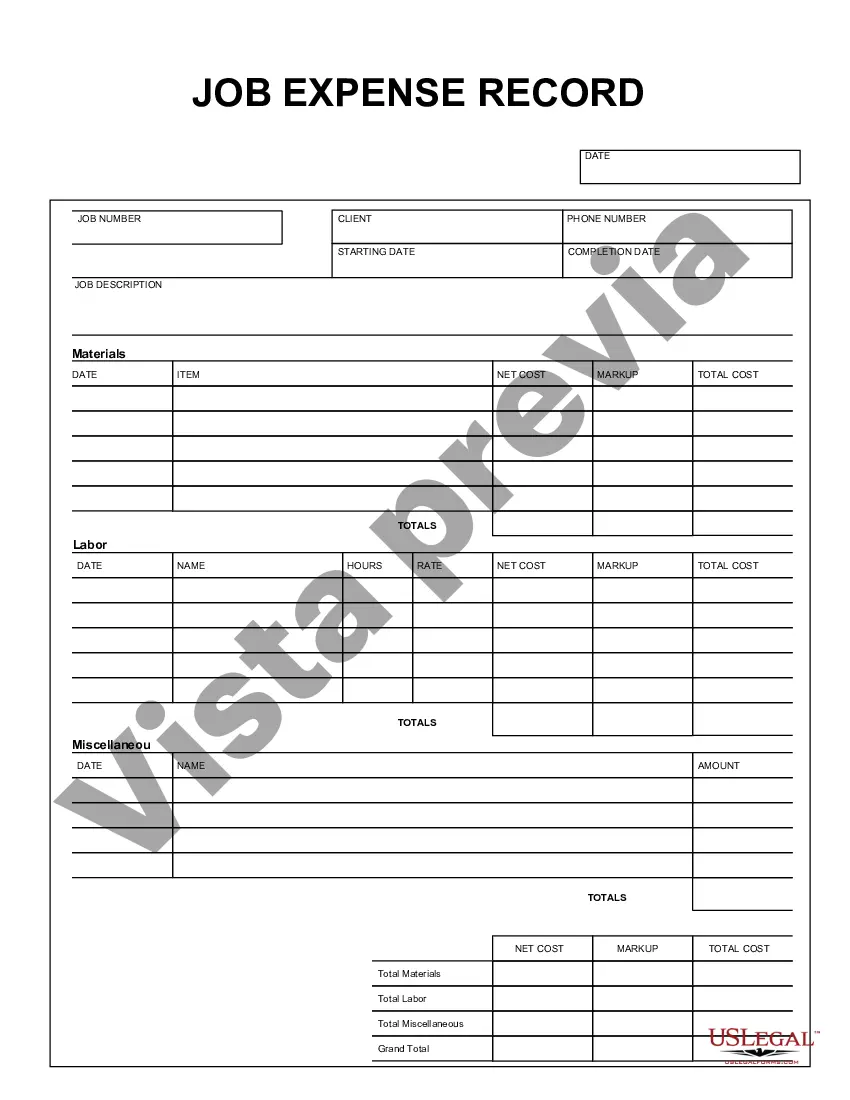

Lima Arizona Job Expense Record is a comprehensive document used by employees and employers in Lima, Arizona to track and document various expenses incurred during job-related activities. This record serves as an essential tool for accurately reporting job-related expenditures, ensuring compliance with taxation requirements, and facilitating reimbursement processes. Keywords: Lima Arizona, job expense record, expenses, employees, employers, track, document, job-related activities, reporting, taxation requirements, reimbursement. There are different types of Lima Arizona Job Expense Records that cater to various employment scenarios and industries. These may include: 1. Standard Lima Arizona Job Expense Record: A template that allows employees to record and categorize their job-related expenses, such as transportation costs, meals, accommodation, tools, equipment, and other relevant expenditures. This type of record is widely used across various industries and is adaptable to different job roles. 2. Lima Arizona Travel Job Expense Record: Specifically designed for employees who frequently travel for work purposes. This record focuses on capturing travel-related expenses, including airfare, lodging, meals, car rentals, fuel, parking fees, and other relevant costs. It ensures that employees can accurately report their expenses while complying with company policies and tax regulations. 3. Lima Arizona Trade Job Expense Record: Geared towards employees in the trade industry, this record highlights expenses related to tools, equipment, supplies, and other materials necessary for job completion. It allows tradespeople to document their investments and claim tax deductions for the items used exclusively for their work. 4. Lima Arizona Freelancer Job Expense Record: Customized for self-employed individuals and freelancers operating in Lima, Arizona, this record focuses on capturing business-related expenses, such as office supplies, marketing and advertising costs, professional services fees, software subscriptions, and other expenditure categories unique to freelancers. 5. Lima Arizona Remote Job Expense Record: Tailored for employees working remotely, this record allows individuals to track their work-from-home expenses, including internet bills, office equipment, utilities, and other expenditures incurred while performing job responsibilities from a home office. This record aids in maintaining a proper record of remote work-related expenses and claiming relevant deductions. By utilizing these various types of Lima Arizona Job Expense Records, individuals and businesses can maintain proper financial records, accurately report job-related expenses, and fulfill their tax obligations. It is crucial to consult with a tax advisor or specialist to ensure compliance with relevant regulations and optimize potential tax deductions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Pima Arizona Registro De Gastos De Trabajo?

Do you need to quickly draft a legally-binding Pima Job Expense Record or maybe any other document to take control of your personal or business affairs? You can select one of the two options: hire a legal advisor to write a legal paper for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Pima Job Expense Record and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, carefully verify if the Pima Job Expense Record is adapted to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's intended for.

- Start the search over if the template isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Pima Job Expense Record template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!