Franklin Ohio Payroll Deduction — Special Services is a convenient and efficient payroll service offered in Franklin, Ohio, designed to streamline the payroll process for businesses and organizations. This service allows employers to deduct specific amounts from an employee's paycheck, directing the funds towards various special services or programs. The Franklin Ohio Payroll Deduction — Special Services is beneficial for employers and employees alike, as it ensures seamless transactions while supporting important causes. This payroll deduction service in Franklin, Ohio, provides customizable options tailored to the needs of individual businesses. Employers can choose from a range of special services or programs to allocate funds for, depending on the specific goals or objectives they wish to support. Some examples of these special services include: 1. Company-sponsored employee benefit programs: With Franklin Ohio Payroll Deduction — Special Services, employers can provide employees with additional benefits such as medical insurance, retirement plans, or wellness programs. By deducting the necessary funds directly from employee paychecks, these benefits are easily accessible, enhancing job satisfaction and employee well-being. 2. Charitable donations: Businesses and organizations in Franklin, Ohio, can utilize payroll deduction to support charities or non-profit organizations. This service allows employees to contribute a specific amount from their paychecks towards charities of their choice, promoting corporate social responsibility within the community. 3. Union or association fees: Franklin Ohio Payroll Deduction — Special Services facilitates the deduction of union dues or association fees directly from employee salaries. This simplifies the collection process for unions or professional organizations, ensuring timely payments and seamless membership maintenance. 4. Education or tuition reimbursement: Employers in Franklin, Ohio, who offer education or tuition reimbursement programs can utilize payroll deduction to deduct the agreed-upon amounts from employee wages. This enables employees to pursue further education or training without bearing the burden of upfront expenses. 5. Employee savings plans: Franklin Ohio Payroll Deduction — Special Services can be used to facilitate automatic contributions to employee savings plans such as 401(k) or Individual Retirement Accounts (IRA). This simplifies the saving process, ensuring consistent and hassle-free contributions towards employees' future financial security. By implementing Franklin Ohio Payroll Deduction — Special Services, businesses and organizations can automate the distribution of funds towards various special services or programs, saving time and effort in manual transactions. The service fosters transparency, accuracy, and convenience, ensuring seamless payroll management while promoting employee engagement and support for specific organizational goals. In summary, Franklin Ohio Payroll Deduction — Special Services provides a customizable and efficient payroll solution, allowing employers in Franklin, Ohio, to deduct predetermined amounts from employee paychecks for specific services or programs. Whether it is employee benefits, charitable donations, union fees, education reimbursement, or savings plans, this service streamlines payroll processes, benefiting employers and employees while supporting various causes within the community.

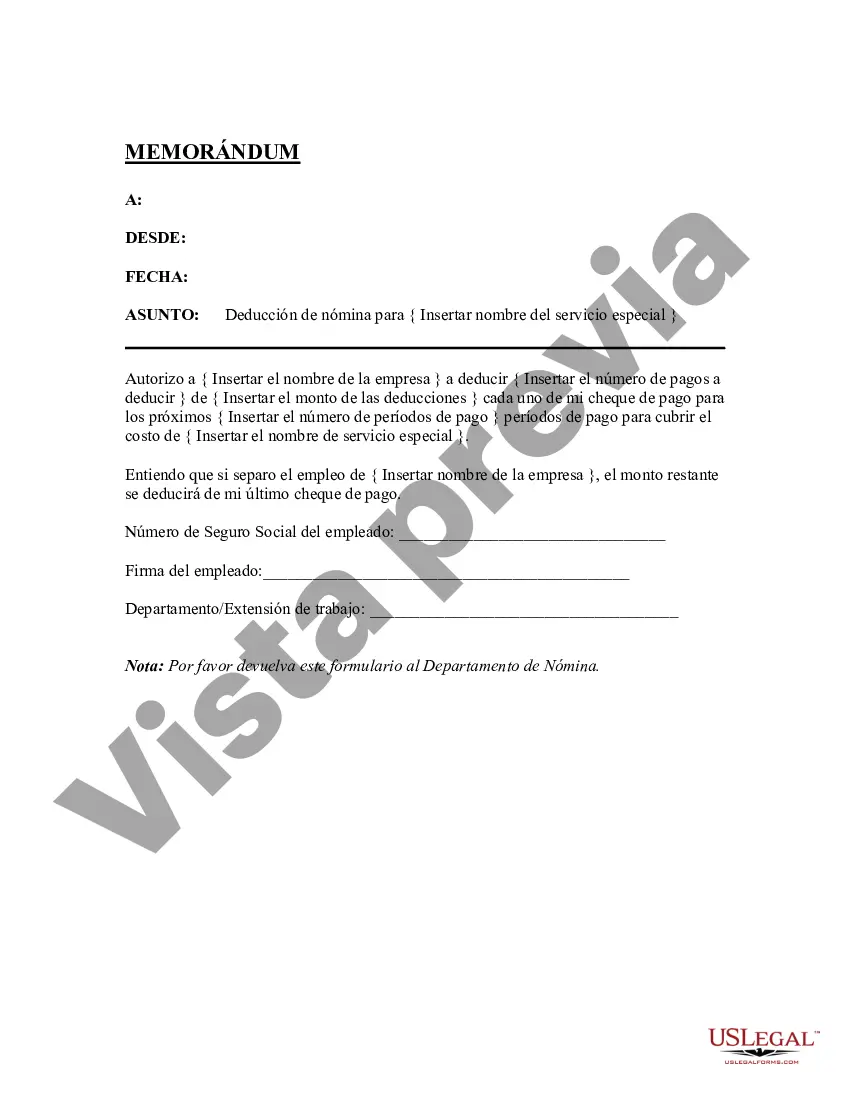

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Franklin Ohio Deducción De Nómina - Servicios Especiales?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Franklin Payroll Deduction - Special Services suiting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Franklin Payroll Deduction - Special Services, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Franklin Payroll Deduction - Special Services:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Franklin Payroll Deduction - Special Services.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!