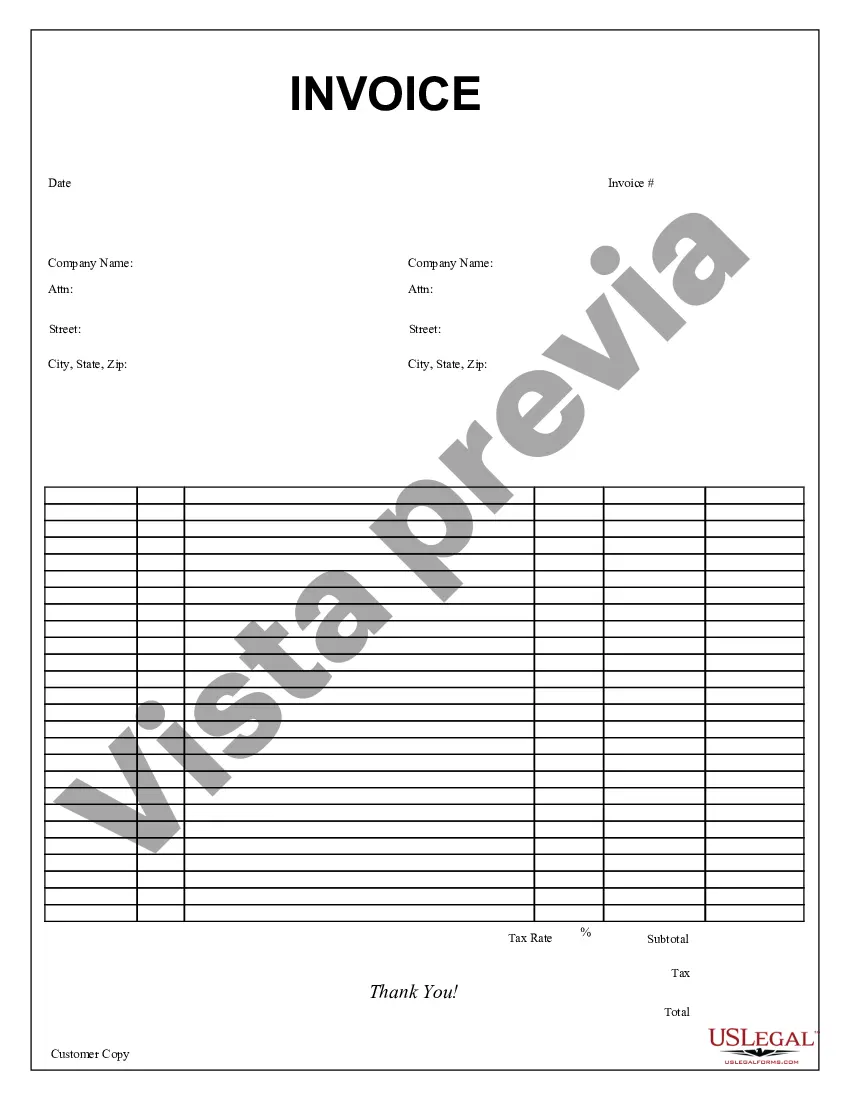

A Miami-Dade Florida Purchase Invoice is a document used in the process of purchasing goods or services in Miami-Dade County, Florida. It serves as proof of the purchase transaction and includes essential details such as the seller's and buyer's information, description of the purchased items or services, quantities, prices, and payment terms. The invoice typically includes relevant keywords such as "Miami-Dade County," "purchase invoice," "goods," "services," "seller," and "buyer." There are several types of Miami-Dade Florida Purchase Invoices, which may vary based on the nature of the transaction or industry involved. Some common types include: 1. Retail Purchase Invoice: This type is used in retail businesses where customers purchase products directly from a store. It includes details of the purchased items, their prices, any applicable discounts, taxes, and the final amount due. 2. Service Purchase Invoice: Service-based businesses issue this type of invoice for services rendered to clients. It contains details about the service provided, the hours or units involved, the hourly or project-based rate, and the total charge. 3. Wholesale Purchase Invoice: Wholesale businesses use this type of invoice when selling goods in bulk quantities to other businesses or retailers. It includes information about the goods sold, their unit prices, discounts (if applicable), taxes, and the total amount payable. 4. E-commerce Purchase Invoice: In the digital era, e-commerce platforms generate purchase invoices for online purchases. These invoices typically include details such as the customer's shipping and billing addresses, order details (products, quantities, and prices), applicable taxes or shipping fees, and the total payment required. 5. Construction Purchase Invoice: Construction companies issue this type of invoice for projects or contracts. It includes details about the services provided, materials used, labor costs, any applicable taxes or additional charges, and the final amount due. Miami-Dade County businesses use purchase invoices as a crucial record-keeping tool for financial and tax purposes. Additionally, these invoices aid in maintaining accurate inventory records, analyze purchasing patterns, and reconcile accounts payable and receivable.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Factura de compra - Purchase Invoice

State:

Multi-State

County:

Miami-Dade

Control #:

US-146-AZ

Format:

Word

Instant download

Description

Descargar en formato PDF o Word rellenable.

A Miami-Dade Florida Purchase Invoice is a document used in the process of purchasing goods or services in Miami-Dade County, Florida. It serves as proof of the purchase transaction and includes essential details such as the seller's and buyer's information, description of the purchased items or services, quantities, prices, and payment terms. The invoice typically includes relevant keywords such as "Miami-Dade County," "purchase invoice," "goods," "services," "seller," and "buyer." There are several types of Miami-Dade Florida Purchase Invoices, which may vary based on the nature of the transaction or industry involved. Some common types include: 1. Retail Purchase Invoice: This type is used in retail businesses where customers purchase products directly from a store. It includes details of the purchased items, their prices, any applicable discounts, taxes, and the final amount due. 2. Service Purchase Invoice: Service-based businesses issue this type of invoice for services rendered to clients. It contains details about the service provided, the hours or units involved, the hourly or project-based rate, and the total charge. 3. Wholesale Purchase Invoice: Wholesale businesses use this type of invoice when selling goods in bulk quantities to other businesses or retailers. It includes information about the goods sold, their unit prices, discounts (if applicable), taxes, and the total amount payable. 4. E-commerce Purchase Invoice: In the digital era, e-commerce platforms generate purchase invoices for online purchases. These invoices typically include details such as the customer's shipping and billing addresses, order details (products, quantities, and prices), applicable taxes or shipping fees, and the total payment required. 5. Construction Purchase Invoice: Construction companies issue this type of invoice for projects or contracts. It includes details about the services provided, materials used, labor costs, any applicable taxes or additional charges, and the final amount due. Miami-Dade County businesses use purchase invoices as a crucial record-keeping tool for financial and tax purposes. Additionally, these invoices aid in maintaining accurate inventory records, analyze purchasing patterns, and reconcile accounts payable and receivable.