Orange California Payroll Deduction — Special Services is a unique system that allows employers and employees in Orange, California, to organize and manage their payroll deductions efficiently. This service is designed to simplify the payroll process, save time, and provide convenience to both employers and employees. The Orange California Payroll Deduction — Special Services offers various options tailored to the needs of different organizations and industries. These services aim to streamline payroll processing and ensure accurate withholding of funds. Some specific types of Orange California Payroll Deduction — Special Services include: 1. Retirement Savings Plans: This service enables employees to contribute a portion of their salary towards a retirement savings account, such as a 401(k) or IRA. The deductions are made automatically from each paycheck, allowing employees to save for their future while enjoying potential tax benefits. 2. Health Insurance Premiums: With this service, employees can have their health insurance premiums deducted directly from their paychecks. This ensures timely premium payments and prevents the hassle of manual payments. 3. Flexible Spending Accounts (FSA): FSA allows employees to set aside pre-tax dollars to cover eligible medical expenses or dependent care costs. The Orange California Payroll Deduction — Special Services simplify the administration of FSA's, deducting the specified amounts from employees' paychecks and allocating them to their FSA accounts. 4. Charitable Contributions: This service allows employees to contribute to charitable organizations through automatic payroll deductions. Employers can set up partnerships with various nonprofits, enabling their employees to make donations conveniently. 5. Wage Garnishments: Wage garnishment occurs when a portion of an employee's wages is legally required to be withheld for items such as child support, alimony, or tax debts. The Orange California Payroll Deduction — Special Services processes these deductions accurately, ensuring compliance with legal requirements. Overall, Orange California Payroll Deduction — Special Services simplify the payroll deduction process, ensuring accurate and timely deductions for various purposes. Employers can choose the specific services that align with their company's needs, promoting financial well-being, and convenience for both employers and employees. Whether it's saving for retirement, paying insurance premiums, contributing to charitable causes, or managing wage garnishments, Orange California Payroll Deduction — Special Services are designed to streamline the payroll process and benefit all stakeholders.

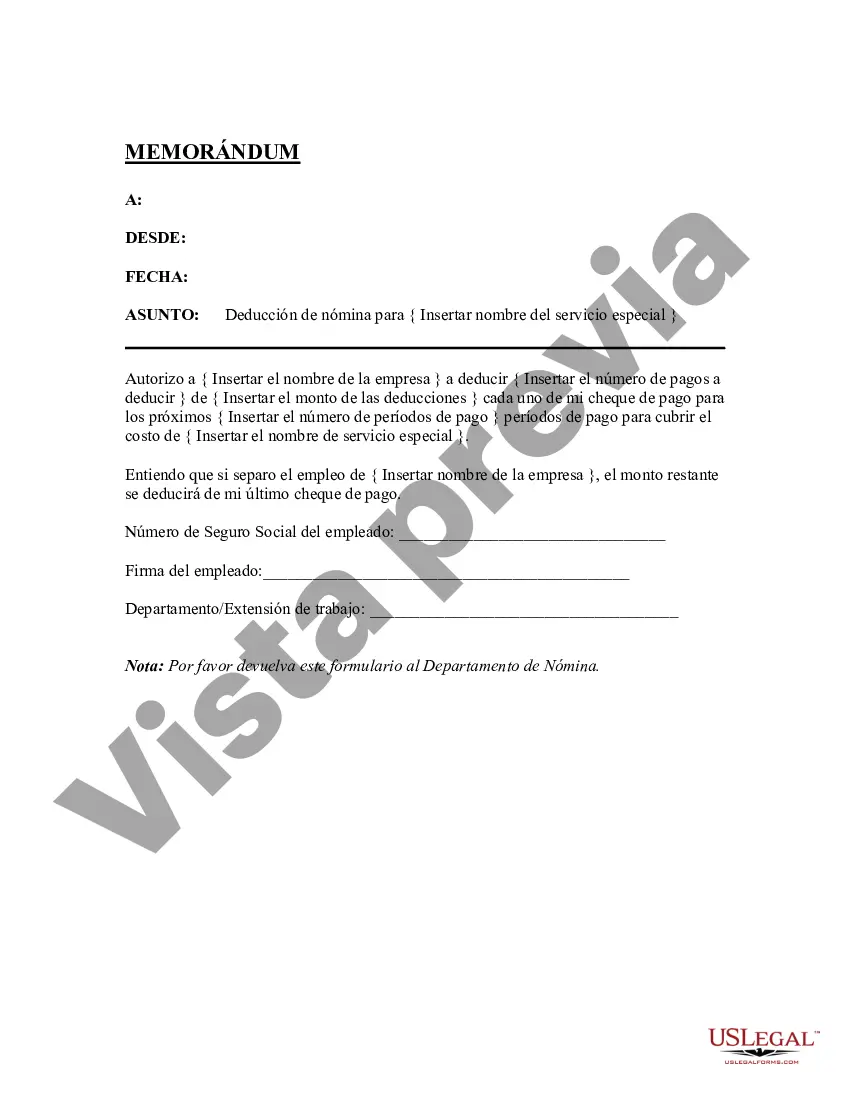

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Orange California Deducción De Nómina - Servicios Especiales?

Are you looking to quickly create a legally-binding Orange Payroll Deduction - Special Services or probably any other form to manage your personal or business matters? You can select one of the two options: contact a professional to draft a valid document for you or draft it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific form templates, including Orange Payroll Deduction - Special Services and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Orange Payroll Deduction - Special Services is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's intended for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Orange Payroll Deduction - Special Services template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the documents we offer are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!