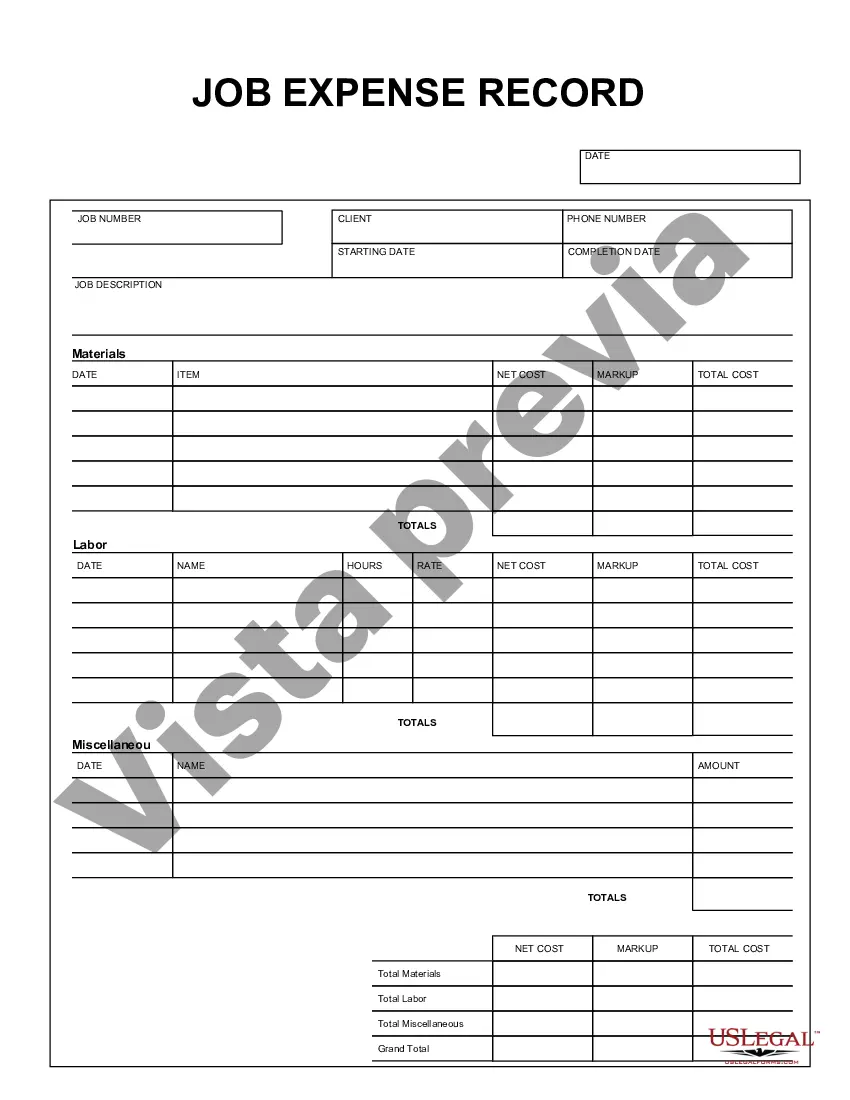

Bronx New York Job Expense Record is a comprehensive documentation system that allows individuals or organizations located in the Bronx, New York, to track and manage their job-related expenses effectively. This detailed record provides a clear overview of all expenses incurred throughout various job tasks and projects, ensuring accurate reporting and financial transparency. The Bronx New York Job Expense Record is crucial for businesses and individuals to maintain a proper record of their job-related expenditures. It helps track and categorize expenses, providing valuable insights for budgeting, tax planning, and reimbursement purposes. Additionally, it ensures compliance with accounting and tax regulations. There are typically two types of Bronx New York Job Expense Records: 1. Bronx New York Individual Job Expense Record: This record is specifically designed for self-employed individuals or independent contractors operating in the Bronx, New York. It allows them to track all their job-related expenses, such as travel expenses, supplies, equipment purchases, advertising costs, and other related expenditures. This type of record is essential for accurately reporting income and deductions during tax filing. 2. Bronx New York Business Job Expense Record: Businesses operating in the Bronx, New York, require a more comprehensive record-keeping system to manage their job-related expenses. This record includes detailed entries for all business expenses, including employee salaries, office rent, utilities, inventory purchases, advertising expenses, transportation costs, and various overhead expenses. It enables businesses to have better financial control and make informed decisions regarding budget allocation and cost management. Both types of Bronx New York Job Expense Records play a crucial role in financial management, allowing individuals and businesses to monitor their expenses, assess profitability, and plan for future growth. They serve as an essential tool for maintaining accurate financial records and demonstrating fiscal responsibility to tax authorities, potential investors, and stakeholders. By diligently recording and categorizing expenses, individuals and businesses in the Bronx, New York, can optimize their financial operations and ensure long-term success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Bronx New York Registro De Gastos De Trabajo?

Are you looking to quickly draft a legally-binding Bronx Job Expense Record or probably any other form to handle your personal or business affairs? You can go with two options: contact a professional to draft a legal document for you or draft it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you get professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Bronx Job Expense Record and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, double-check if the Bronx Job Expense Record is tailored to your state's or county's laws.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Bronx Job Expense Record template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the paperwork we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!