Harris Texas Payroll Deduction — Special Services is a specialized service offered to employees in Harris County, Texas, that allows them to conveniently and automatically deduct certain expenses from their payroll. This service aims to streamline financial transactions and help employees effectively manage their finances. Here are some detailed descriptions of the different types of Harris Texas Payroll Deduction — Special Services: 1. Healthcare Deduction: Under this service, employees can opt to deduct their healthcare premiums, including medical, dental, and vision insurance, directly from their paychecks. This ensures that employees never miss a premium payment and allows them to effortlessly maintain their healthcare coverage. 2. Retirement Savings: Harris Texas Payroll Deduction — Special Services also provides employees with the opportunity to deduct a portion of their salary and contribute towards a retirement savings plan, such as a 401(k) or IRA. This deduction is made before taxes, offering potential tax advantages and encouraging employees to save for their future financial security. 3. Charitable Donations: Employees who wish to support charitable organizations can opt for this deduction service. It allows them to automatically contribute a fixed amount or a percentage of their salary to the registered charities of their choice. This payroll deduction not only makes giving easier but also potentially enables employees to support causes and make a positive impact in their communities. 4. Education Savings: This service allows employees to deduct funds from their payroll and contribute towards college savings plans or educational expenses for themselves or their dependents. By taking advantage of this deduction, employees can proactively plan for future education costs and ensure that they or their family members have access to quality education. 5. Transit and Parking Expenses: Harris Texas Payroll Deduction — Special Services also includes provisions for employees to set aside a portion of their paychecks for qualifying transportation expenses. These deductions can be used for public transit passes, van pool expenses, and parking fees, giving employees an opportunity to save money on commuting costs while promoting environmentally-friendly transportation options. 6. Union Dues: Employees who are members of labor unions can utilize this deduction service to conveniently pay their union dues directly from their paychecks. This ensures hassle-free payment processing and helps employees actively participate in union activities while supporting collective bargaining and workers' rights. Harris Texas Payroll Deduction — Special Services encompass various types of deductions, allowing employees to manage their finances effectively and simplify the process of meeting financial obligations. By providing these diverse options, Harris County aims to support its employees' financial well-being and ensure a seamless payroll management experience.

