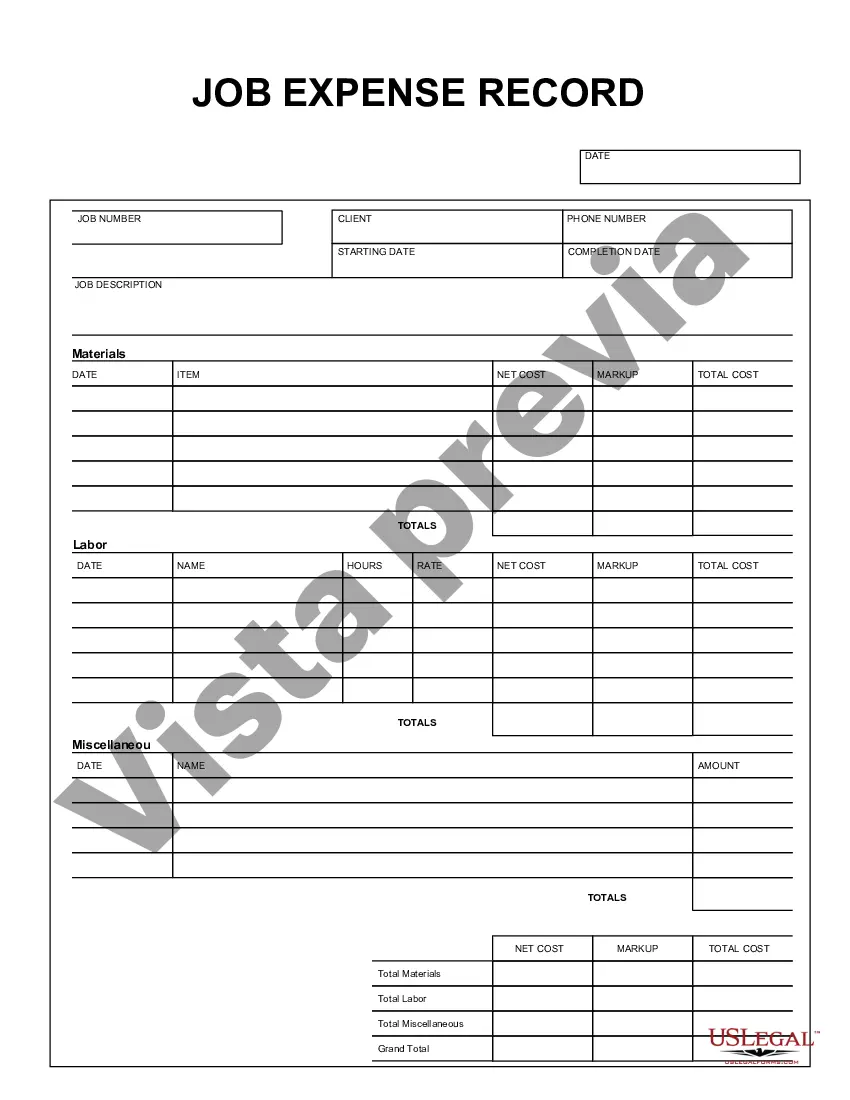

Contra Costa California Job Expense Record is a crucial document that helps individuals or businesses track and manage their job-related expenses in Contra Costa County, California. This record is especially important for tax purposes and can be used to claim deductions or reimbursements. The Contra Costa California Job Expense Record is designed to capture various job-related expenses incurred by employees or independent contractors operating within the county. It includes a comprehensive list of common expense categories relevant to different professions and industries. Some examples of these expense categories include: 1. Travel Expenses: This category covers transportation costs such as mileage, public transportation fares, or airfare for business-related travel within Contra Costa County or outside the county when necessary. 2. Meals and Entertainment: This category includes expenses related to business meals, networking events, or entertainment that occurs in the course of conducting business in Contra Costa County. 3. Equipment and Supplies: This category covers expenses related to purchasing or maintaining job-specific equipment, tools, or materials required for work in Contra Costa County. 4. Home Office Expenses: For individuals or independent contractors working from home, this category includes expenses such as rent, utilities, and home office supplies that are directly relevant to their work in Contra Costa County. 5. Continuing Education: This category includes expenses related to job-related training, workshops, seminars, or courses in Contra Costa County that help individuals improve their professional skills or maintain their licenses. 6. Professional Memberships: This category captures expenses related to joining or renewing memberships in professional organizations or associations relevant to the job or industry in Contra Costa County. 7. Miscellaneous Expenses: This category covers other job-related expenses that may not fit into the above categories but are still relevant to work in Contra Costa County, such as fees for licenses, certifications, or subscriptions to professional publications. It is important to note that the specific types and details of the Contra Costa California Job Expense Record may vary depending on the individual or business's unique circumstances and profession. It is recommended to consult with a certified accountant or tax professional to ensure accurate and compliant recording and management of job-related expenses in Contra Costa County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Contra Costa California Registro De Gastos De Trabajo?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Contra Costa Job Expense Record suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Apart from the Contra Costa Job Expense Record, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Contra Costa Job Expense Record:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Contra Costa Job Expense Record.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!