Alameda California Payroll Deduction — Special Services is a program that allows employees in the Alameda area to conveniently contribute a portion of their income to various special services. This voluntary payroll deduction system enables individuals to support different causes, organizations, or initiatives directly from their salary. One prominent type of Alameda California Payroll Deduction — Special Service entails charitable donations. Through this program, employees can choose to allocate a specific amount of their earnings to local charities and nonprofits that are dedicated to enhancing the lives of the community members. These funds may be utilized for education programs, healthcare services, poverty alleviation efforts, environmental conservation initiatives, and more. Another notable type of Alameda California Payroll Deduction — Special Service is retirement savings. Alameda residents can opt to have a proportion of their salary deducted and contributed towards their retirement plans, ensuring financial security in the long run. By participating in this program, employees can effectively plan for their future and accrue savings that will be beneficial during their retirement years. Additionally, Alameda California Payroll Deduction — Special Services may also encompass employee benefits packages. These services can include options for individuals to make regular contributions towards their health insurance premiums, life insurance coverage, or other benefits offered by their employer. By utilizing this program, employees can conveniently manage their benefit deductions, ensuring that their coverage remains active. Overall, Alameda California Payroll Deduction — Special Services provide employees with a flexible and straightforward way to support local charities, plan for retirement, and manage their employee benefits. It empowers individuals to give back to the community, secure their financial future, and receive valuable coverage without hassle.

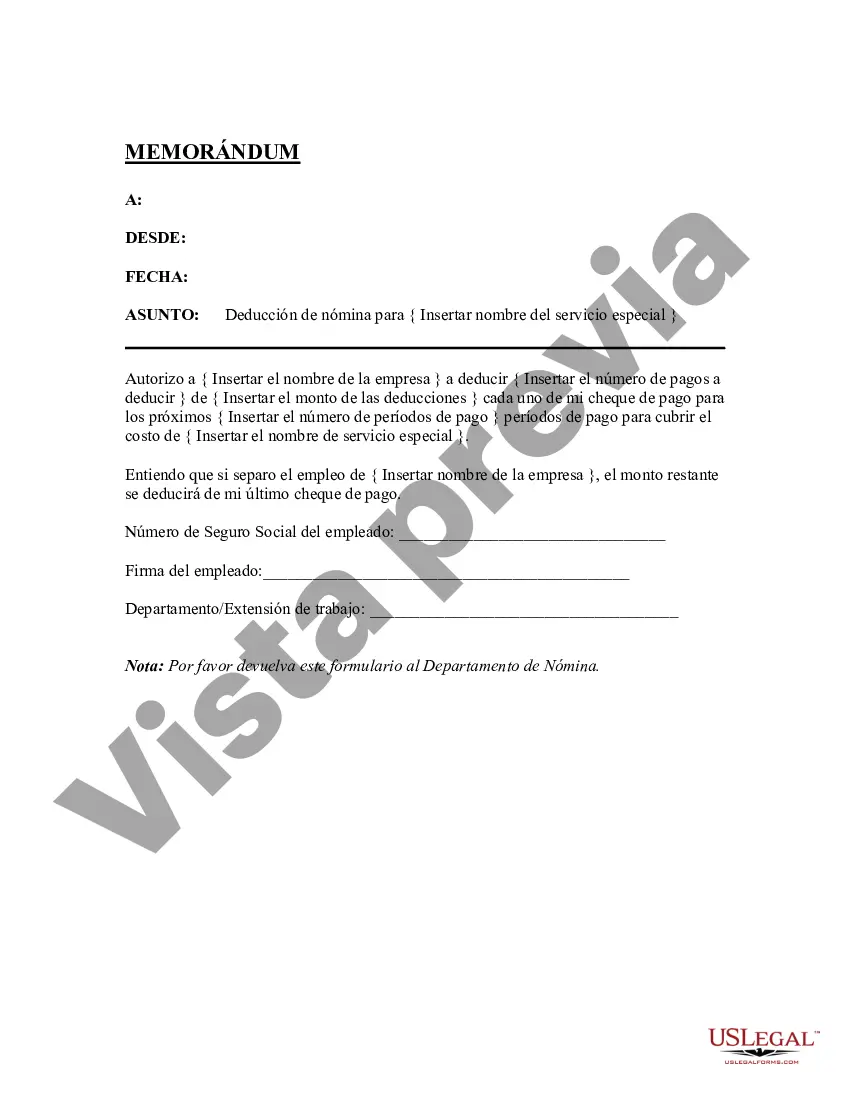

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Alameda California Deducción De Nómina - Servicios Especiales?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Alameda Payroll Deduction - Special Services, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Alameda Payroll Deduction - Special Services from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Alameda Payroll Deduction - Special Services:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!