Broward Florida Payroll Deduction — Special Services is a system implemented by the Broward County government to offer employees a convenient and efficient way to manage their financial obligations. This voluntary program allows employees to authorize specific deductions from their paychecks, thereby ensuring seamless transactions and timely payments. One of the noteworthy types of Broward Florida Payroll Deduction — Special Services is the Healthcare Plan Deduction. This service allows employees to deduct their healthcare plan premiums directly from their paychecks. By opting for this deduction, employees can enjoy the convenience of pre-tax deductions, reducing their taxable income while ensuring their healthcare coverage remains intact. Another type of Payroll Deduction — Special Services offered in Broward County is the Retirement Plan Deduction. Through this program, employees can contribute a portion of their earnings towards their retirement savings account. These deductions can be made on a pretax basis, providing employees with potential tax advantages and assisting them in building a secure financial future. Additionally, the Broward Florida Payroll Deduction — Special Services encompasses the Charitable Contributions Deduction. This service allows employees to support various charitable organizations via payroll deductions. By selecting this deduction, employees can contribute to causes they believe in without the hassle of personal check writing or online payments. Such contributions often foster a sense of community and social responsibility among employees. Moreover, the Broward Florida Payroll Deduction — Special Services covers deductions for educational purposes. The Education Plan Deduction enables employees to allocate portions of their pay towards covering educational expenses, such as tuition fees, educational materials, and training courses. This deduction eases the financial burden associated with furthering one's education, encouraging professional development among Broward County employees. To participate in any of these Broward Florida Payroll Deduction — Special Services, employees must submit authorization forms to their respective department's human resources office. These forms determine the duration and amount of deductions, ensuring accuracy and adherence to an individual's preferences and needs. Overall, Broward Florida Payroll Deduction — Special Services offer an array of practical solutions for employees to manage their financial obligations efficiently. By employing these services, individuals can experience ease and peace of mind while fulfilling their healthcare, retirement, charitable, and educational needs.

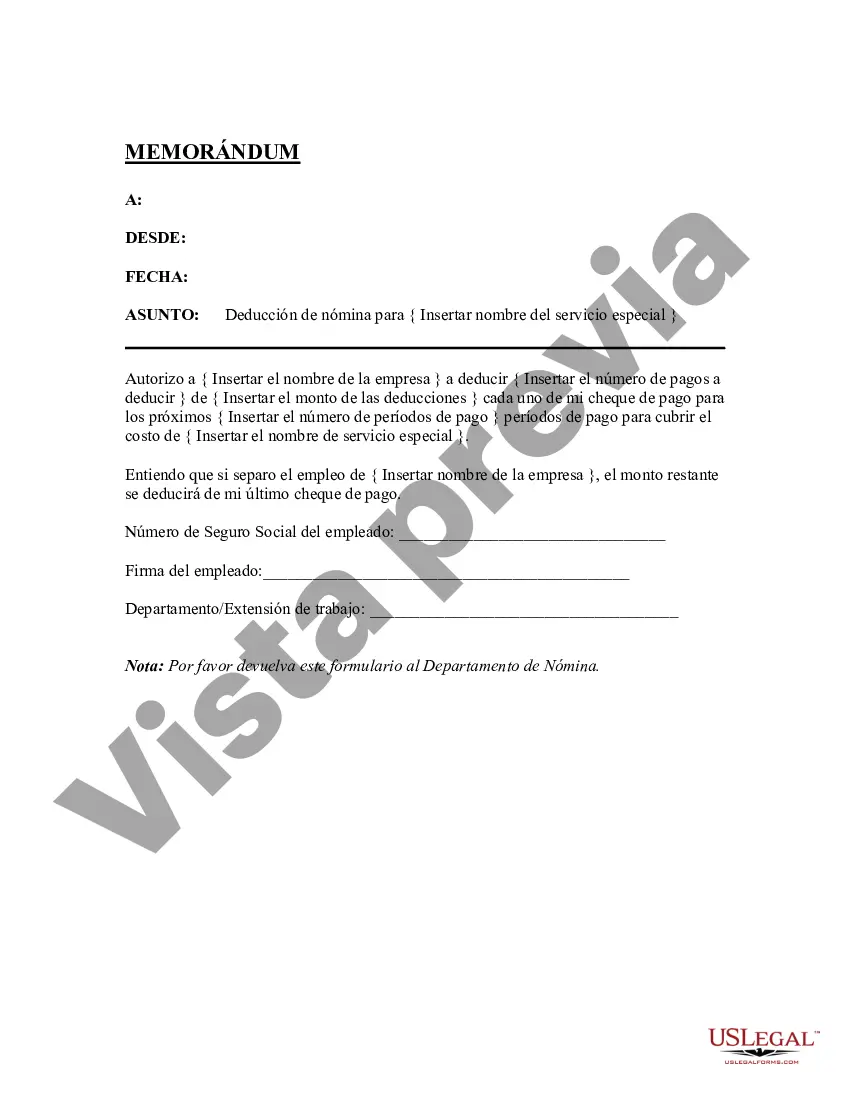

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Broward Florida Deducción De Nómina - Servicios Especiales?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Broward Payroll Deduction - Special Services meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Broward Payroll Deduction - Special Services, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Broward Payroll Deduction - Special Services:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Broward Payroll Deduction - Special Services.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!