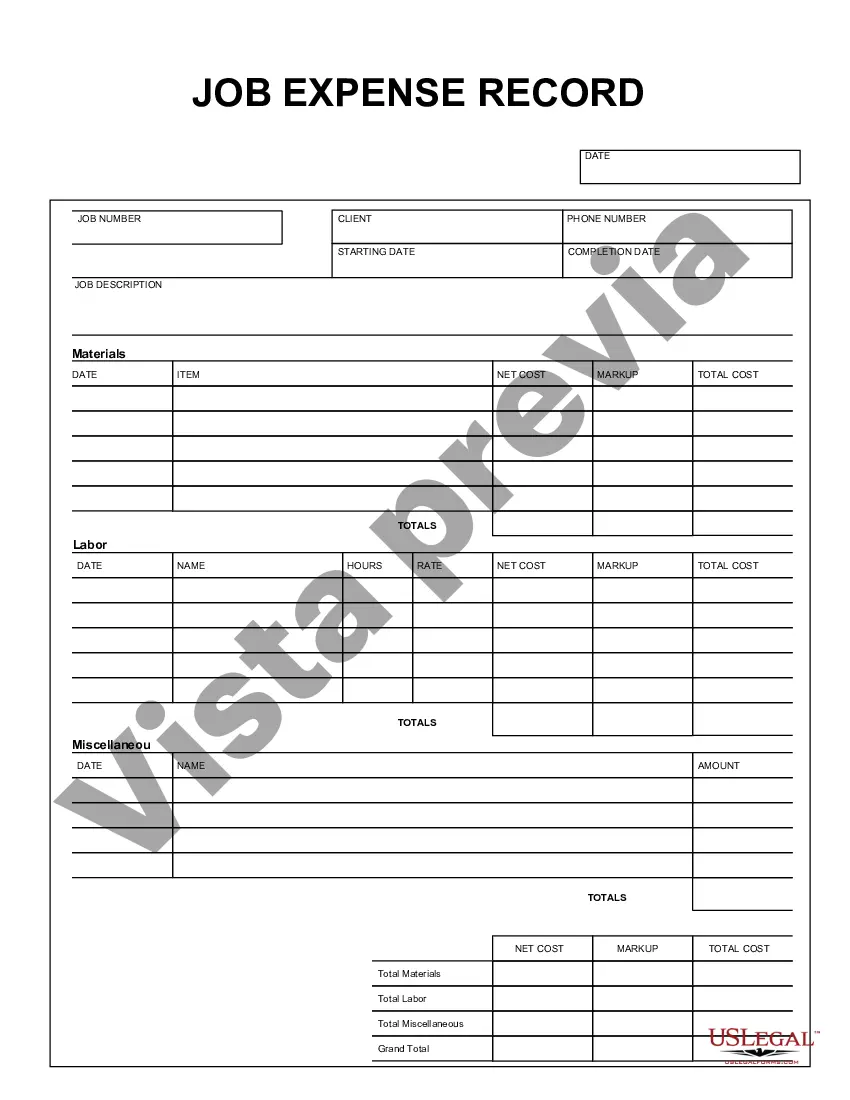

The Franklin Ohio Job Expense Record is a crucial document used by businesses and individuals to track and monitor expenses related to employment in Franklin, Ohio. This record allows individuals and businesses to maintain accurate records of job-related expenses, ensuring compliance with tax regulations and helping to maximize tax deductions. The Franklin Ohio Job Expense Record serves as a centralized location for recording various categories of job-related expenses incurred during employment in Franklin, Ohio. It includes both deductible expenses and those that are not deductible for tax purposes. This record helps individuals and businesses have a clear overview of their expenses, enabling them to make informed financial decisions and effectively manage their finances. Some of the key categories that can be found within the Franklin Ohio Job Expense Record include: 1. Transportation Expenses: This section includes costs associated with commuting to and from work, such as fuel, parking fees, tolls, public transportation fares, and car maintenance expenses. 2. Travel Expenses: Here, individuals can record expenses incurred during business trips or while working at different locations. This may include airfare, lodging, meals, and other related costs. 3. Meal and Entertainment Expenses: This category covers expenses incurred while entertaining clients or conducting business-related meals. Individuals can record the date, purpose, and cost of each meal or entertainment expense. 4. Home Office Expenses: Those who work from home can track expenses related to their home office setup, including rent or mortgage interest, utilities, internet fees, office supplies, and equipment. 5. Professional Development Expenses: This section allows individuals to record expenses associated with professional training, certifications, conferences, workshops, and subscriptions to industry publications. 6. Work-Related Supplies and Equipment: Individuals can track expenses related to purchasing supplies, tools, and equipment required for their job. This includes items like stationery, computer software, safety gear, uniforms, and other job-specific equipment. These are just a few examples of the categories that individuals and businesses can find within the Franklin Ohio Job Expense Record. By keeping accurate records of job-related expenses, individuals and businesses can ensure compliance with tax rules, maximize tax deductions, and maintain a clear overview of their financial inflows and outflows. It is important to consult with a tax professional or accountant to understand specific requirements and guidelines associated with job expense tracking in Franklin, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Franklin Ohio Registro De Gastos De Trabajo?

Do you need to quickly create a legally-binding Franklin Job Expense Record or probably any other document to manage your personal or business affairs? You can select one of the two options: hire a legal advisor to draft a legal document for you or create it completely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant document templates, including Franklin Job Expense Record and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Franklin Job Expense Record is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Franklin Job Expense Record template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the templates we provide are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!