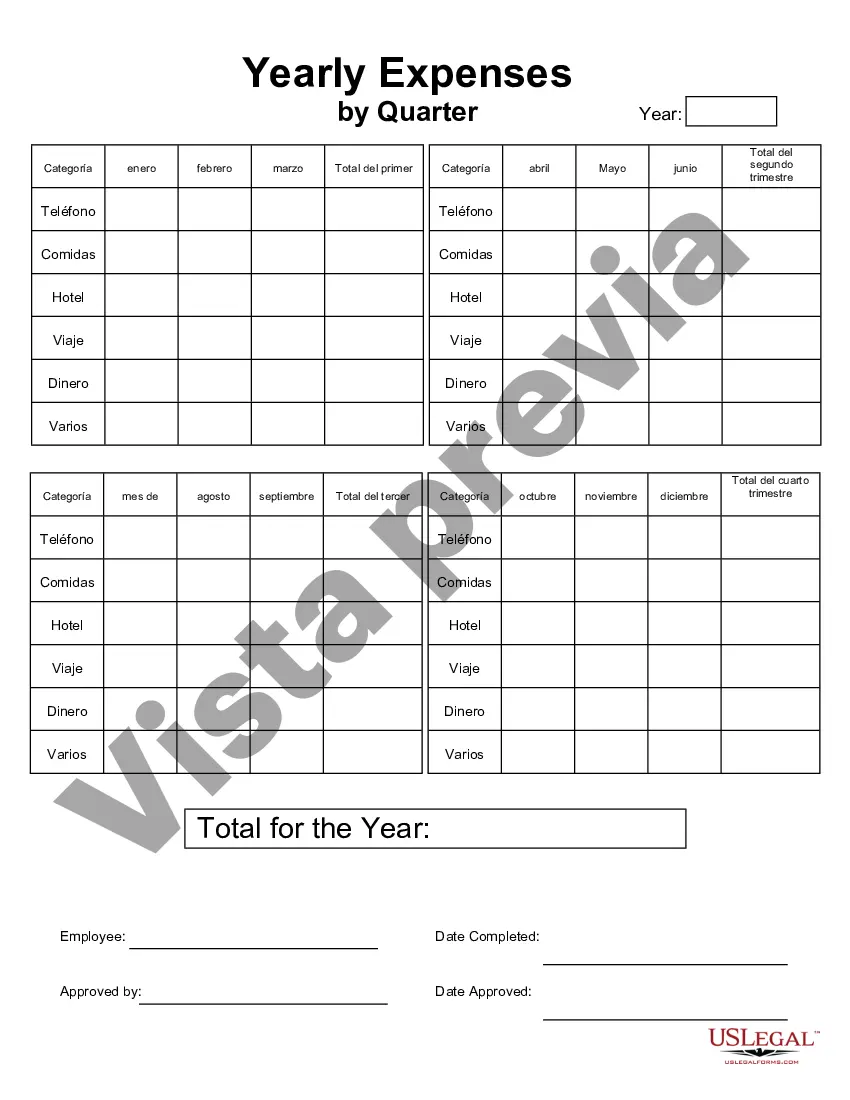

Houston Texas yearly expenses by quarter refer to the detailed breakdown of the financial obligations and costs incurred by individuals, households, or businesses in Houston, Texas, throughout the year. These expenses are categorized and analyzed on a quarterly basis, providing a comprehensive overview of the city's economic landscape. Various types of Houston Texas yearly expenses by quarter include: 1. Housing Costs: Housing expenses encompass rent or mortgage payments, property taxes, homeowners' insurance, home maintenance, and utilities such as electricity, water, and gas. 2. Transportation Expenses: This category covers costs related to commuting, vehicle maintenance, gasoline, public transportation fees, car insurance, tolls, and parking fees. 3. Food and Groceries: Expenses related to food consumption, groceries, dining out, and meal delivery services fall under this category. It includes groceries, restaurant bills, fast food, and meal subscription services. 4. Healthcare Costs: Healthcare expenses include insurance premiums, medical bills, doctor visits, prescription medications, dental care, and health insurance deductibles. 5. Education and Childcare: This category covers expenses related to education, such as tuition fees, school supplies, books, and educational materials. Childcare expenses, including daycare fees, babysitting, and after-school programs, are also accounted for. 6. Entertainment and Recreation: Expenses related to leisure activities, vacations, movie tickets, concerts, sports events, hobbies, and gym memberships fall under this category. 7. Personal Care and Maintenance: This category includes expenses for personal grooming, haircuts, salon services, skincare and beauty products, fitness classes, and spa treatments. 8. Debt Payments: This category includes monthly payments for credit cards, loans, mortgages, student loans, and personal debts. 9. Insurance Premiums: Expenses for various insurance policies, including life insurance, car insurance, health insurance, and homeowners or renters insurance. 10. Taxes: This category covers local, state, and federal taxes including income tax, property tax, sales tax, and business taxes. By analyzing Houston Texas yearly expenses by quarter, individuals or businesses can better understand their financial priorities, monitor spending patterns, identify potential savings opportunities, and make informed budgeting decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Gastos anuales por trimestre - Yearly Expenses by Quarter

Description

How to fill out Houston Texas Gastos Anuales Por Trimestre?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Houston Yearly Expenses by Quarter, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any tasks related to document completion simple.

