Tarrant Texas Payroll Deduction — Special Services is a system designed to simplify and streamline the process of deducting payments from an employee's salary for various services offered by organizations in Tarrant, Texas. This service offers convenience, budgeting control, and ensures hassle-free transactions for both employers and employees. One type of Tarrant Texas Payroll Deduction — Special Service is healthcare benefits. Many employers in Tarrant, Texas, provide medical, dental, and vision insurance to their employees. With this payroll deduction service, employees can have their insurance premiums automatically deducted from their paychecks, making it easier to manage healthcare expenses. Another type of service under Tarrant Texas Payroll Deduction — Special Services is retirement savings plans. Employers offer options such as 401(k) or IRA accounts to help employees save for their future. With payroll deduction, employees can allocate a percentage of their salary to be deducted automatically and contributed towards their retirement accounts, ensuring consistent and disciplined savings. Furthermore, charitable contributions can also be made through Tarrant Texas Payroll Deduction — Special Services. Employers often partner with nonprofit organizations and allow employees to contribute to these causes directly from their paychecks. This platform allows employees to support their favorite charities effortlessly, making a positive impact on their community. Besides healthcare benefits, retirement savings plans, and charitable contributions, Tarrant Texas Payroll Deduction — Special Services may include deductions for employee loans or advances. In situations where employees require financial assistance, employers can offer loans or advances and set up automatic deductions from their future paychecks, ensuring a structured repayment plan. In summary, Tarrant Texas Payroll Deduction — Special Services simplifies the process of deducting employees' payments for various services, ranging from healthcare benefits to retirement savings plans and charitable contributions. This system offers convenience, financial control, and efficient transactions, benefiting both employers and employees in Tarrant, Texas.

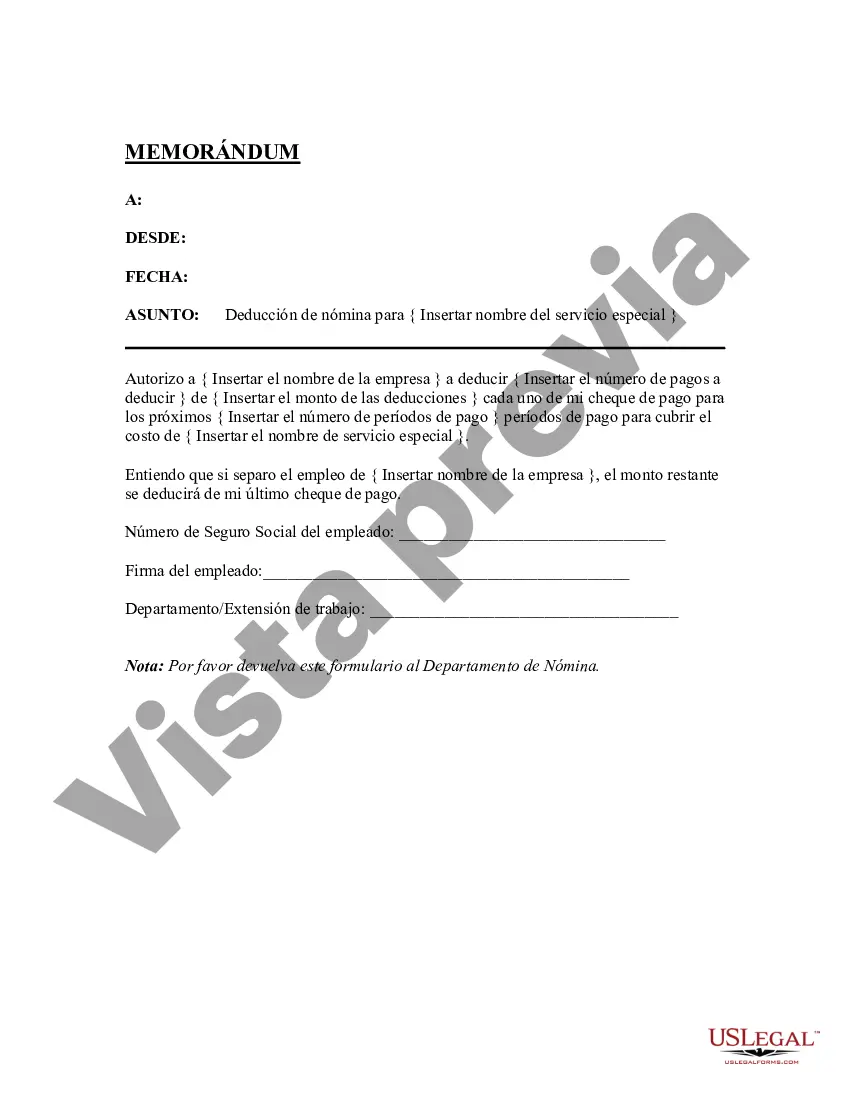

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Tarrant Texas Deducción De Nómina - Servicios Especiales?

Creating forms, like Tarrant Payroll Deduction - Special Services, to take care of your legal affairs is a challenging and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for a variety of scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Tarrant Payroll Deduction - Special Services template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Tarrant Payroll Deduction - Special Services:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Tarrant Payroll Deduction - Special Services isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our website and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!