Collin Texas Payroll Deduction — Special Services refers to a specific program offered in Collin County, Texas, that allows employees to have certain deductions taken directly from their paychecks. This service is designed to provide additional benefits to employees and is typically managed by the employer or the payroll department. Some common types of Collin Texas Payroll Deduction — Special Services include: 1. Retirement Contributions: Employees can choose to have a portion of their salary deducted to contribute towards their retirement fund, such as a 401(k) or pension plan. These deductions are usually tax-deductible, and the funds are invested to grow over time, ensuring financial security during retirement. 2. Health Insurance Premiums: Through this service, employees can opt to have their health insurance premiums deducted directly from their paychecks. This convenient method ensures that the premiums are paid consistently, relieving employees from the burden of manual payments while staying protected with appropriate health coverage. 3. Flexible Spending Accounts (FSA's): By utilizing this option, employees can earmark a portion of their pre-tax income into a flexible spending account. This dedicated account can be used for qualified medical expenses, such as co-payments, prescription medications, and other healthcare costs not covered by insurance. It offers potential tax savings and simplifies the reimbursement process. 4. Life and Disability Insurance: Collin Texas Payroll Deduction — Special Services can also involve deductions for life insurance premiums or disability insurance coverage. Employees who want to ensure financial protection for their loved ones or secure income in case of disability can take advantage of these deductions. 5. Charitable Donations: This service allows employees to contribute a portion of their salary to charitable organizations through payroll deductions. This not only simplifies the donation process but also supports local community causes and makes a positive impact on the lives of others. 6. Tax Withholding Adjustments: Employees may use payroll deduction services to adjust their tax withholding, ensuring accurate tax payments throughout the year. This option can be particularly useful when employees experience changes in their personal or financial situations. Collin Texas Payroll Deduction — Special Services serves as an efficient and straightforward method for employees to manage various deductions from their salaries. By offering these services, employers demonstrate their commitment to assist employees with financial planning, insurance coverage, retirement savings, and charitable giving. It streamlines the processes involved and provides peace of mind to both employers and employees.

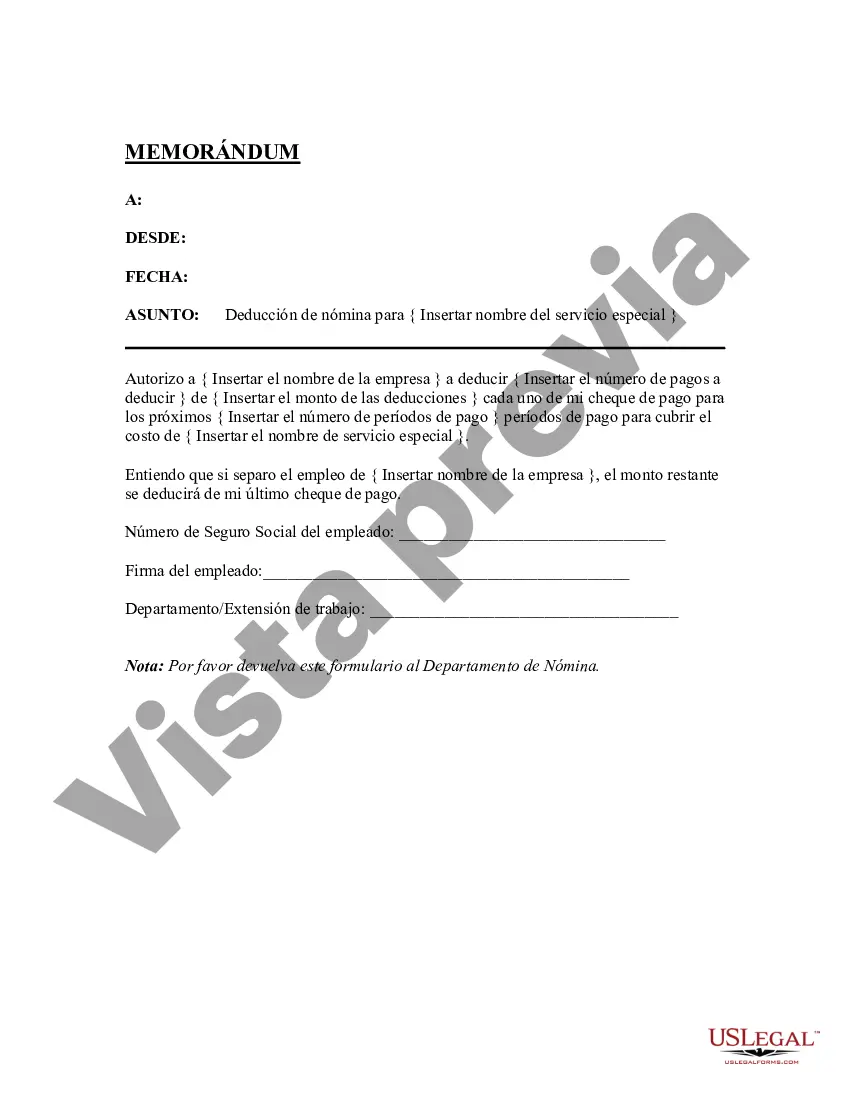

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Collin Texas Deducción De Nómina - Servicios Especiales?

If you need to get a trustworthy legal paperwork supplier to find the Collin Payroll Deduction - Special Services, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to find and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Collin Payroll Deduction - Special Services, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Collin Payroll Deduction - Special Services template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Collin Payroll Deduction - Special Services - all from the convenience of your sofa.

Join US Legal Forms now!