San Jose is a vibrant city located in the heart of Silicon Valley, California, with a wide range of yearly expenses that fluctuate throughout the four quarters of the year. These expenses are essential for residents and businesses to effectively plan their budgets and financial goals. Let's delve into the quarterly breakdown of San Jose's yearly expenses. 1. San Jose California Yearly Expenses by Quarter: — Q1: January to Marc— - Q2: April to June — Q3: July to Septembe— - Q4: October to December 2. Housing Expenses: — Mortgage Payments: The cost of borrowing for homeowners. — Rent: Monthly payments for residential properties. — Property Taxes: Taxes levied on property ownership. — Home Insurance: Protecting properties against damages and liabilities. — Utilities: Costs for electricity, water, gas, and sewage services. — Maintenance: Regular upkeep and repairs to ensure property functionality. 3. Transportation Expenses: — Car Payments: Monthly installments for vehicle financing. — Gasoline: The cost of fuel to keep vehicles running. — Public Transportation: Fares for commuting through buses, light rail, or trains. — Vehicle Insurance: Coverage to protect against accidents and damages. — Vehicle Maintenance: Regular servicing and repairs to ensure safe driving. 4. Food and Grocery Expenses: — Groceries: Costs of purchasing food items for home consumption. — Dining Out: Expenses incurred while eating at restaurants or cafés.—- Fast Food: Expenses related to quick-service restaurants. — Takeout: Costs for ordering food for delivery or pickup. — Alcohol: Expenses related to purchasing alcoholic beverages. 5. Education Expenses: — Tuition Fees: Costs associated with attending schools or colleges. — Books and Supplies: Expenses for necessary educational materials. — Equipment: Purchasing or leasing technology, instruments, or devices. — Online Learning: Fees for e-learning platforms or courses. 6. Healthcare Expenses: — Health Insurance: Monthly premiums for medical coverage. — Doctor Visits: Costs of regular check-ups and medical consultations. — Medications: Expenses for prescribed or over-the-counter drugs. — Dental Care: Costs related to dental treatments and check-ups. — Emergency Services: Expenses for urgent medical situations. 7. Entertainment and Leisure Expenses: — Movie Tickets: Costs for watching films in theaters. — Concerts and Events: Expenses for attending performances or shows. — Fitness Memberships: Fees for gym or sports club access. — Hobbies: Expenses associated with pursuing personal interests. — Vacations: Costs related to traveling and accommodation. These are just a few examples of the various expenses that residents of San Jose, California, may encounter throughout the year. Budgeting and understanding these expenses by quarter can help individuals and businesses effectively manage their finances and plan for future goals.

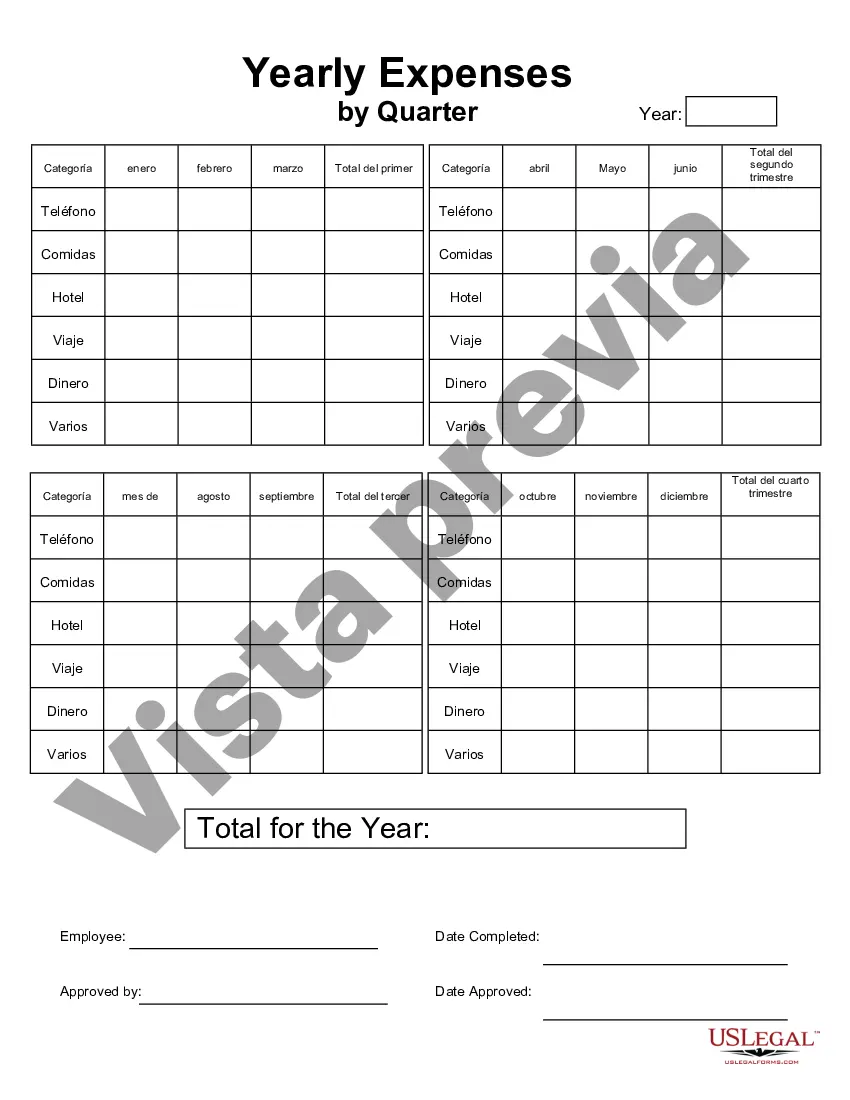

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Gastos anuales por trimestre - Yearly Expenses by Quarter

Description

How to fill out San Jose California Gastos Anuales Por Trimestre?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your region, including the San Jose Yearly Expenses by Quarter.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the San Jose Yearly Expenses by Quarter will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the San Jose Yearly Expenses by Quarter:

- Make sure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the San Jose Yearly Expenses by Quarter on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!