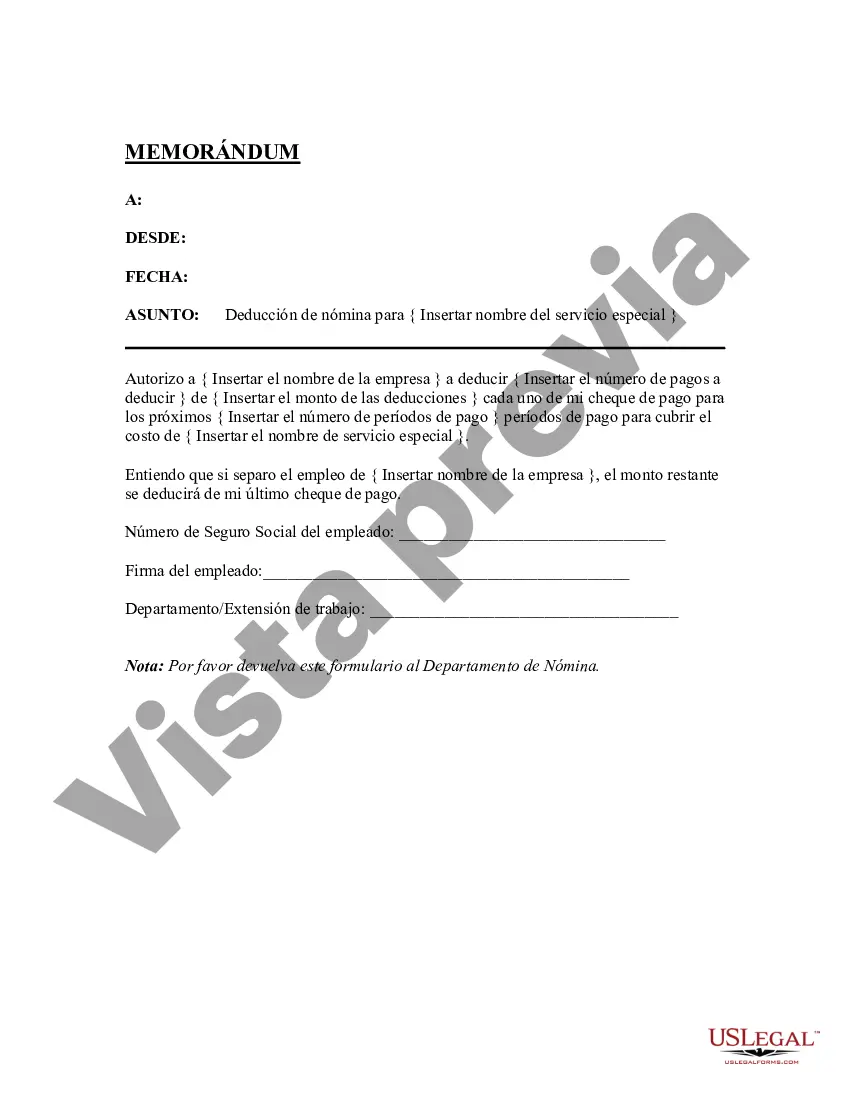

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Harris Texas Deducción De Nómina - Servicios Especiales?

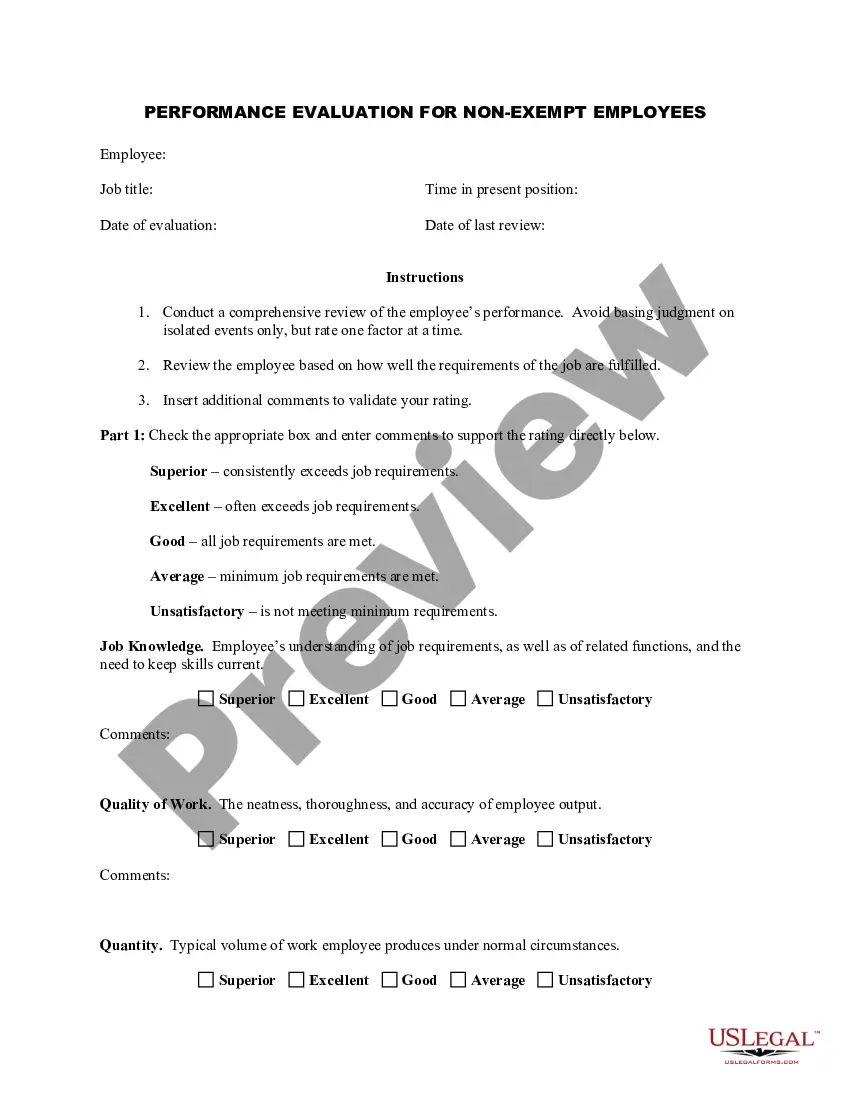

Do you need to quickly create a legally-binding Harris Payroll Deduction - Special Services or probably any other document to take control of your own or business matters? You can select one of the two options: hire a professional to draft a legal document for you or draft it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific document templates, including Harris Payroll Deduction - Special Services and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the Harris Payroll Deduction - Special Services is tailored to your state's or county's laws.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Harris Payroll Deduction - Special Services template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!