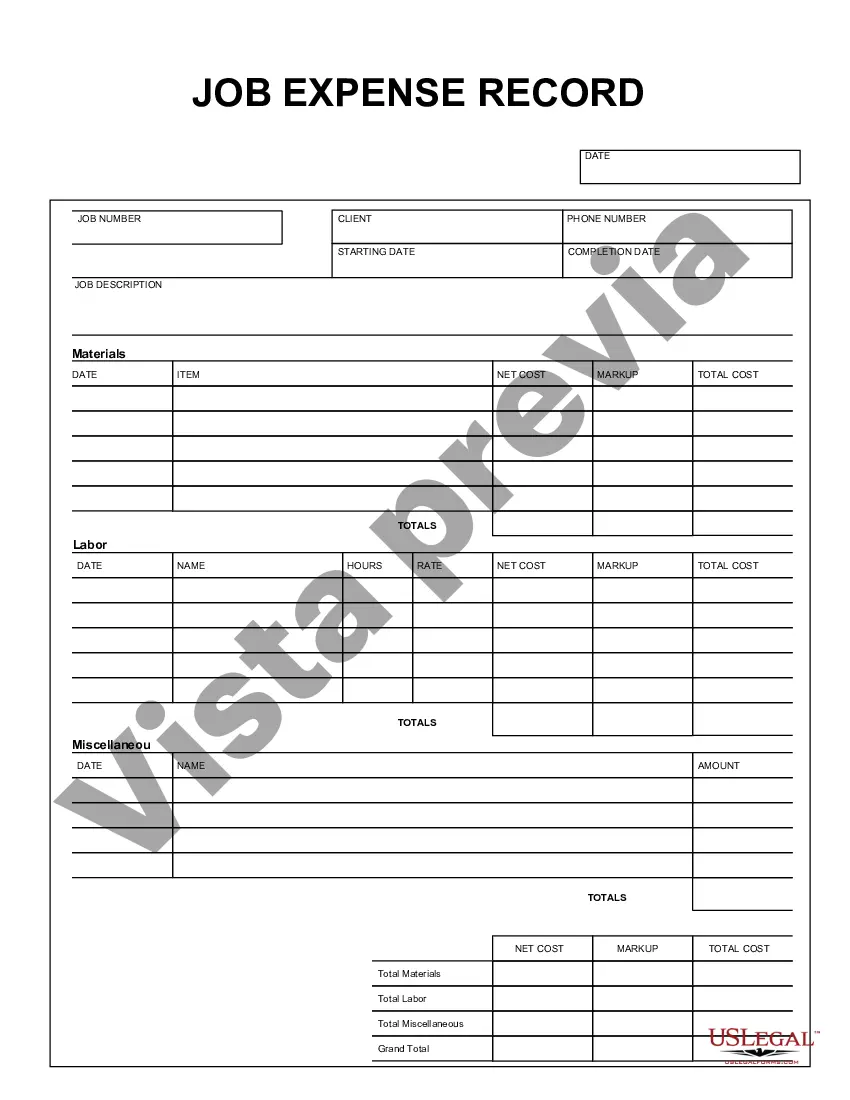

Los Angeles California Job Expense Record is a document used to track and manage job-related expenses incurred by individuals or businesses in the city of Los Angeles, California. This record helps individuals and businesses maintain an accurate record of all job-related expenses for financial and tax purposes. It serves as a valuable reference when compiling expense reports or claiming deductions. There are different types of Los Angeles California Job Expense Records tailored to specific industries or purposes. Some of these include: 1. Freelancer Job Expense Record: This type of expense record caters to freelancers, self-employed individuals, or independent contractors working in various fields such as graphic design, writing, consulting, or photography. It includes specific expense categories like office supplies, equipment, software, and travel expenses incurred while conducting freelance work. 2. Entertainment Industry Job Expense Record: This variant of the expense record is designed specifically for professionals working in the vibrant entertainment industry of Los Angeles, including actors, musicians, filmmakers, or production crew members. It accounts for expenses related to auditions, classes, headshots, costumes, film equipment rentals, studio rentals, and other industry-specific needs. 3. Construction Industry Job Expense Record: Construction workers, contractors, or builders in Los Angeles require unique expense records. This type of record encompasses expenses related to materials, tools, permits, subcontractor payments, insurance costs, vehicle expenses, and safety gear purchases. 4. Healthcare Industry Job Expense Record: Professionals working in the healthcare sector, such as doctors, nurses, therapists, or medical practitioners, need an expense record specifically tailored to their unique job-related expenditures. This record may include expenses for medical supplies, equipment, professional licenses, certification fees, continuing education, or even travel expenses for medical conferences. 5. Sales Representative Job Expense Record: Sales representatives or salespeople in Los Angeles may have different expense requirements. Their expense record may include categories like client entertainment, travel expenses (including mileage and accommodation), meals, client gifts, marketing materials, sales tools, and trade show exhibits. Regardless of the specific type of Los Angeles California Job Expense Record, it is crucial to maintain detailed and accurate records to ensure compliance with tax regulations and to manage overall financial health. These records not only help individuals and businesses maintain a clear financial picture but also provide the necessary evidence for deductions, reimbursements, or audits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Los Angeles California Registro De Gastos De Trabajo?

Creating forms, like Los Angeles Job Expense Record, to take care of your legal matters is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for various scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Los Angeles Job Expense Record form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before getting Los Angeles Job Expense Record:

- Make sure that your document is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Los Angeles Job Expense Record isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

En el estado de California, los empleados tienen derecho a: Igualdad salarial. Pausas para la comida y los descansos. Permisos Retribuidos, en algunos casos. Pago de Horas Extras. No sufrir de discriminacion.

Aunque trabajar mas de 10 horas al dia no es legal, en caso de que el trabajador labore mas de esas 10 horas, naturalmente que se le debe pagar el respectivo recargo por trabajo suplementario.

Este beneficio se paga a razon de 2/3 del salario semanal promedio, con algunas excepciones, durante 104 semanas.

Si recibe compensacion por accidentes en el trabajo o algun otro tipo de beneficios del gobierno por incapacidad y al mismo tiempo recibe los beneficios de SSDI, la cantidad total de estos beneficios, al presente, no puede exceder el 80 por ciento de las ganancias promedio que usted tenia antes de incapacitarse.

Si usted sufre una lesion o enfermedad laboral y su empleador no esta asegurado, su empleador es responsable de pagar todas las cuentas relacionadas con su lesion o enfermedad.

La compensacion para trabajadores se paga semanalmente o quincenalmente en funcion del salario semanal promedio del empleado lesionado. La Compensacion a los Trabajadores por una discapacidad total es equivalente a dos tercios del salario semanal promedio del empleado lesionado hasta un monto maximo de beneficio.

Si usted tiene una lesion o enfermedad laboral, su empleador esta obligado por ley a pagarle los beneficios de compensacion de trabajadores.

En general, se tarda entre 4 y 8 semanas desde el momento en que se llega a un acuerdo para que tengas un cheque en la mano.

Muchas personas que sufrieron lesiones en su lugar de trabajo optan por presentar un reclamo de compensacion para trabajadores. Aunque no existen cifras exactas, la firma de abogados Morris Bart estima que la mayoria de los empleados obtienen entre $2,000 y $40,000 dolares por su reclamo.

Los beneficios por incapacidad temporal pagan dos tercios del salario bruto (antes de impuestos) que usted pierde mientras se recupera de una lesion laboral. Sin embargo, usted no puede recibir mas del monto semanal maximo ni menos del monto semanal minimo legalmente establecido.