Santa Clara California Payroll Deduction — Special Services is a unique benefit program offered to employees that allows them to make convenient deductions from their salary towards various specialized services. These services are designed to help employees manage their finances, save money, and enhance their overall well-being. The primary purpose of Santa Clara California Payroll Deduction — Special Services is to simplify the payment process for employees and provide them with exclusive, cost-effective options. This benefit is often provided by employers to promote financial stability and offer employees attractive perks. Here are different types of Santa Clara California Payroll Deduction — Special Services: 1. Retirement Savings Plans: Santa Clara California Payroll Deduction — Special Services encompass retirement savings plans, such as 401(k) or 403(b) plans. Employees can opt to have a portion of their paycheck automatically deducted and contributed to their retirement account. This service enables individuals to save systematically for their future and enjoy potential tax advantages. 2. Healthcare and Insurance Premiums: Many organizations offer employees the option to deduct their healthcare premiums directly from their paycheck. This convenient method ensures timely payment and simplifies the complex insurance billing process. Deductions can be made towards health, dental, vision, and supplemental insurance premiums. 3. Flexible Spending Accounts (FSA): Santa Clara California Payroll Deduction — Special Services maincludesSSASAs, which allow employees to set aside pre-tax dollars for eligible healthcare or dependent care expenses. By deducting portions of their salary before taxes, employees can reduce taxable income and potentially save money on medical or childcare costs. 4. Charitable Donations: Some companies provide employees with the opportunity to make charitable contributions through payroll deduction. Employees can choose to support a range of charitable organizations, empowering them to give back to their community conveniently. 5. Transit and Parking Expenses: For employees who commute to work via public transportation or need parking, payroll deduction services can be offered to deduct these costs pre-tax. These deductions can help employees save money by reducing their taxable income and offsetting commuting expenses. 6. Education and Tuition Reimbursement: Employers may offer payroll deductions to fund education-related expenses. This can include tuition reimbursement or deductions for continuing education programs, providing employees with the opportunity to enhance their skills and knowledge. Santa Clara California Payroll Deduction — Special Services aim to simplify financial transactions, promote employee wellness, and strengthen overall financial security. By offering a range of deductible services, employers show their commitment to supporting employees' financial goals and fostering a positive work environment.

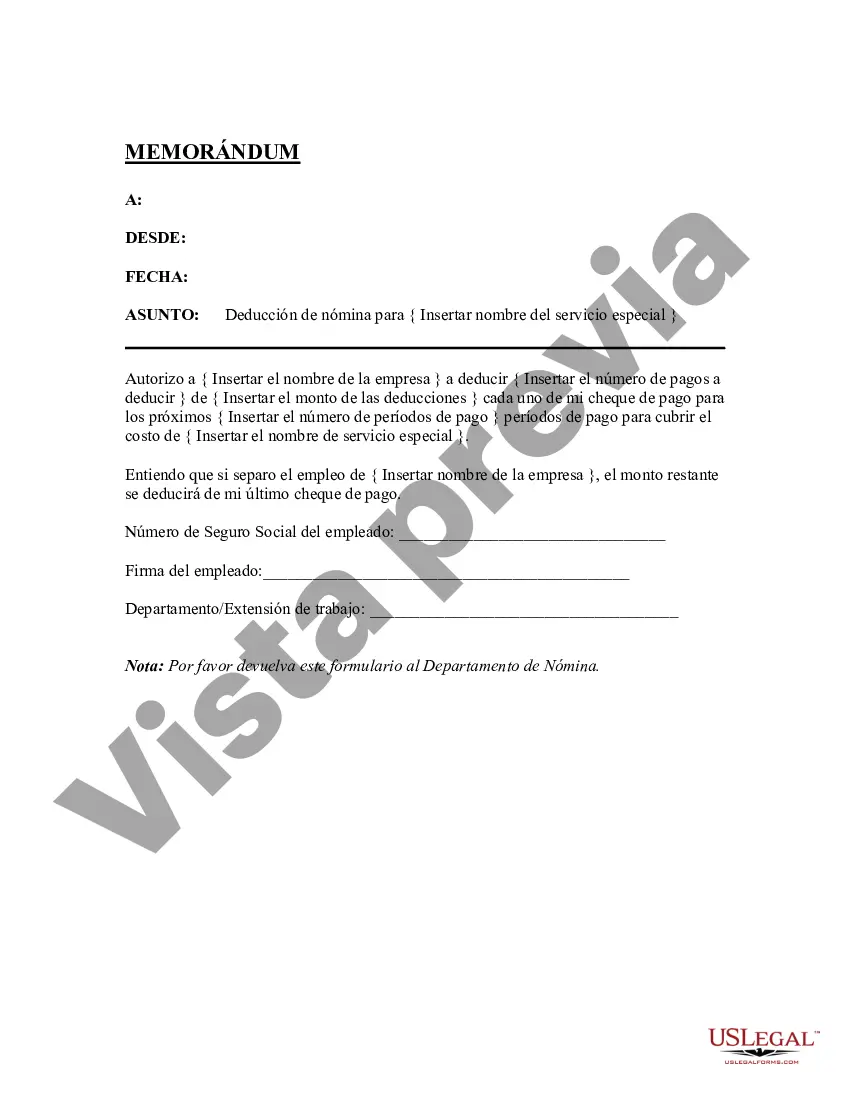

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Santa Clara California Deducción De Nómina - Servicios Especiales?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Santa Clara Payroll Deduction - Special Services, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to document completion simple.

Here's how you can find and download Santa Clara Payroll Deduction - Special Services.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the related document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Santa Clara Payroll Deduction - Special Services.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Santa Clara Payroll Deduction - Special Services, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an extremely complicated situation, we advise getting a lawyer to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!