Chicago Illinois Yearly Expenses by Quarter refers to the detailed breakdown of the financial costs incurred throughout the year in the city of Chicago, Illinois, categorized and analyzed on a quarterly basis. Understanding these expenses is crucial for individuals, businesses, and organizations wishing to budget effectively and make informed financial decisions. The different types of Chicago Illinois Yearly Expenses by Quarter are as follows: 1. Housing and Rent Expenses: This category encompasses costs related to housing, such as mortgage or rent payments, property taxes, homeowner's insurance, and maintenance fees. Tracking housing expenses provides insight into the city's real estate market and helps individuals understand their overall cost of living. 2. Utilities and Energy Expenses: This category includes expenses related to electricity, gas, water, and other utilities. It provides valuable information for residents and businesses to evaluate energy consumption patterns, monitor costs, and identify potential areas for conservation or efficiency improvements. 3. Transportation Expenses: This category covers the costs associated with commuting and transportation, including fuel or public transportation expenses, vehicle maintenance and repairs, parking fees, and tolls. Monitoring transportation expenses helps individuals and businesses determine the most cost-effective commuting options and evaluate the impact on their overall budget. 4. Food and Grocery Expenses: This category accounts for expenses related to groceries, dining out, and food delivery services. Understanding food and grocery expenses helps individuals manage their monthly grocery bills, plan meals, and budget for dining out or ordering in. 5. Healthcare Expenses: This category includes expenses for healthcare services, insurance premiums, prescription medications, and medical equipment. Monitoring healthcare expenses allows individuals and businesses to plan for medical costs, evaluate insurance coverage, and budget for unexpected healthcare needs. 6. Education Expenses: This category covers expenses related to education, including tuition, books, supplies, and educational activities. Monitoring education expenses assists students, parents, and educational institutions in assessing the costs associated with education and planning accordingly. 7. Entertainment and Recreation Expenses: This category accounts for expenses related to leisure activities, such as movie tickets, concerts, dining out, sports events, and recreational memberships. Tracking entertainment and recreation expenses helps individuals and families manage their discretionary spending and plan for leisure activities within their budget. 8. Miscellaneous Expenses: This category encompasses various expenses that don't fall under the above categories, such as personal care items, clothing purchases, gifts, charitable donations, and other miscellaneous expenditures. Monitoring miscellaneous expenses provides insight into personal spending habits and assists in making informed financial decisions. Understanding Chicago Illinois Yearly Expenses by Quarter across these various categories offers a comprehensive overview of the city's financial landscape. Utilizing this information, individuals, businesses, and organizations can effectively plan their budgets, identify areas of potential cost savings, and make informed financial decisions to ensure their financial stability and success.

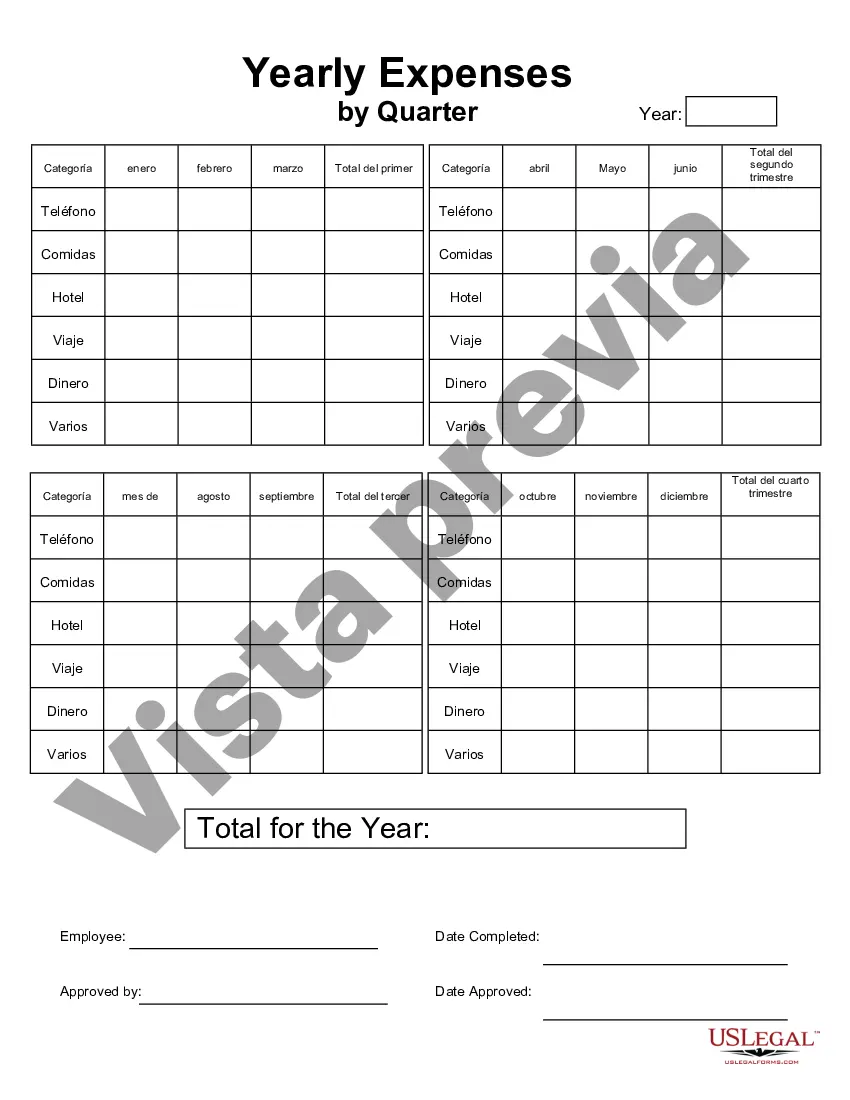

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Gastos anuales por trimestre - Yearly Expenses by Quarter

Description

How to fill out Chicago Illinois Gastos Anuales Por Trimestre?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Chicago Yearly Expenses by Quarter, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Chicago Yearly Expenses by Quarter, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Chicago Yearly Expenses by Quarter:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Chicago Yearly Expenses by Quarter and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!