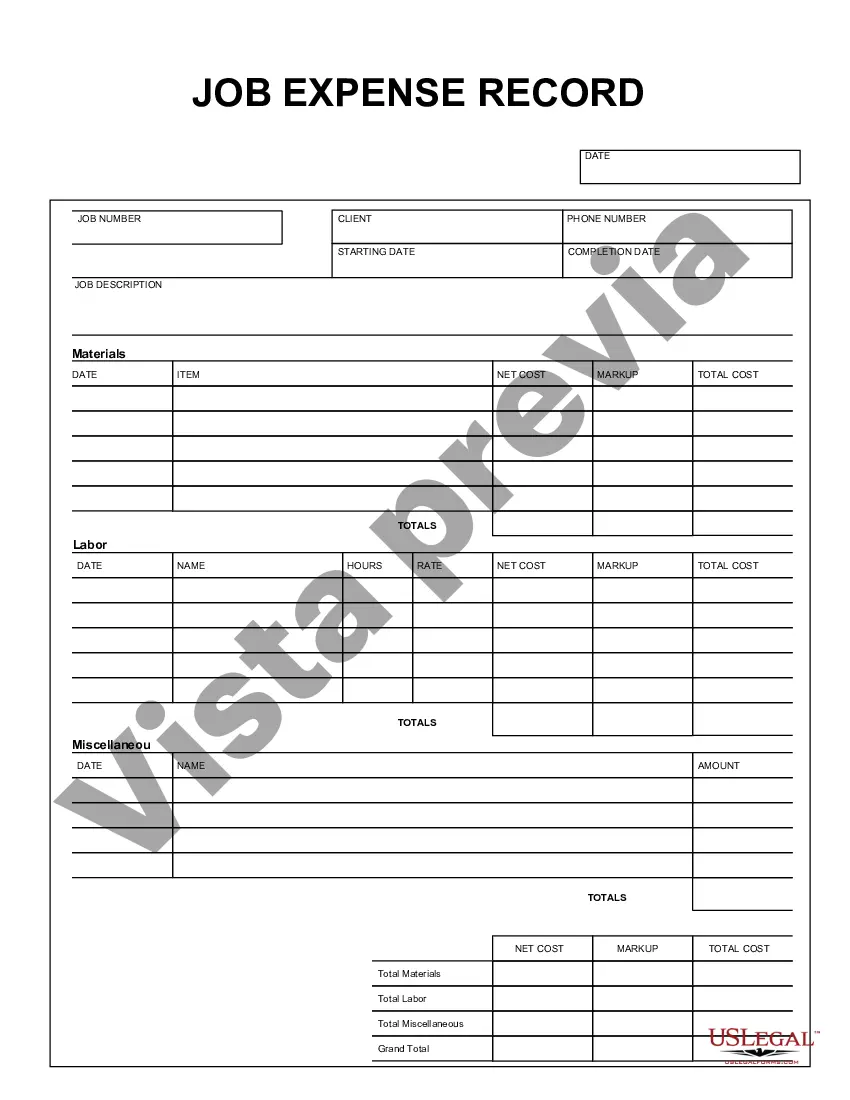

Travis Texas Job Expense Record is a comprehensive document used by employees or self-employed individuals to track and report their job-related expenses. It helps to maintain accurate records of expenses incurred during work or business activities, ensuring proper tax deductions, reimbursements, and financial tracking. The Travis Texas Job Expense Record is specifically designed to comply with the tax rules and regulations of the Travis County area in Texas. The Travis Texas Job Expense Record is essential for employees or individuals who work for multiple employers or engage in self-employment activities, such as freelancers, contractors, or small business owners. By diligently recording their job-related expenses, individuals can claim tax deductions for legitimate expenses, resulting in potential tax savings and increased tax compliance. The Travis Texas Job Expense Record typically includes various sections and categories to cover a wide range of job-related expenses. These may include categories such as transportation, meals and entertainment, office supplies, communication, tools and equipment, professional development, travel expenses, and more. Each category allows individuals to capture and categorize their expenses accurately. Different types of Travis Texas Job Expense Records may cater to specific professions or industries. For instance, there could be separate templates available for construction workers, healthcare professionals, real estate agents, or delivery drivers. These variations may come with predefined expense categories tailored to the specific needs and requirements of those professions or industries. In addition to capturing expense details, the Travis Texas Job Expense Record typically includes sections to document relevant information such as the date of the expense, vendor or payee details, receipts or supporting documentation, and any additional notes. This comprehensive record-keeping ensures transparency and helps individuals substantiate their expenses if required during audits or inquiries. Overall, the Travis Texas Job Expense Record is an invaluable tool for employees and self-employed individuals to stay organized, accurately track their job-related expenses, and maximize their tax deductions. By diligently maintaining this record, individuals can minimize tax liabilities, ensure compliance with relevant laws, and effectively manage their finances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Travis Texas Registro De Gastos De Trabajo?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Travis Job Expense Record, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the recent version of the Travis Job Expense Record, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Job Expense Record:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Travis Job Expense Record and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!