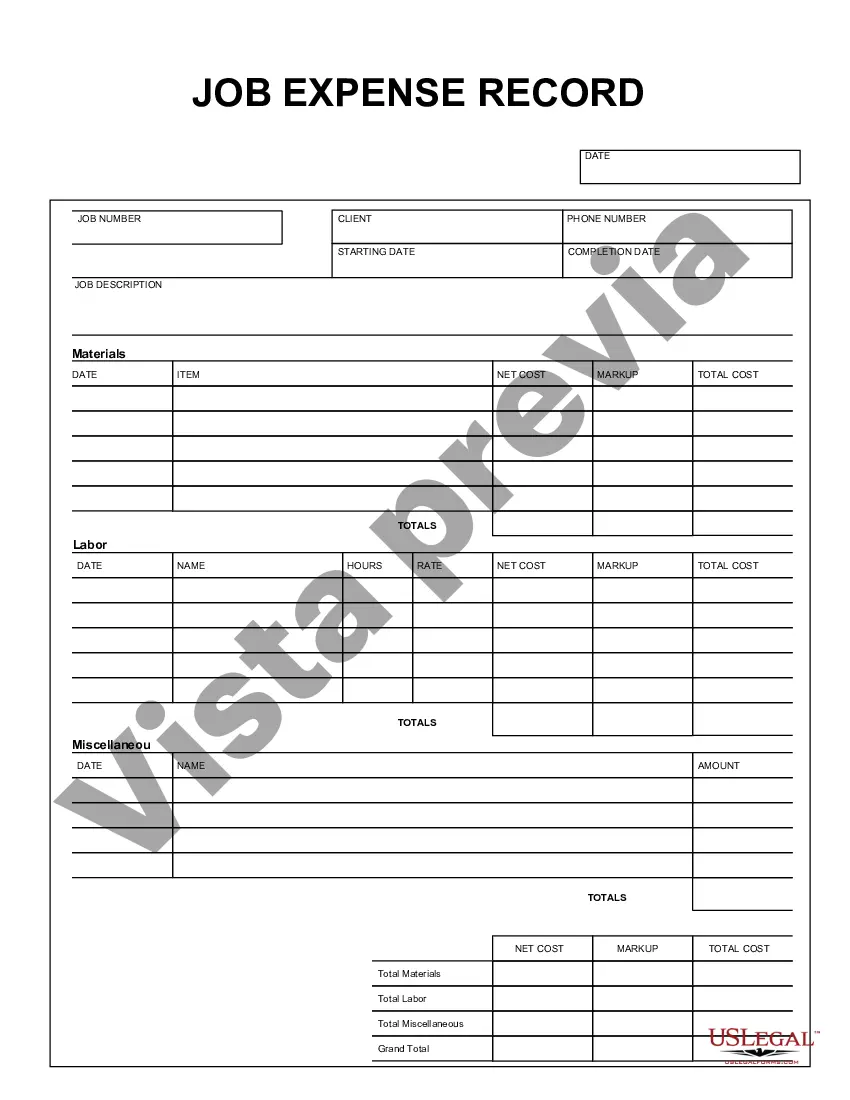

San Antonio Texas Job Expense Record is a crucial document used by professionals and employees to keep track of job-related expenses incurred during their work tenure in San Antonio, Texas. This detailed description will provide an overview of its importance, key components, and types, using relevant keywords. A San Antonio Texas Job Expense Record serves as an organized record of all the expenses that an employee accrues while performing job-related tasks. It is imperative for individuals looking to claim reimbursements, track tax deductions, or manage personal finances efficiently. This record typically includes various expense categories such as travel, meals, entertainment, supplies, mileage, and more. In San Antonio, Texas, there are different types of Job Expense Records available to cater to different types of employment and industries. Some of these variations include: 1. San Antonio Texas Independent Contractor Expense Record: This type of record is specifically designed for individuals working as independent contractors or freelancers in San Antonio. It helps them accurately track and report their expenses for tax purposes, ensuring compliance with the IRS guidelines. 2. San Antonio Texas Sales Representative Expense Record: Created for sales professionals based in San Antonio, this record enables sales representatives to maintain an organized log of their job-related expenditures, such as client meetings, travel expenses, samples, and promotional materials. 3. San Antonio Texas Construction Worker Expense Record: Construction workers in San Antonio require a specialized expense record to track their unique job-related expenses. This can include equipment rentals, tools, safety gear, permits, and travel costs associated with multiple construction sites. 4. San Antonio Texas Healthcare Professional Expense Record: Healthcare professionals, such as doctors, nurses, and medical practitioners, can avail of this expense record to accurately document their job-related expenses. This may encompass charges for medical supplies, continuing education courses, commuting costs, and professional licensing fees. 5. San Antonio Texas Remote Worker Expense Record: In today's digital age, many professionals work remotely. This type of expense record is tailored for individuals working remotely from San Antonio, allowing them to monitor costs incurred at home offices, co-working spaces, or during business travel. Having a San Antonio Texas Job Expense Record is crucial for ensuring financial transparency, maximizing tax deductions, and managing personal budgets effectively. By maintaining detailed expense records, individuals can safeguard themselves during tax audits, accurately claim reimbursements, and gain insight into their overall financial position. In conclusion, San Antonio Texas Job Expense Record is a comprehensive tool used to track and manage job-related expenses for various professions in San Antonio, Texas. Different types of records cater to specific industries, ensuring accurate tracking and reporting of expenses. Maintaining an organized record helps individuals stay on top of their finances, claim reimbursements, and adhere to tax regulations with ease.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Registro de gastos de trabajo - Job Expense Record

Description

How to fill out San Antonio Texas Registro De Gastos De Trabajo?

Drafting paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft San Antonio Job Expense Record without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid San Antonio Job Expense Record on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the San Antonio Job Expense Record:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!