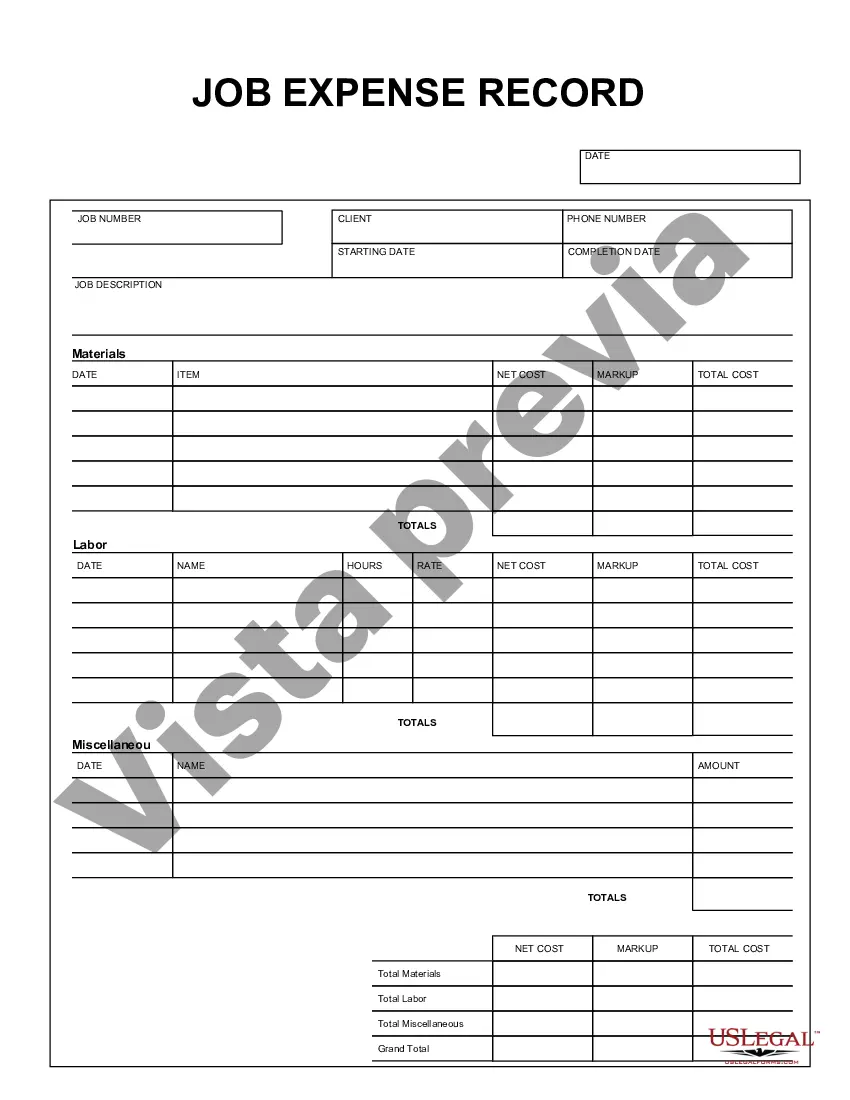

Dallas Texas Job Expense Record is a crucial document used to track and record various job-related expenses incurred by individuals living or working in Dallas, Texas. It allows employees, self-employed individuals, and contractors to keep meticulous records of their business-related expenses, ensuring accuracy, transparency, and compliance with tax regulations. These records are essential for tax deductions, reimbursements, and financial management purposes. Dallas Texas Job Expense Record typically includes expense details such as date, description, category, amount, method of payment, and supporting documentation. Categories may encompass travel expenses, meals and entertainment, office supplies, equipment purchases or rentals, communication expenses, professional services, and more. Different types of Dallas Texas Job Expense Records may be specific to certain industries or professions. Here are a few examples: 1. Transportation and Travel Expense Record: This record is used to document expenses related to commuting, business travel, public transportation, parking fees, tolls, mileage, flights, and accommodation. 2. Meals and Entertainment Expense Record: This record is dedicated to tracking expenses incurred during client meetings, business lunches, networking events, and any other business-related meal or entertainment events. 3. Office Supplies Expense Record: This record focuses on recording expenses related to items necessary for daily operations, such as stationery, computer equipment, software, furniture, and general office supplies. 4. Communication Expense Record: This record helps track expenses associated with phone bills, internet services, mobile devices, data plans, and any other communication-related costs. 5. Professional Services Expense Record: Freelancers or individuals contracting professional services can maintain this record to monitor expenses incurred in hiring consultants, lawyers, accountants, marketing agencies, or other professional service providers. Dallas Texas Job Expense Record provides a comprehensive overview of business-related costs, ensuring accurate tax reporting, identifying tax deductions, and maximizing potential reimbursements. By maintaining detailed records, individuals can claim valid expenses, demonstrate business-related transactions, and minimize any risks associated with tax audits or financial reviews.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Dallas Texas Registro De Gastos De Trabajo?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Dallas Job Expense Record, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Dallas Job Expense Record from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Dallas Job Expense Record:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!