Here's how you can find and download Houston Yearly Expenses by Quarter.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the similar forms or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and buy Houston Yearly Expenses by Quarter.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Houston Yearly Expenses by Quarter, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you need to cope with an extremely complicated situation, we recommend using the services of a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!

Form popularity

FAQ

Para hacer tu declaracion, necesitas tener tu RFC y una contrasena. Si aun no cuentas con ella puedes generarla desde la pagina web del SAT, para conseguirla no es necesario acudir a las oficinas. Para facilitar el proceso a los contribuyentes, el SAT cuenta con herramientas que te hacen mas facil el trabajo.

Los tipos de deducciones detalladas Intereses hipotecarios que pagas por un maximo de dos viviendas. Impuestos sobre ingresos locales o estatales o los impuestos a las ventas. Impuestos a la propiedad. Gastos medicos y dentales que excedan el 7.5% de tu Ingreso Bruto Ajustado (AGI por sus siglas en ingles)

Las 10 deducciones de impuestos que mas se pasan por alto Impuestos estatales sobre las ventas. Dividendos reinvertidos. Contribuciones beneficas extraordinarias. Intereses pagados sobre prestamos estudiantiles tuyos o de otra persona. Gastos de mudanza para tomar un primer trabajo. Credito por Gastos de Cuidado Menores.

Visite IRS.gov/pagos para ver todas las opciones. Para obtener mas informacion, consulte la Publicacion 505, Retencion de impuestos e impuestos estimados (en ingles).

24 de enero: El IRS comienza la temporada de impuestos de 2022. Comienzan a aceptarse las declaraciones de impuestos individuales de 2021 y comienza el procesamiento.

Medidas que puede tomar ahora para hacer que la presentacion de los impuestos de 2022 sea mas facil Vea la informacion de su cuenta en linea.Recopile y organice sus registros tributarios.Verifique su numero de identificacion personal del contribuyente (ITIN)Asegurese que se le ha retenido suficiente impuesto.

Pasos para presentar una declaracion de impuestos Un formulario W-2 de cada uno de sus empleadores. Otras declaraciones de ingresos e intereses (formularios 1099 y 1099-INT) Recibos de donaciones caritativas, gastos medicos y de negocios, si hace una declaracion detallada.

Para el caso de un emprendedor o una persona que brinda servicios profesionales de forma independiente la cantidad minima para hacer taxes es de $600. Esto debe presentarse a traves del Formulario 1099, que resume los ingresos del ano.

24 de enero: El IRS comienza la temporada de impuestos de 2022. Comienzan a aceptarse las declaraciones de impuestos individuales de 2021 y comienza el procesamiento.

Los gastos de medicinas recetadas son deducibles. Tambien se incluyen en este renglon los gastos de equipo ortopedico. El total de los donativos a entidades sin fines de lucro hasta un total de 50% del ingreso bruto ajustado del contribuyente. Si se dona propiedad apreciada se reduce a 30% del ingreso bruto ajustado.