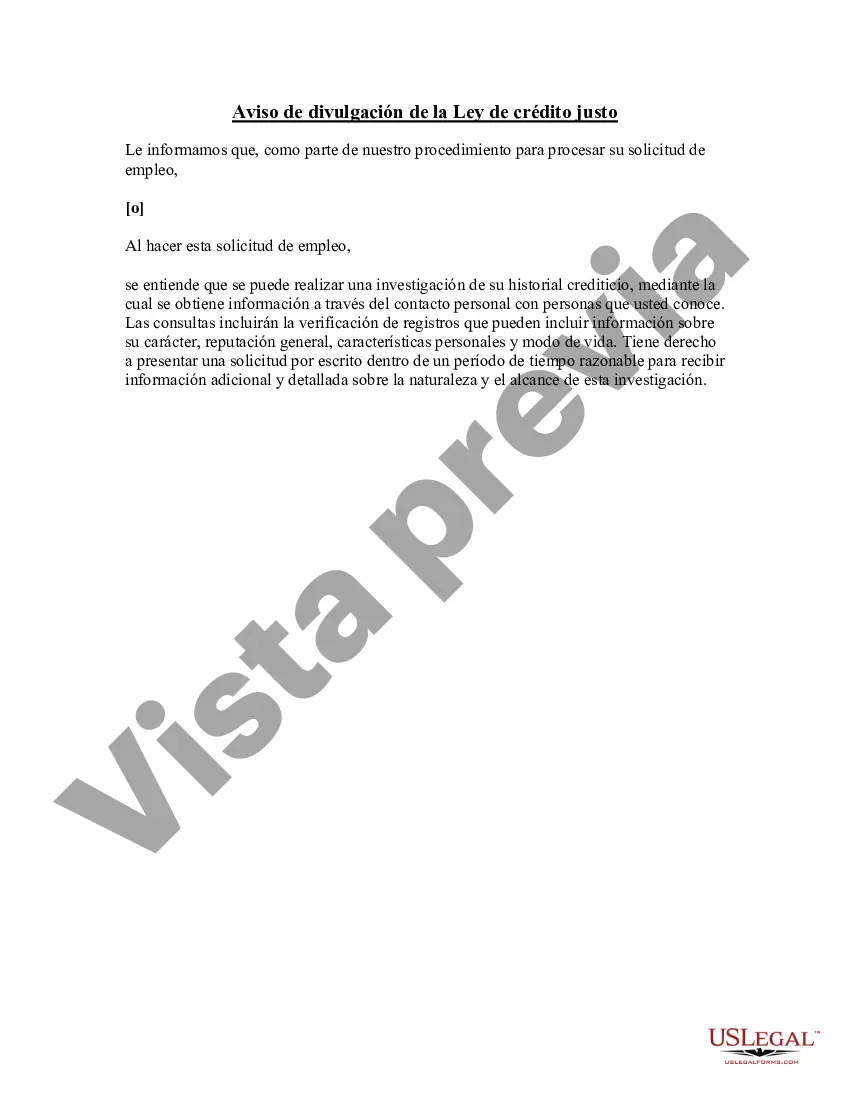

The Cuyahoga Ohio Fair Credit Act Disclosure Notice is a legal requirement that provides consumers in Cuyahoga County, Ohio with important information about their rights and protections under the Fair Credit Reporting Act (FCRA). This disclosure notice is designed to promote transparency and fairness in the collection, use, and reporting of consumer credit information. Under the Cuyahoga Ohio Fair Credit Act Disclosure Notice, individuals have the right to be informed about their credit history and the data being reported to credit bureaus. It serves as a reminder that consumers have the power to monitor and dispute any inaccurate information that could negatively impact their credit score and overall financial well-being. Some key aspects included within the Cuyahoga Ohio Fair Credit Act Disclosure Notice are: 1. Credit Reporting Agencies: The notice informs individuals about the major credit reporting agencies, such as Equifax, Experian, and TransUnion, which collect and maintain consumer credit information. It emphasizes that consumers have the right to obtain a free copy of their credit report from each agency once a year. 2. Dispute Resolution Process: The disclosure notice outlines the process for disputing inaccuracies found within the credit report. It emphasizes the right of consumers to challenge any erroneous information and the responsibility of credit reporting agencies to investigate and correct such errors promptly. 3. Negative Information Reporting: Individuals are made aware of how negative information, such as late payments, foreclosures, or bankruptcies, may be reported by creditors to credit bureaus. The notice provides guidance on how long such information can remain on a credit report and the steps individuals can take to rebuild their creditworthiness. 4. Identity Theft Protection: The Cuyahoga Ohio Fair Credit Act Disclosure Notice also addresses the growing concern of identity theft. It advises individuals on ways to protect themselves from identity thieves, such as by monitoring their credit reports, being cautious with personal information, and promptly reporting any suspected fraudulent activity. It's important to note that there may not be different types of Cuyahoga Ohio Fair Credit Act Disclosure Notices, as this notice typically follows the guidelines set forth under the FCRA. However, specific variations or updates to the notice may occur over time to reflect changes in regulations or local requirements. Therefore, it's advisable for individuals to consult the most recent version of the Cuyahoga Ohio Fair Credit Act Disclosure Notice to ensure compliance with current laws and provisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Aviso de divulgación de la Ley de crédito justo - Fair Credit Act Disclosure Notice

Description

How to fill out Cuyahoga Ohio Aviso De Divulgación De La Ley De Crédito Justo?

