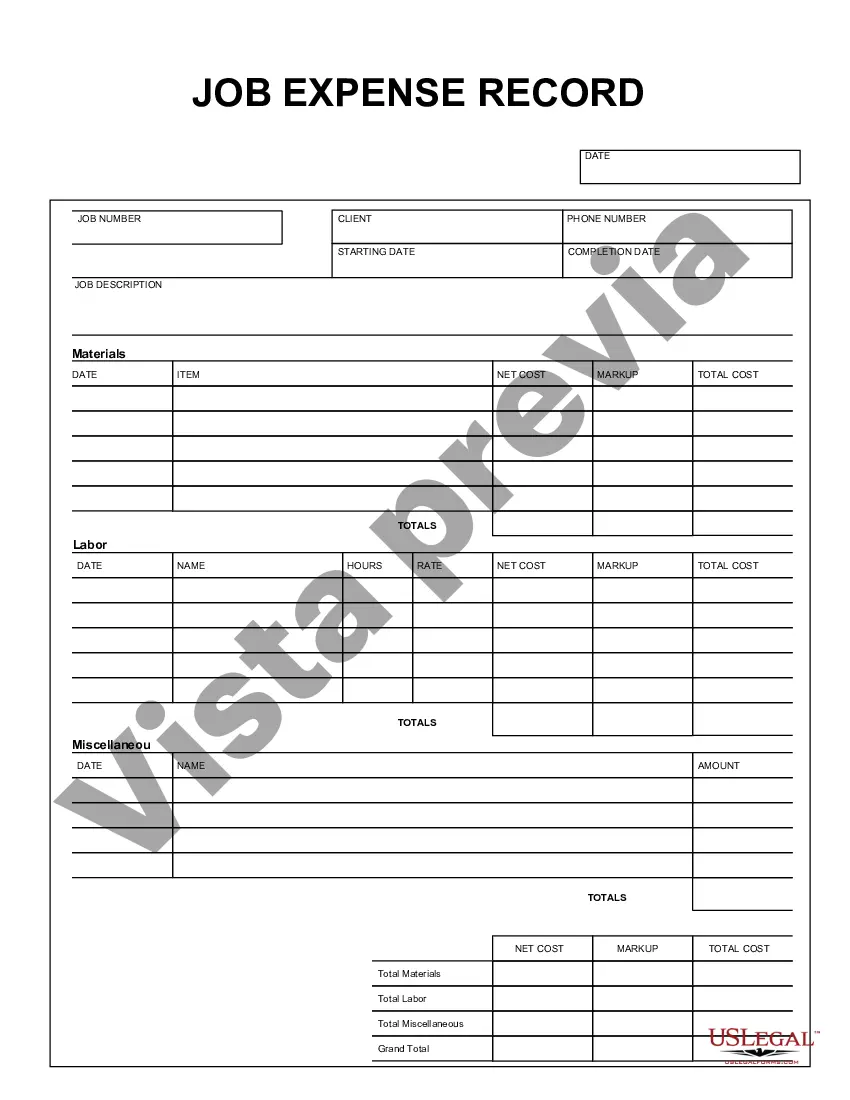

Suffolk New York Job Expense Record is a crucial document that allows individuals or businesses in Suffolk County, New York, to keep a comprehensive account of their job-related expenses. This record serves as a valuable resource for accurately tracking and reporting deductible expenses, providing financial transparency, and maximizing tax benefits. The Suffolk New York Job Expense Record helps individuals and self-employed professionals to categorize and organize various job-related expenses effectively. By documenting these expenses, they can claim deductions on their tax returns, ultimately reducing their taxable income and increasing potential refunds. This record also aids in maintaining compliance with state and federal tax regulations. The different types of Suffolk New York Job Expense Records may vary based on the specific nature of the job and the expenses incurred. Here are a few common categories and examples of job-related expenses that might be recorded: 1. Travel Expenses: This category includes costs associated with transportation, such as mileage, fuel, parking fees, tolls, and public transportation fares. It may also cover accommodation expenses during business trips. 2. Meals and Entertainment: Expenses related to business meals and entertainment activities, such as client lunches, dinners, or entertainment events, can be documented in this category. However, it's important to note that there are limitations on the reducibility of meals and entertainment expenses. 3. Home Office Expenses: Self-employed individuals who use a portion of their home exclusively for business purposes can record expenses like rent, utilities, insurance, and maintenance costs related to their home office. 4. Office Supplies and Equipment: This category covers expenses related to office supplies, computer equipment, software, printers, internet services, and other materials necessary for job-related tasks. 5. Professional Development: Expenses incurred for professional development and continuing education, including seminars, workshops, conferences, and relevant courses, can be recorded in this category. 6. Licenses and Certifications: Any fees paid for professional licenses, certifications, or memberships required to perform the job or maintain professional standing can be documented here. 7. Advertising and Marketing: This category includes expenses related to promoting the job or business, such as website development, advertising campaigns, printing materials, online advertisements, and social media marketing costs. By diligently maintaining a Suffolk New York Job Expense Record, individuals and businesses can ensure accurate reporting of deductible expenses, reduce their tax liability, and demonstrate compliance with tax regulations. It is crucial to consult with a certified tax professional or accountant to fully understand which expenses are deductible and any specific requirements set forth by Suffolk County or the state of New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Suffolk New York Registro De Gastos De Trabajo?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Suffolk Job Expense Record without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Suffolk Job Expense Record by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Suffolk Job Expense Record:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!