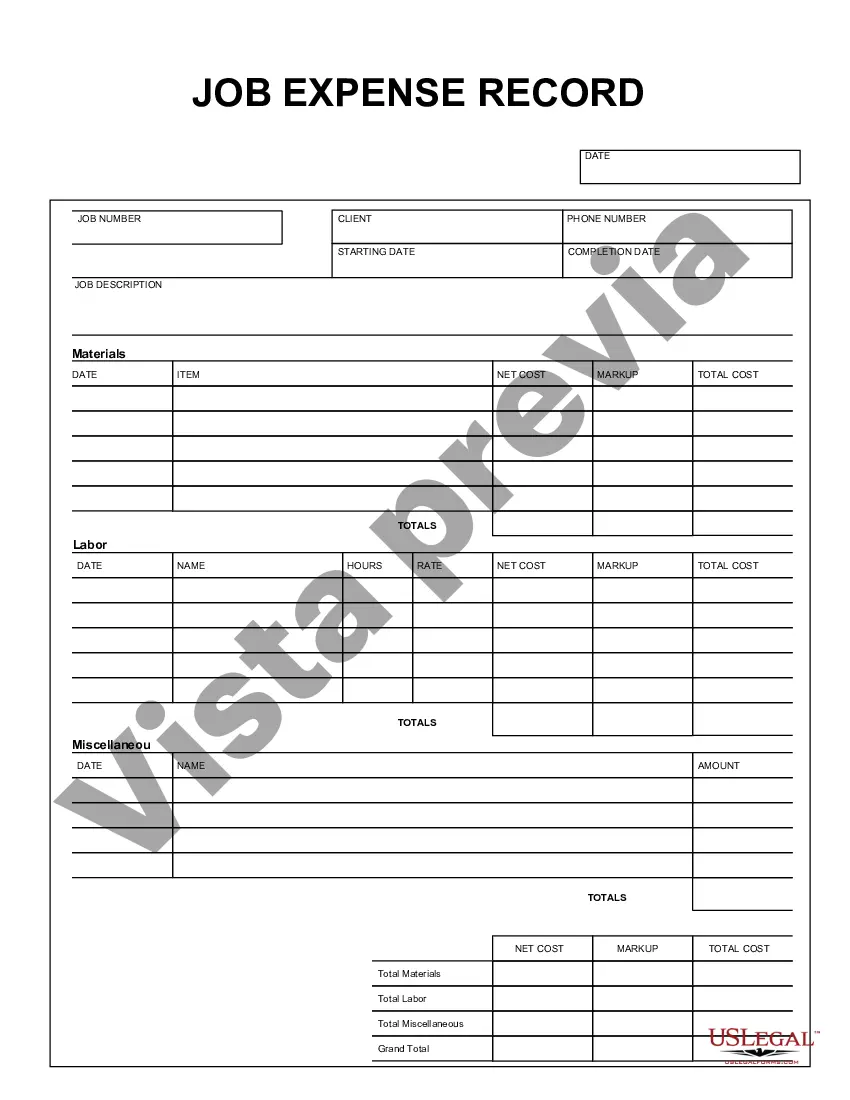

Title: Exploring Sacramento California Job Expense Record: Types and Detailed Description Introduction: Sacramento, California, boasts a vibrant job market that attracts professionals from various industries. Keeping accurate records of job-related expenses is crucial for individuals and businesses alike. In this article, we will delve into the Sacramento California Job Expense Record, its importance, and shed light on different types of expense records commonly used in the region. 1. Sacramento California Job Expense Record: The Sacramento California Job Expense Record is a comprehensive system designed to track and record expenses incurred while performing job-related activities. It serves as a reliable documentation method for individuals to claim tax deductions, submit expense reports, or seek reimbursements from employers. 2. Types of Sacramento California Job Expense Records: a) Mileage Log: Mileage logs document the mileage driven for work purposes. To claim tax deductions, individuals must maintain accurate records of their business-related travel, including mileage, date, destination, purpose, and vehicle usage. This record helps calculate vehicle-related expenses and supports travel reimbursements if applicable. b) Receipts and Invoices: Keeping receipts and invoices is essential for tracking work-related expenses, such as purchasing supplies, equipment, software, or office space rentals. These records should include vendor details, purchase date, item description, cost, and purpose. c) Travel Expense Report: Frequently used by employees who travel for job assignments, a travel expense report provides detailed information about transportation, lodging, meals, and miscellaneous expenses. It typically requires submission of receipts, tickets, and supporting documents to ensure accurate reimbursement. d) Entertainment and Client Meetings Log: For individuals involved in business development or client-facing roles, maintaining an entertainment and client meetings log is crucial. It records expenses related to entertaining clients, prospects, or colleagues, including meals, tickets, events, and gifts. These records help substantiate deductions and demonstrate business-related expenses during audits. e) Home Office Expense Log: In the era of remote work, many individuals in Sacramento establish a home office to carry out job tasks. A home office expense log allows individuals to record and document various expenses related to their home office setup, such as rent, utilities, office supplies, and equipment. These records assist in tax deductions on home office expenses, subject to fulfilling specific requirements. Conclusion: A meticulous Sacramento California Job Expense Record is vital for professionals and businesses to maintain financial accuracy, support tax deductions, facilitate reimbursements, and demonstrate compliance during audits. Whether it's mileage logs, receipts and invoices, travel expense reports, entertainment and client meetings logs, or home office expense logs, these records play a pivotal role in managing and documenting job-related expenses effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Sacramento California Registro De Gastos De Trabajo?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a Sacramento Job Expense Record meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Sacramento Job Expense Record, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Sacramento Job Expense Record:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Sacramento Job Expense Record.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!