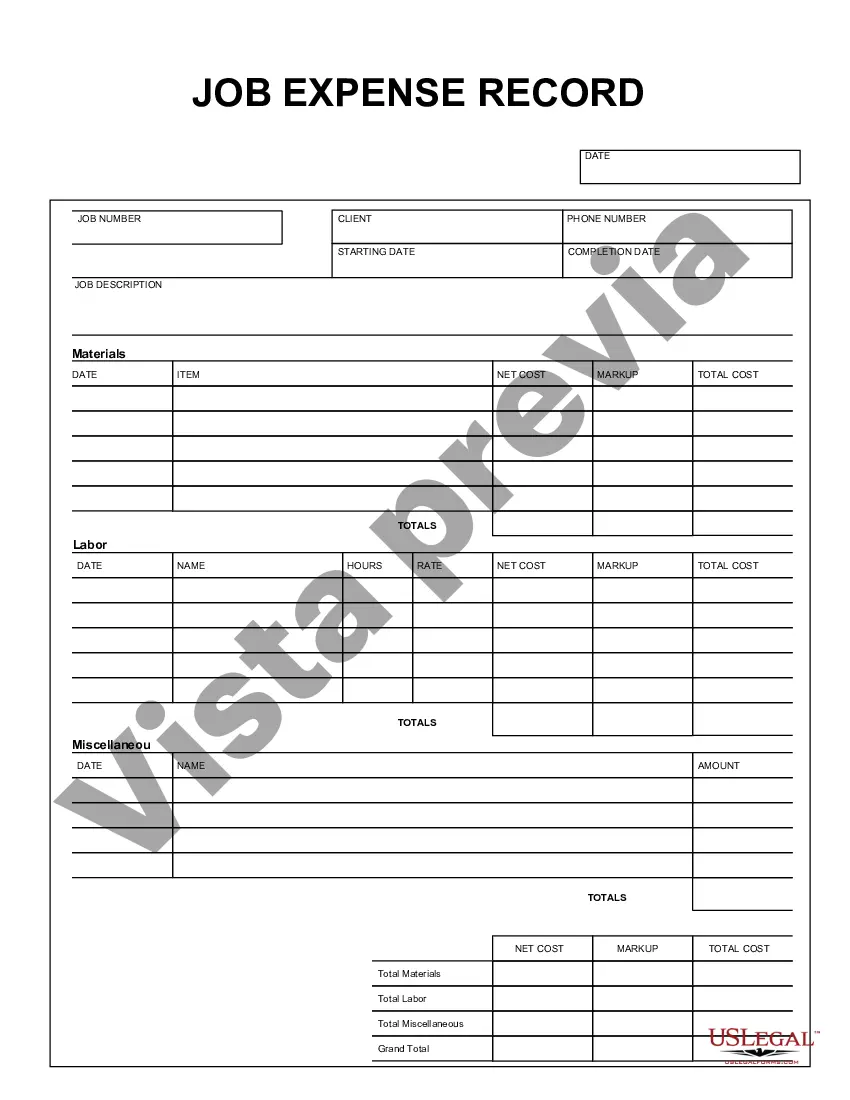

The Cook Illinois Job Expense Record is a crucial document used by employees and employers to track and account for job-related expenses incurred during the course of employment in Illinois. This record serves as a detailed logbook to maintain accurate records of expenses which may be reimbursed or deducted for tax purposes. Various types of Cook Illinois Job Expense Records exist depending on the nature of job-related expenses incurred. These may include: 1. Transportation Expenses: This category encompasses costs related to commuting between job sites, business-related travel, and transportation expenses for work-related meetings, conferences, or seminars. 2. Meals and Entertainment Expenses: Job-related meals and entertainment expenses are recorded here. This includes expenses incurred while dining with clients, customers, or potential business partners, as well as costs associated with business-related functions, such as conferences or team-building events. 3. Lodging Expenses: This category covers expenses related to overnight stays for business purposes. It includes the cost of hotel rooms or other accommodations incurred while traveling for work or attending conferences, seminars, or training sessions. 4. Supplies and Equipment Expenses: Job-related supplies and equipment expenses are recorded under this category. This includes the cost of purchasing or maintaining tools, uniforms, safety gear, and any other supplies necessary to perform job duties effectively. 5. Communication Expenses: This category includes expenses associated with job-related communication, such as telephone bills, internet services, and postage or courier costs incurred during the course of employment. 6. Professional Development Expenses: Job-related expenses incurred for professional development or continuing education are recorded in this category. It covers expenses such as workshop fees, training courses, professional memberships, and subscriptions to trade publications. 7. Miscellaneous Expenses: This category accounts for various other job-related expenses that do not fit into the above categories. Examples include parking fees, tolls, passport or visa fees for international business travel, and other relevant expenditures. To ensure accuracy and consistency in record-keeping, it is recommended to organize the Cook Illinois Job Expense Record using relevant keywords such as date, description of the expense, amount spent, receipt or invoice number, purpose of the expense, and any supporting documentation. Regularly updating and maintaining this record can aid in accurate reimbursement, tax deductions, and compliance with applicable rules and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Cook Illinois Registro De Gastos De Trabajo?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Cook Job Expense Record, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Cook Job Expense Record from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Cook Job Expense Record:

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!