Mecklenburg North Carolina Purchase Invoice is a financial document that serves as evidence of a transaction between a buyer and a seller in Mecklenburg County, North Carolina. It contains crucial details regarding the purchase, including the items or services purchased, quantity, unit price, total price, payment terms, and important contact information for both the buyer and seller. Keywords: Mecklenburg North Carolina, purchase invoice, financial document, transaction, buyer, seller, Mecklenburg County, purchase details, items, services, quantity, unit price, total price, payment terms, contact information. Different Types of Mecklenburg North Carolina Purchase Invoices: 1. Standard Purchase Invoice: This is the most common type of invoice used in Mecklenburg County. It includes all the essential elements mentioned above and is used for regular purchases made by businesses or individuals. 2. Sales Tax Invoice: In cases where sales tax applies to the transaction, a Sales Tax Invoice is issued. This type of invoice includes additional details related to the applicable sales tax, such as tax rate, tax amount, and the total amount inclusive of tax. 3. Proforma Invoice: A Proforma Invoice is a preliminary invoice provided by the seller before the goods or services are delivered. It contains detailed information about the anticipated purchase, including the estimated costs, terms, and conditions. Although not legally binding, it serves as a commitment between the buyer and seller. 4. Recurring Invoice: Recurring invoices are used for repetitive purchases or services with regular intervals. Examples include monthly subscriptions, ongoing maintenance services, or rented equipment. These invoices automate the billing process by setting up a recurring schedule for generating invoices. 5. Commercial Invoice: Commercial invoices are used for international trade transactions. When exporting goods from Mecklenburg County to another country, a commercial invoice is required for customs purposes. It includes information such as the exporter's and importer's details, a detailed description of goods, shipping terms, and the total value of the transaction. 6. Credit Invoice: A credit invoice is issued when there is a need to adjust or correct a previously issued invoice. It indicates a negative amount, canceling out the initial invoice's balance or crediting the buyer with the necessary amount. This could happen due to returns, discounts, or other adjustments made after the original invoice was issued. These various types of Mecklenburg North Carolina Purchase Invoices cater to different scenarios, ensuring accurate record-keeping and compliance with local regulations. Businesses and individuals alike rely on these documents for financial tracking, inventory management, and taxation purposes.

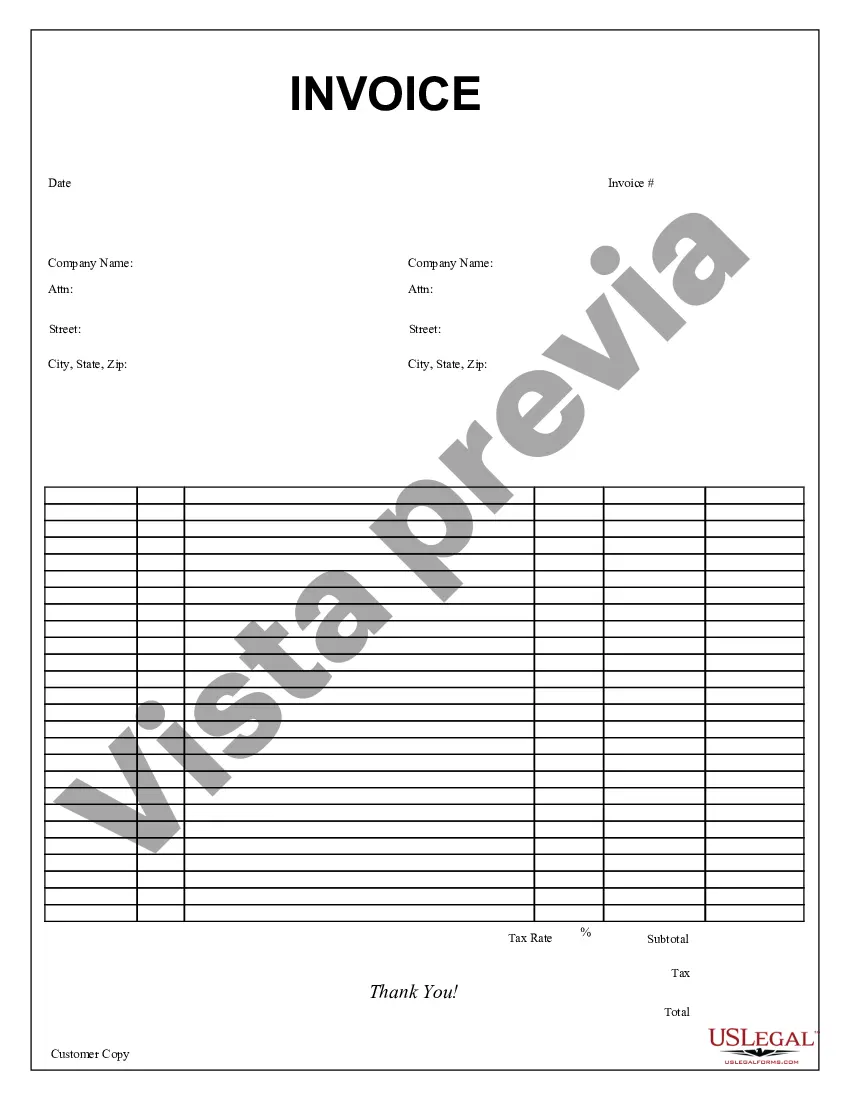

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Factura de compra - Purchase Invoice

Description

How to fill out Mecklenburg North Carolina Factura De Compra?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Mecklenburg Purchase Invoice, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Mecklenburg Purchase Invoice from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Mecklenburg Purchase Invoice:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!