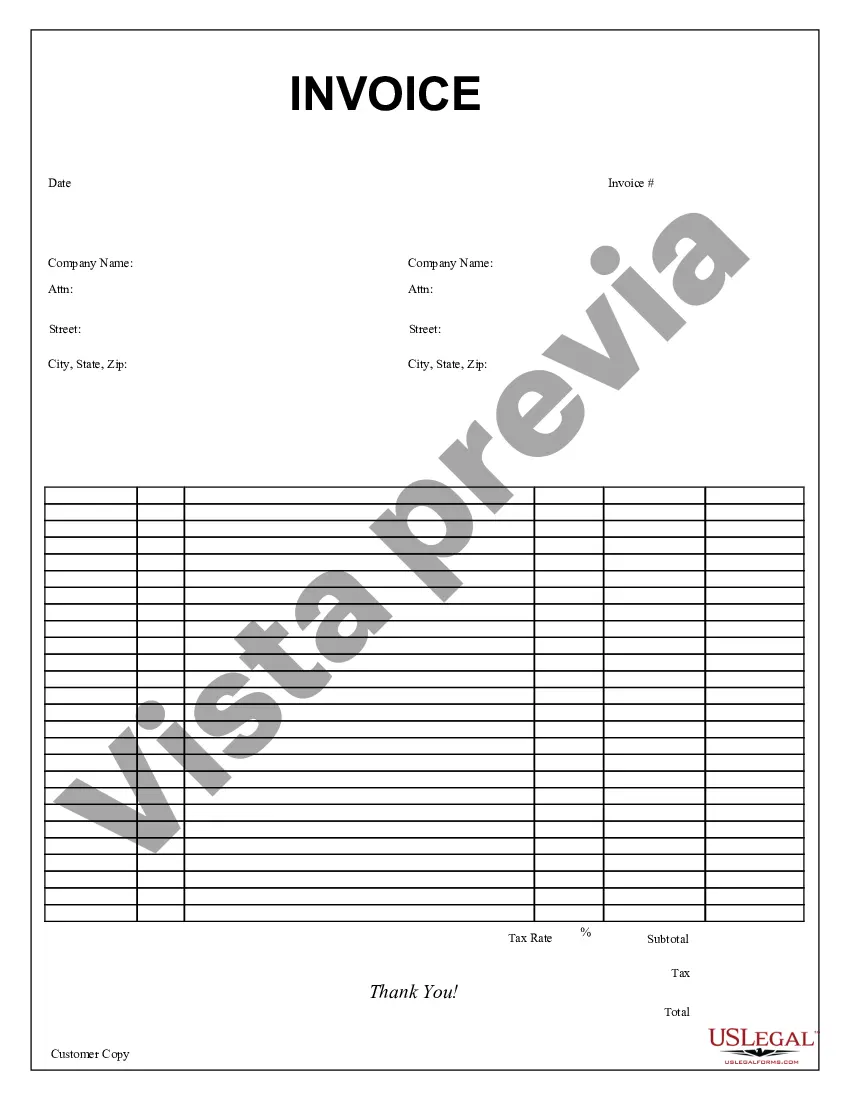

San Jose California Purchase Invoice: A San Jose California Purchase Invoice is a legally binding document that outlines the details of a purchase made by a buyer from a seller based in San Jose, California. It serves as a record of the transaction and includes important information necessary for accounting and documentation purposes. The purchase invoice typically consists of the following key elements: 1. Seller Details: The invoice includes the seller's name, address, contact information, and tax identification number. 2. Buyer Details: The invoice lists the buyer's name, address, contact details, and any relevant identification numbers. 3. Invoice Number: Each purchase invoice is assigned a unique identification number, aiding in tracking and reference. 4. Invoice Date: This indicates the date when the purchase invoice is issued. 5. Purchase Details: The goods/services being purchased are described in detail, including the quantity, unit price, and any applicable discounts or taxes. 6. Payment Terms: The invoice includes the agreed-upon terms of payment, such as due date and accepted payment methods. 7. Taxes: If applicable, the invoice clearly states the amount of tax, such as sales tax or value-added tax, to be paid on the purchase. 8. Total Amount: The invoice calculates and displays the total amount payable by the buyer, including any taxes or discounts applied. 9. Payment Instructions: The invoice may provide instructions for making the payment, including bank details, online payment links, or other relevant information. 10. Terms and Conditions: In some cases, the invoice may include additional terms and conditions related to the purchase, refund policy, or warranties. Types of San Jose California Purchase Invoice: 1. Product Purchase Invoice: This type of invoice is used when purchasing physical products or merchandise from San Jose-based sellers, such as electronics, clothing, or household items. 2. Service Purchase Invoice: Service-based businesses, such as consulting firms, freelancers, or repair services, use this invoice type when billing customers for provided services in San Jose, California. 3. Wholesale Purchase Invoice: This invoice is generated when purchasing goods in bulk from wholesale suppliers or distributors located in San Jose, California. Wholesale purchase invoices often involve larger quantities and may offer bulk discounts. 4. Online Purchase Invoice: With the growth of e-commerce, online purchase invoices are commonly used when buying products or services from San Jose-based businesses via online platforms. They include all necessary purchase details and payment instructions. In conclusion, a San Jose California Purchase Invoice is a comprehensive document that represents a financial transaction between a buyer and a seller in San Jose, California. It includes various key components, and there are different types of invoices based on the nature of the purchase, such as product purchase, service purchase, wholesale purchase, and online purchase invoices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Factura de compra - Purchase Invoice

Description

How to fill out San Jose California Factura De Compra?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create San Jose Purchase Invoice without professional assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid San Jose Purchase Invoice by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the San Jose Purchase Invoice:

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!