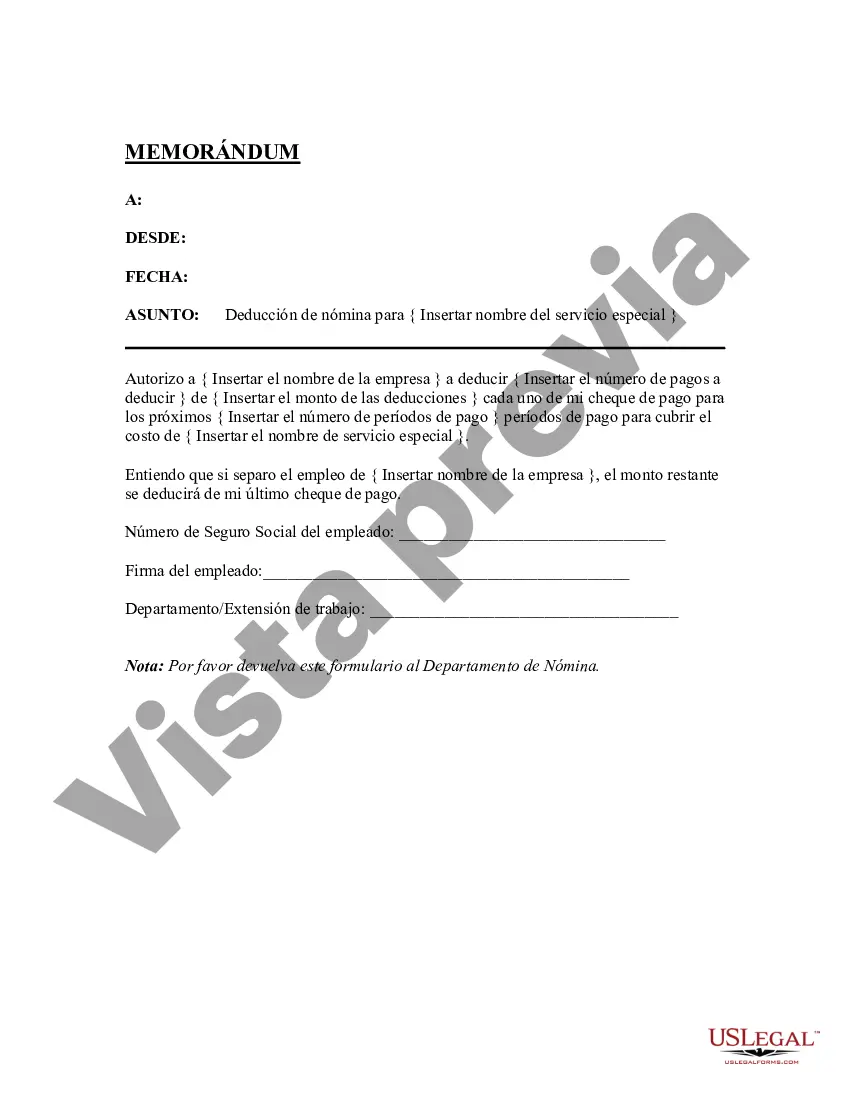

Mecklenburg North Carolina Payroll Deduction — Special Services offer a variety of options for public and private sector employees to conveniently manage their finances. With these services, individuals can have a portion of their pay deducted directly from their wages to allocate towards specific purposes or benefits. One example of Mecklenburg North Carolina Payroll Deduction — Special Service is the Employee Benefits Deduction scheme. This service allows employees to divert a portion of their salary towards various employee benefits, such as healthcare plans, retirement savings accounts, or life insurance policies. By opting for this deduction, employees can effortlessly contribute to these benefits and enjoy the advantages they offer. Another type of Payroll Deduction — Special Service available in Mecklenburg North Carolina is the Charitable Contribution Deduction. Through this option, employees can choose to donate a designated amount of their wages to charitable organizations or causes of their choice. This allows individuals to support the community and give back to society while conveniently managing their donations directly from their payroll. Mecklenburg North Carolina Payroll Deduction — Special Services also include the Education Savings Deduction. This particular deduction empowers employees to contribute funds towards education-related expenses for themselves or their family members. Whether it is for tuition fees, books, or other educational needs, individuals can make regular payroll deductions to gradually build up their education savings. Furthermore, the Loan Repayment Deduction is another beneficial service offered in Mecklenburg North Carolina. Employees who have taken out loans, such as student loans or personal loans, can use this deduction option to automatically allocate a portion of their income towards debt repayment. This simplifies loan management and ensures timely repayments, reducing the burden on individuals to manually handle monthly installments. In summary, Mecklenburg North Carolina Payroll Deduction — Special Services provide employees with various options to efficiently manage their finances and benefit from diverse services. Some types of deductions available include Employee Benefits Deduction, Charitable Contribution Deduction, Education Savings Deduction, and Loan Repayment Deduction. With these services, individuals can effectively allocate their income towards specific purposes, ensuring ease and convenience in financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Mecklenburg North Carolina Deducción De Nómina - Servicios Especiales?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Mecklenburg Payroll Deduction - Special Services suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Mecklenburg Payroll Deduction - Special Services, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Mecklenburg Payroll Deduction - Special Services:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Mecklenburg Payroll Deduction - Special Services.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!