Hennepin County in Minnesota offers a variety of payroll deduction — special services aimed at providing employees with convenient options for managing their finances. Through these services, employees can have specific financial deductions automatically taken from their paychecks, ensuring a hassle-free and structured approach to managing their financial commitments. There are several types of Hennepin Minnesota Payroll Deduction — Special Services available to employees, tailored to address different financial needs: 1. Health Insurance Premiums: This service allows employees to have their health insurance premiums deducted from their paychecks automatically. By opting for this service, employees can ensure timely payment of their health insurance, eliminating the need for manual payment each month. 2. Retirement Savings: Hennepin Minnesota Payroll Deduction — Special Services also includes retirement savings options. Through this service, employees can contribute a portion of their salary towards retirement savings accounts, such as 401(k) or pension plans. This deduction is typically done pre-tax, providing potential tax advantages and helping employees build a secure financial future. 3. Flexible Spending Accounts (FSA): Hennepin County offers employees the opportunity to establish FSA's, which are used to set aside pre-tax funds for various eligible expenses, such as medical and dependent care expenses. Using payroll deduction, employees can systematically contribute to their FSA, making it easier to cover these costs throughout the year. 4. Charitable Donations: This service enables employees to contribute to charitable organizations directly from their paychecks. By utilizing payroll deduction, individuals can make regular donations and support causes they are passionate about without the hassle of writing checks or initiating separate transactions. 5. Employee Savings Programs: Hennepin Minnesota Payroll Deduction — Special Services also include employee savings programs. These programs encourage employees to save money by offering the option to automatically deduct a predetermined amount from their paychecks and deposit it into a savings account. This simple and convenient savings method promotes healthy financial habits and helps employees achieve their savings goals. By offering these various types of Hennepin Minnesota Payroll Deduction — Special Services, Hennepin County demonstrates its commitment to supporting employees' financial well-being. These services streamline the payment process, promote savings, and enhance employees' ability to contribute to important causes or prepare for future expenses.

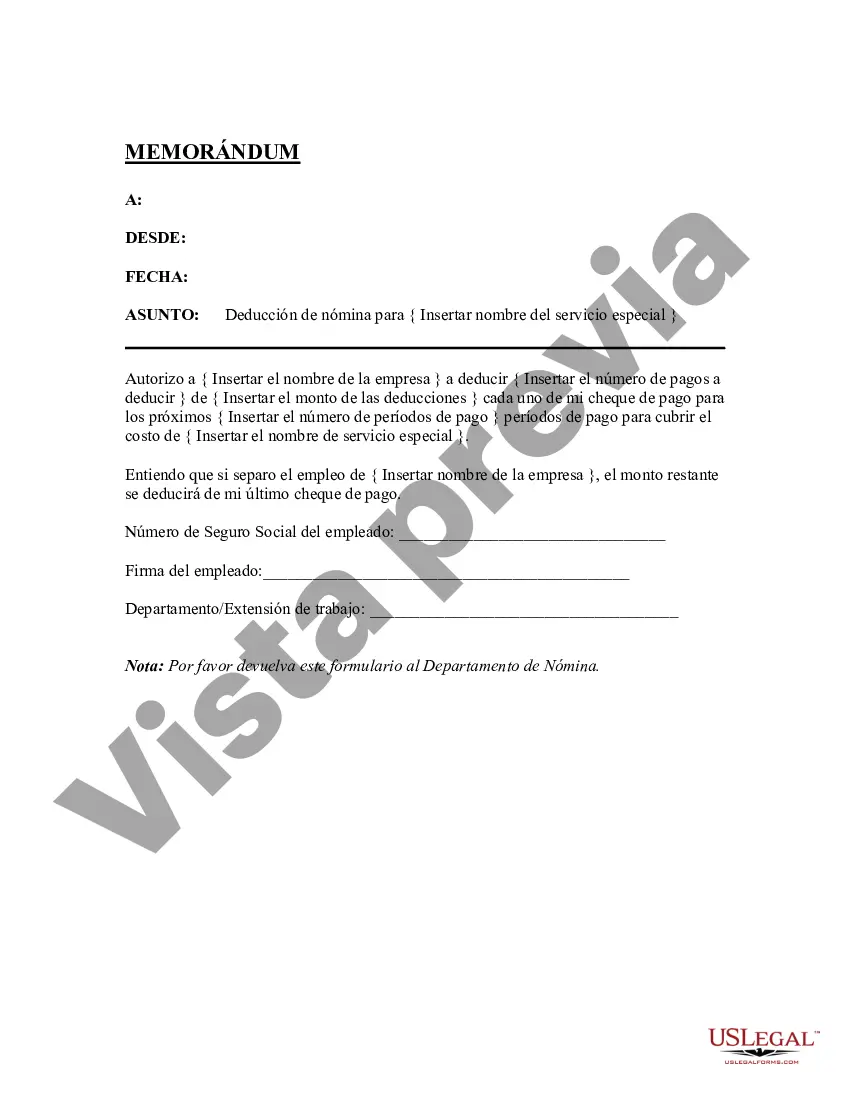

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Hennepin Minnesota Deducción De Nómina - Servicios Especiales?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the Hennepin Payroll Deduction - Special Services.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Hennepin Payroll Deduction - Special Services will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Hennepin Payroll Deduction - Special Services:

- Ensure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Hennepin Payroll Deduction - Special Services on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!