a fixed asset is being moved or transferred to another department, agency, or location within Miami-Dade County, a transfer form is utilized to document the asset's movement. 3. Retirement Form: In cases where a fixed asset has completed its useful life or is no longer viable, the retirement form is used to acknowledge its removal from the active inventory. 4. Repurposing Form: This type of form is used when a fixed asset is repurposed within the county, such as equipment being reassigned from one task or location to another. It is crucial for Miami-Dade County employees involved in fixed asset management and removal to understand the specific types of forms required for different situations. Proper completion and submission of the Miami-Dade Florida Fixed Asset Removal Forms ensure transparency, compliance with regulations, and the accurate maintenance of the county's fixed asset records.