San Jose California Payroll Deduction — Special Services is a convenient and efficient way for employees in San Jose, California to manage their finances and allocate a portion of their salary towards various special services. These services are designed to offer employees added benefits, convenience, and savings. One type of San Jose California Payroll Deduction — Special Service is the Employee Assistance Program (EAP). This program provides employees with access to confidential counseling services, mental health support, substance abuse assistance, financial planning, legal guidance, and other resources. By deducting a predetermined amount from their payroll, employees can easily avail these services and improve their overall well-being. Another special service offered through San Jose California Payroll Deduction is the Commuter Benefits Program. This program enables employees to allocate a portion of their salary towards commuting expenses, such as public transportation passes, ride-share programs, parking fees, and more. By utilizing this service, employees can save money on their daily commute, reduce traffic congestion, and contribute to a greener environment. San Jose California Payroll Deduction — Special Services also include retirement savings plans like 401(k) or 403(b). These plans allow employees to save for their future by deducting a percentage of their salary before taxes. Employers often match a portion of these contributions, providing employees with an additional incentive to save. Healthcare and flexible spending accounts (FSA) are additional special services available through San Jose California Payroll Deduction. Employees can allocate a portion of their salary towards healthcare expenses, such as insurance premiums, co-pays, prescription medications, and other eligible medical costs. FSA's allow employees to set aside pre-tax funds to cover qualified expenses like childcare, dependent care, and healthcare costs not covered by insurance. In conclusion, San Jose California Payroll Deduction — Special Services provide employees with a range of financial benefits and resources to enhance their overall well-being. From Employee Assistance Programs to Commuter Benefits, Retirement Savings Plans, and Healthcare/FSA options, employees have the opportunity to make the most of their earnings while enjoying added convenience, savings, and peace of mind.

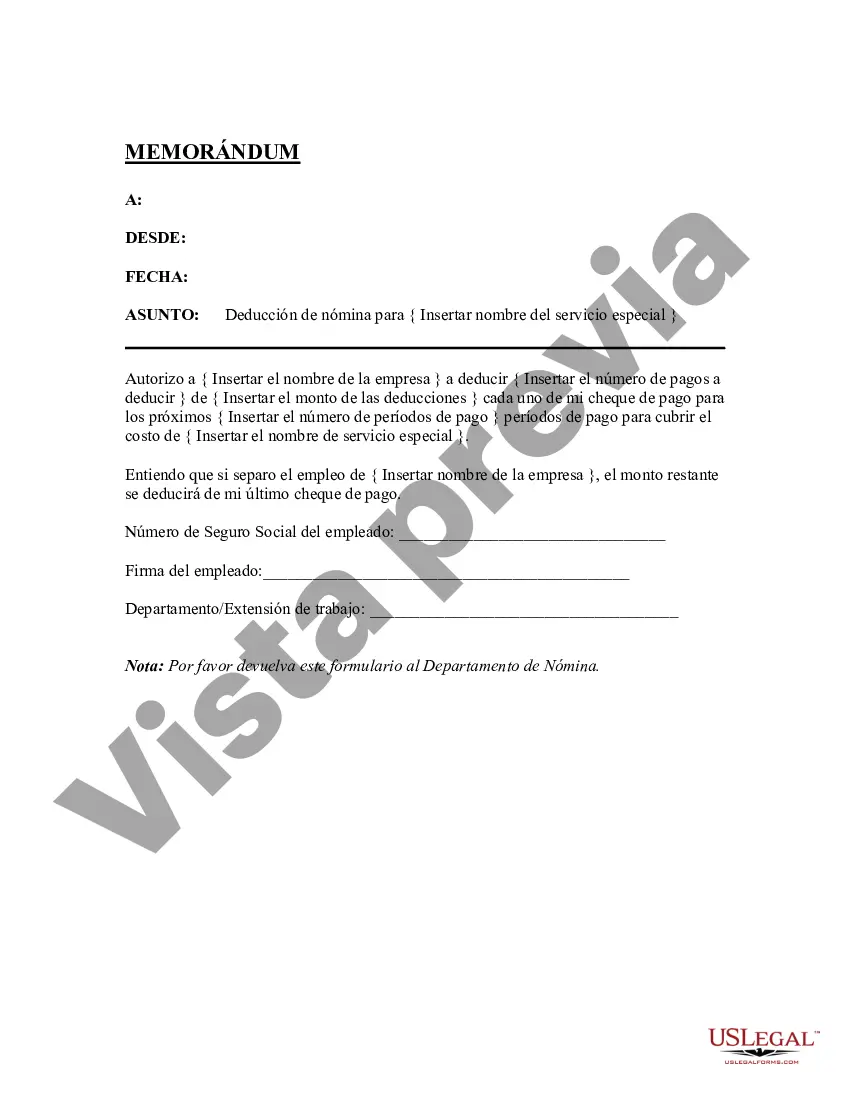

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out San Jose California Deducción De Nómina - Servicios Especiales?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the San Jose Payroll Deduction - Special Services, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the San Jose Payroll Deduction - Special Services from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the San Jose Payroll Deduction - Special Services:

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!