Cook Illinois Payroll Deduction — Special Services is a program offered by Cook Illinois Corporation, a leading provider of transportation services. With this payroll deduction service, employees have the flexibility to enjoy various special services while conveniently paying for them through automatic deductions from their salary. This initiative aims to simplify payments and give employees access to exclusive services without the hassle of separate payments. One of the standout features of Cook Illinois Payroll Deduction — Special Services is its diverse range of offerings. Here are a few examples of the different types of special services available through this program: 1. Employee Benefits: Cook Illinois collaborates with reputable partners to provide employee benefits such as medical insurance, dental coverage, vision plans, and retirement savings programs. By opting for payroll deduction, employees can seamlessly contribute to these benefits, making it easier to manage their finances. 2. Commuter Benefits: Cook Illinois Payroll Deduction — Special Services also includes commuter benefit programs. This option enables employees to set aside pre-tax dollars to cover commuting expenses like public transportation fares, parking fees, or even bicycle commuter expenses. This benefit helps employees save money by reducing their taxable income and promoting eco-friendly alternatives to driving alone. 3. Fitness and Wellness Initiatives: Cook Illinois understands the importance of employee well-being and offers various wellness programs. Through payroll deduction, employees can enroll in fitness memberships, nutrition programs, yoga or exercise classes, and other wellness activities. This service encourages employees to prioritize their health and maintain a work-life balance. 4. Educational Programs: Cook Illinois acknowledges the importance of continuous learning and supports employee development by offering payroll deductions for educational programs. Employees can take advantage of this service to pursue certifications, training courses, or even college degrees, all while conveniently paying for these educational opportunities through their regular paycheck. 5. Charitable Contributions: Cook Illinois Payroll Deduction — Special Services also allows employees to make charitable contributions directly from their payroll. This feature reflects the company's commitment to social responsibility, giving employees an effortless way to support their favorite causes or participate in charitable giving campaigns. Overall, Cook Illinois Payroll Deduction — Special Services provides employees with a seamless way to access a range of benefits, while simplifying payment processes and promoting financial responsibility. By leveraging automatic deductions from their salaries, employees can conveniently manage various aspects of their lives, from health and wellness to education and charitable giving.

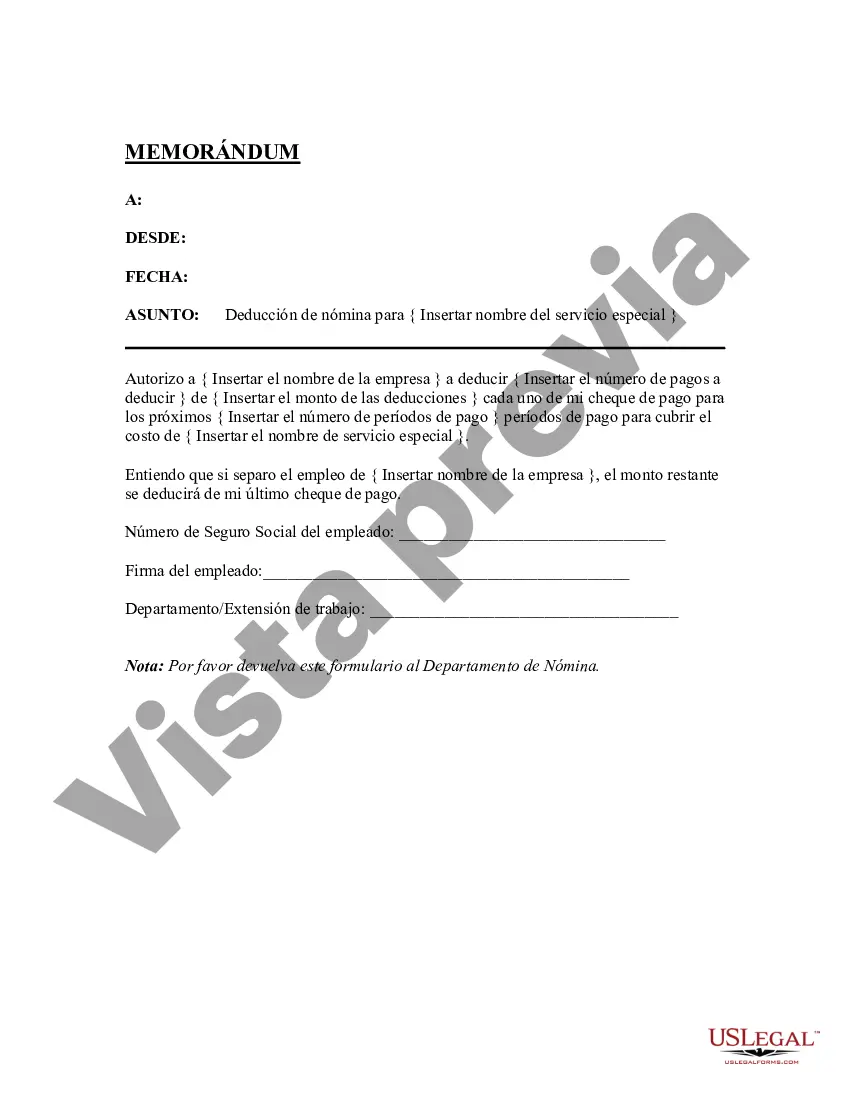

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Cook Illinois Deducción De Nómina - Servicios Especiales?

Creating documents, like Cook Payroll Deduction - Special Services, to manage your legal matters is a tough and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for different cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Cook Payroll Deduction - Special Services form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Cook Payroll Deduction - Special Services:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Cook Payroll Deduction - Special Services isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our website and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!