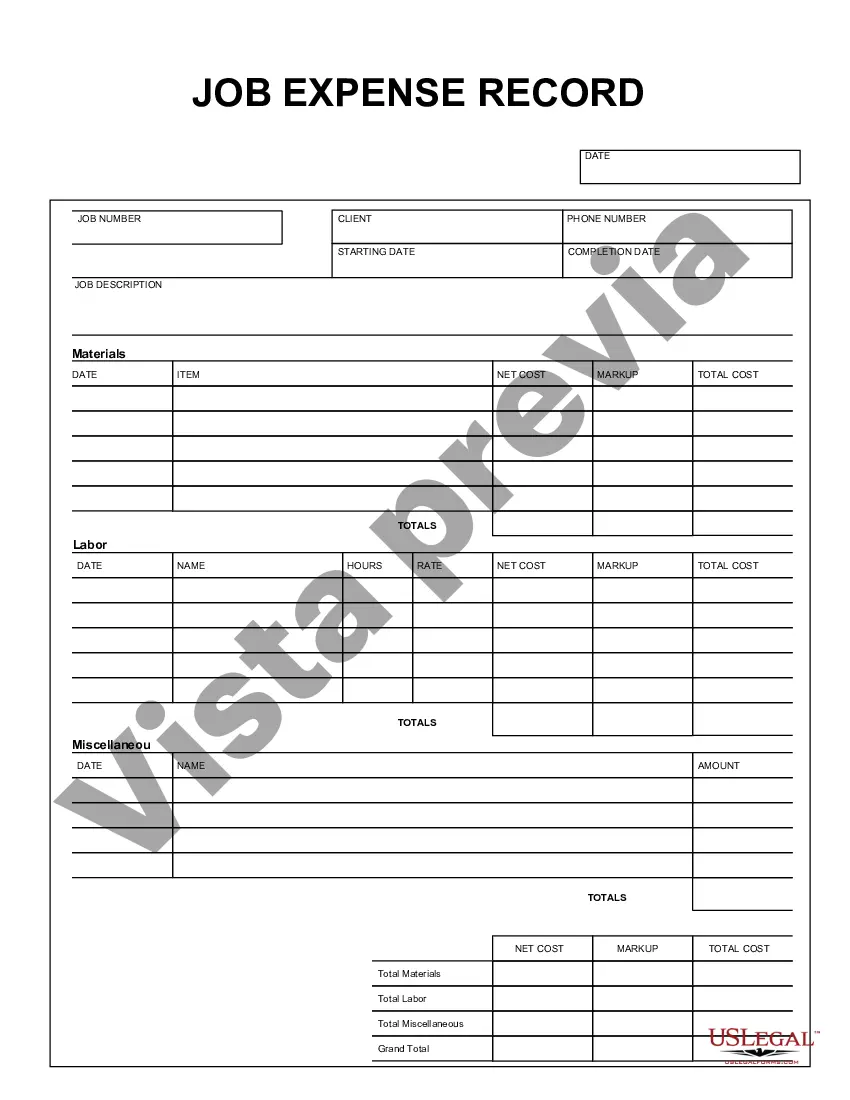

Philadelphia Pennsylvania Job Expense Record is a document that records and tracks job-related expenses incurred by individuals or businesses in Philadelphia, Pennsylvania. This record is crucial for tracking and managing expenses, ensuring accurate financial reporting, and maximizing tax deductions related to job-related expenditures. It helps individuals, self-employed professionals, and businesses in Philadelphia to keep an organized record of their job expenses for various purposes like tax filings, reimbursements, budgeting, and financial planning. The Philadelphia Pennsylvania Job Expense Record typically includes the following details: 1. Date: The specific date when the job-related expense was incurred. 2. Description: A detailed description of the job-related expense, including the purpose and nature of the expense. 3. Amount: The total cost of the expense. 4. Category: Job expenses are categorized to provide a breakdown of different types of expenses and make it easier for tracking and analysis. Common expense categories include travel, meals and entertainment, office supplies, equipment, professional development, and other relevant categories. 5. Receipt/Invoice: Attachments or references to the original receipts or invoices supporting the expense. 6. Client/Project: If applicable, the client or project associated with the job expense can be noted. 7. Reimbursement: If the expense is eligible for reimbursement, this section can be used to track the status of the reimbursement process. Different types of Philadelphia Pennsylvania Job Expense Records exist depending on the specific needs and preferences of individuals or businesses. These may include: 1. Personal Job Expense Record: For individuals who have job-related expenses that are not reimbursed by their employer, this record helps keep track of all the expenses that might be eligible for deductions during tax filings in Philadelphia. It includes categories like transportation, work-related education, and professional licenses. 2. Self-Employed Job Expense Record: Self-employed individuals in Philadelphia need a comprehensive record to track all their business-related expenses. This record includes categories such as office rent, utilities, insurance, advertising, legal and professional fees, and mileage. 3. Small Business Job Expense Record: This record caters to small businesses in Philadelphia that want to track their job expenses separately for each project or client. It helps them accurately allocate costs, budget efficiently, and analyze profitability on a project-by-project basis. Tracking job expenses accurately and consistently through the Philadelphia Pennsylvania Job Expense Record enables individuals and businesses to remain financially organized, claim the maximum allowable tax deductions, ensure compliance with tax regulations, and make informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Philadelphia Pennsylvania Registro De Gastos De Trabajo?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Philadelphia Job Expense Record is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Philadelphia Job Expense Record. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Job Expense Record in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!