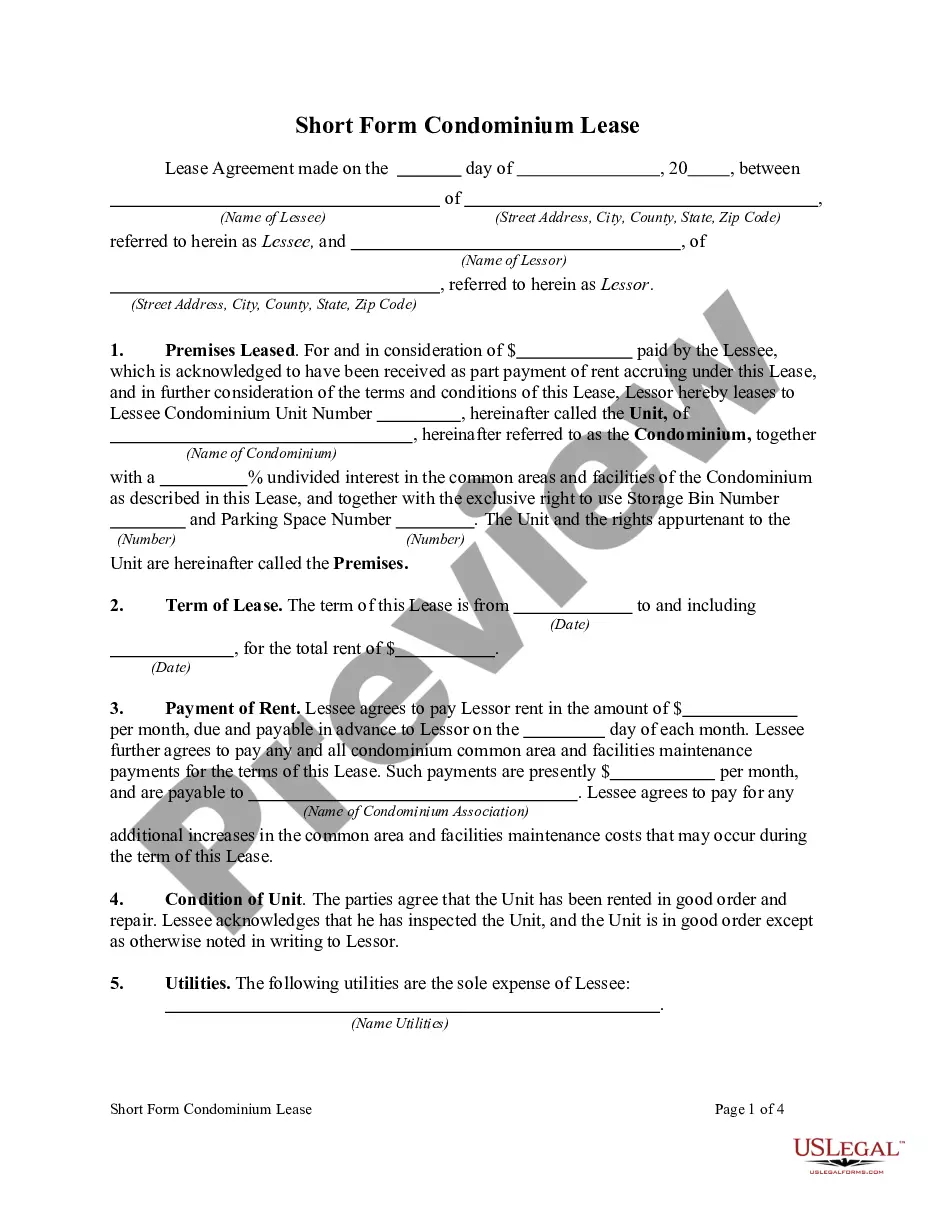

Draftwing forms, like Cuyahoga Fair Credit Act Disclosure Notice, to manage your legal affairs is a difficult and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for a variety of scenarios and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Cuyahoga Fair Credit Act Disclosure Notice form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Cuyahoga Fair Credit Act Disclosure Notice:

- Make sure that your form is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Cuyahoga Fair Credit Act Disclosure Notice isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our website and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!