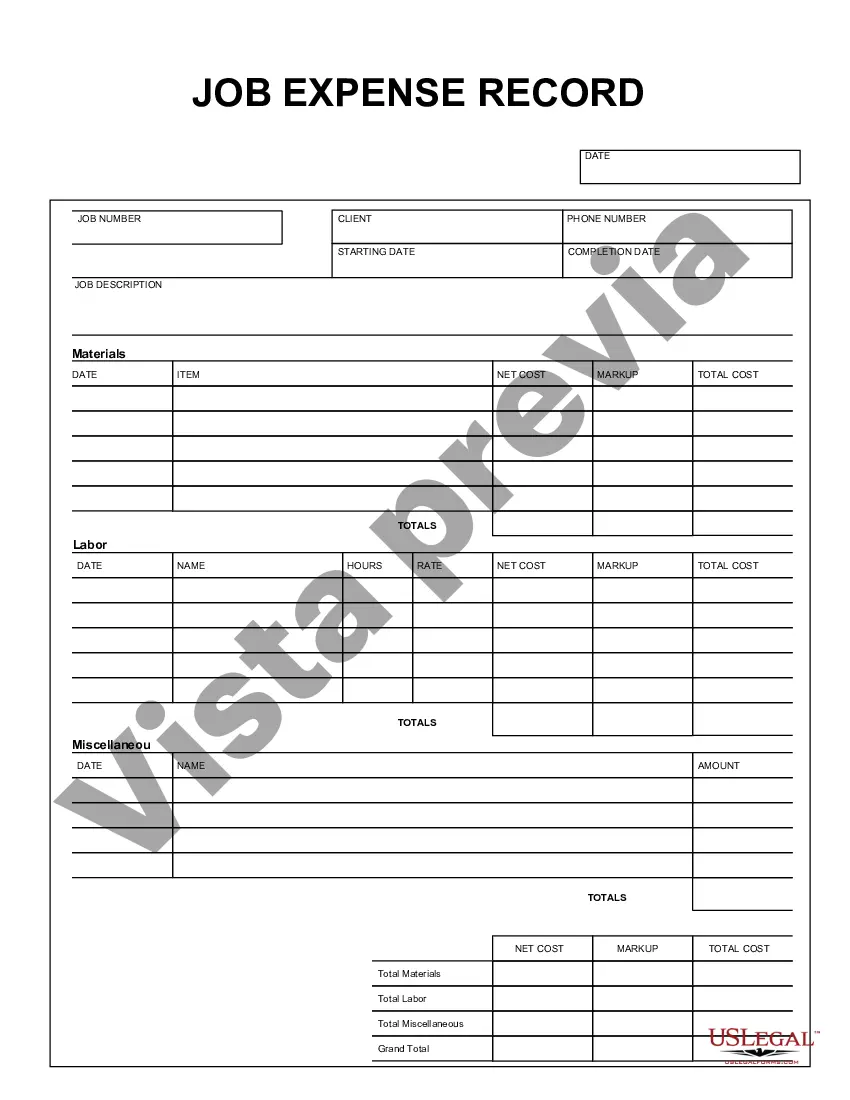

San Jose California Job Expense Record is a crucial tool used by individuals working in San Jose, California to track and manage their job-related expenses. It serves as a detailed log that helps employees keep a record of their incurred expenses to claim reimbursement or for tax purposes. The San Jose California Job Expense Record includes various types of job-related expenses, such as mileage, meals, transportation, accommodations, supplies, equipment, and other miscellaneous expenditures directly associated with one's employment. Each expense category has specific guidelines and requirements, and maintaining an accurate record ensures compliance with company policies and tax regulations. There are different types of San Jose California Job Expense Records based on the nature of one's employment and specific requirements. Some common types include: 1. Commuting Expenses Record: This focuses on tracking expenses incurred while commuting to and from work, such as parking fees, toll payments, and public transportation costs. 2. Travel Expenses Record: Designed for individuals who frequently travel for work purposes, this record helps keep track of expenses related to flights, hotel stays, rental cars, meals, and other travel-related costs. 3. Business Meals & Entertainment Record: This specific record focuses on documenting expenses related to business-related meals, client entertainment, and networking events. It includes details such as the date, location, purpose, and individuals present during the event. 4. Equipment & Supplies Record: Aimed at individuals who frequently purchase equipment, tools, or supplies for their job, this record enables tracking of expenses related to necessary work items, such as laptops, tools, stationery, software licenses, etc. 5. Home Office Expenses Record: For individuals working from home, this record helps manage expenses like internet bills, utility costs, office supplies, and equipment specifically used for their home-based work setup. Maintaining a San Jose California Job Expense Record not only helps individuals stay organized and ensure accurate reimbursement or tax deductions but also streamlines the process for employers or clients who require these records for auditing or expense verification purposes. By diligently recording expenses and categorizing them accordingly, employees can save time and mitigate potential errors during expense reporting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Registro de gastos de trabajo - Job Expense Record

Description

How to fill out San Jose California Registro De Gastos De Trabajo?

If you need to find a trustworthy legal form provider to obtain the San Jose Job Expense Record, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support team make it easy to locate and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse San Jose Job Expense Record, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the San Jose Job Expense Record template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or complete the San Jose Job Expense Record - all from the comfort of your home.

Sign up for US Legal Forms now!