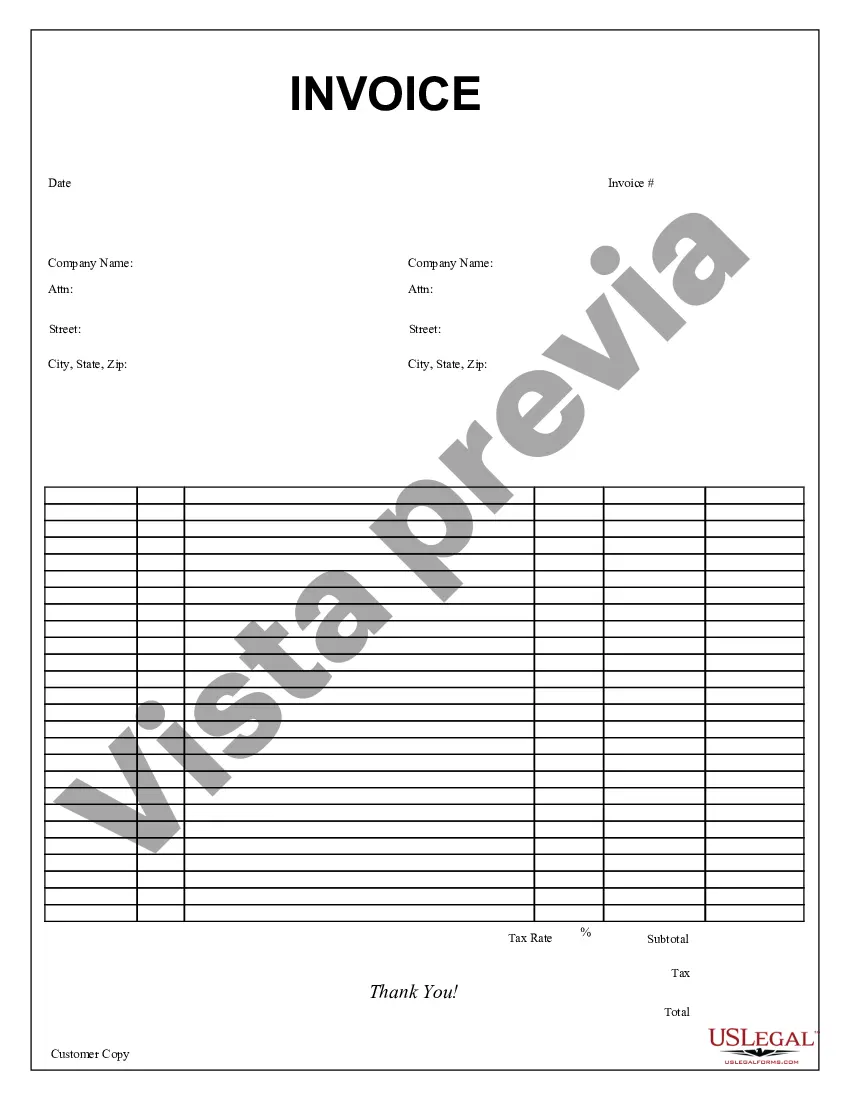

A Collin Texas Purchase Invoice is a document that serves as proof of a transaction between a buyer and a seller in Collin County, Texas. It provides detailed information about the goods or services purchased, along with the corresponding costs, terms, and conditions. This essential financial document helps both parties keep track of their transactions and facilitates efficient bookkeeping. Collin County is located in the northern part of Texas and is home to numerous businesses and industries. The Collin Texas Purchase Invoice is widely used within this region to document various types of purchases, ensuring accuracy and transparency in business transactions. Different types of Collin Texas Purchase Invoices may include: 1. Goods Purchase Invoice: This type of invoice is used when a buyer purchases tangible goods from a seller. It includes details such as the item description, quantity purchased, unit price, total price, and any applicable taxes. 2. Services Purchase Invoice: This invoice is utilized when a buyer avails services from a service provider. It outlines the type of services provided, the duration or quantity of services, the service rate, and the total cost incurred. 3. Retail Purchase Invoice: A retail purchase invoice is specific to businesses engaged in selling products directly to end consumers. It contains information about the purchased items, their prices, any discounts applied, the payment method, and the customer's details. 4. Wholesale Purchase Invoice: Wholesale purchase invoices are used in transactions between businesses operating on a wholesale model. These invoices typically include details such as the items purchased in bulk, the unit price, the quantity, any negotiated discounts, and the total cost. 5. Online Purchase Invoice: With e-commerce growing rapidly, online purchase invoices have become common. These invoices are generated when customers make purchases through online platforms, and they typically include details such as the order number, item details, shipping address, payment method, and any applicable taxes or shipping charges. Regardless of the type, a Collin Texas Purchase Invoice is crucial for record-keeping, financial analysis, and taxation purposes. By accurately documenting each transaction, businesses can maintain a clear and organized accounting system, comply with legal obligations, and ensure smooth operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Factura de compra - Purchase Invoice

Description

How to fill out Collin Texas Factura De Compra?

Draftwing forms, like Collin Purchase Invoice, to take care of your legal affairs is a tough and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for a variety of cases and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Collin Purchase Invoice form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Collin Purchase Invoice:

- Make sure that your template is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Collin Purchase Invoice isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and get the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!