Montgomery Maryland Payroll Deduction — Special Services is a convenient feature offered by various organizations and employers in Montgomery, Maryland, allowing employees to automate the process of deducting payments from their salaries. This service simplifies financial transactions and ensures hassle-free procedures for employees. The Montgomery Maryland Payroll Deduction — Special Services encompass several types, each serving different purposes and catering to specific needs. Let's explore some of these special services: 1. Employee Benefits Programs: Many employers in Montgomery, Maryland, offer payroll deduction services for employee benefits programs. These can include healthcare insurance premiums, retirement contributions, flexible spending accounts (FSA), and other employee benefits. By deducting these costs directly from the employee's paycheck, it enables a seamless and systematic management of these benefits. 2. Charitable Giving Programs: Some employers support charitable causes and encourage their employees to contribute. Montgomery Maryland Payroll Deduction — Special Services can be used to deduct donation amounts from an employee's salary and transfer them to the designated charities or non-profit organizations. This service provides a convenient and efficient way for employees to give back to their community or support causes they believe in. 3. Transportation Programs: Many businesses in Montgomery, Maryland, offer transportation-related benefits such as commuter benefits or parking fees. With payroll deduction services, employees can easily have these costs deducted directly from their salary, allowing for a hassle-free commute and a seamless integration of transportation benefits into their monthly finances. 4. Loan Repayment Programs: Some employers offer loan repayment programs to assist employees with student loans or other outstanding debts. Through payroll deduction, employees can set up automatic payments, ensuring their loan obligations are met on time without the need for manual transfers or remembering payment due dates. 5. Savings Programs: Montgomery Maryland Payroll Deduction — Special Services also extend to savings programs, such as retirement savings plans, 401(k) contributions, or other savings accounts. Employees can allocate a portion of their salary to be deducted automatically and deposited into their savings accounts, encouraging consistent savings practices and promoting financial security. In conclusion, Montgomery Maryland Payroll Deduction — Special Services provide employees in Montgomery, Maryland, with a range of benefits that simplify financial transactions and help them manage various costs more effectively. These services can include employee benefits programs, charitable giving programs, transportation programs, loan repayment programs, and savings programs. With these convenient services, employees can focus on their work while their financial commitments are taken care of automatically.

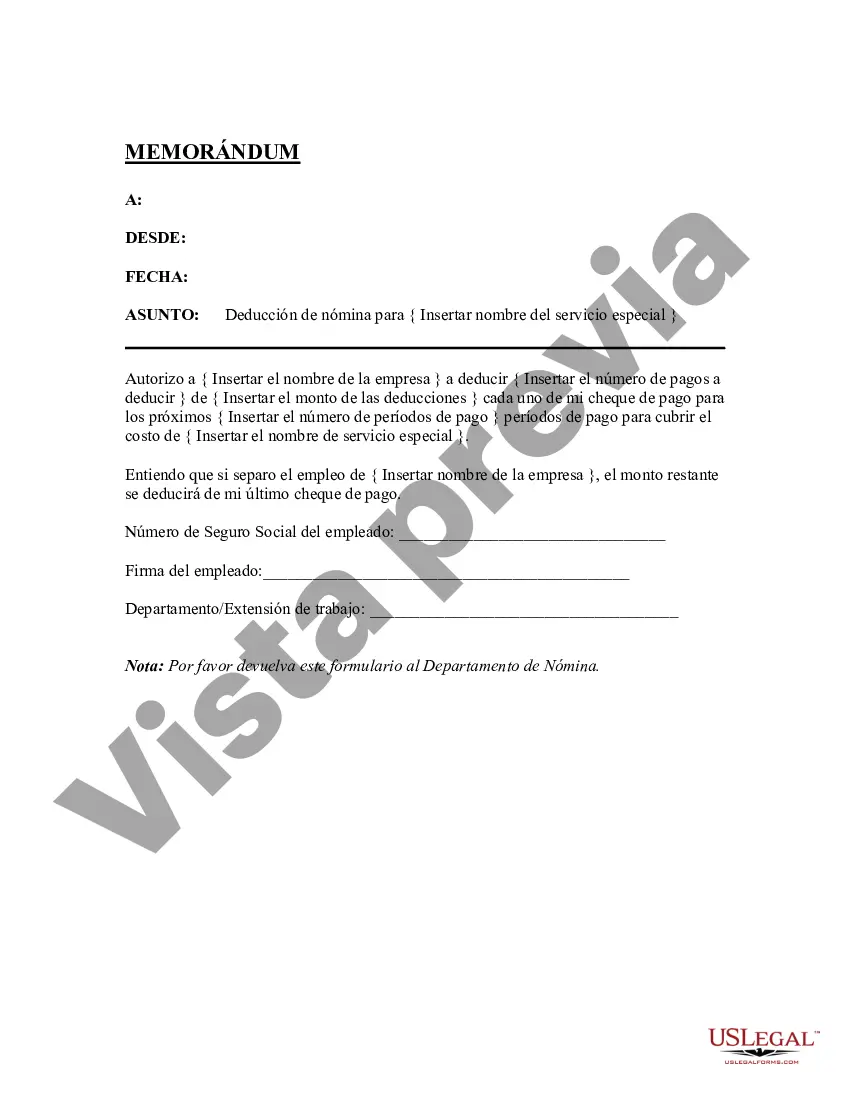

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Montgomery Maryland Deducción De Nómina - Servicios Especiales?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Montgomery Payroll Deduction - Special Services, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Montgomery Payroll Deduction - Special Services from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Montgomery Payroll Deduction - Special Services:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!