Cook Illinois is a prestigious transportation company that provides various services, including school bus transportation, charter bus services, and tour services. When it comes to their yearly expenses, there are several key components that contribute to their overall financial outlook. 1. Fuel Expenses: As Cook Illinois operates a large fleet of vehicles, a significant yearly expense is attributed to fuel costs. With fuel prices fluctuating throughout the year, this expense is subject to market conditions and is closely monitored by the company's management. 2. Vehicle Maintenance: The company's fleet requires regular maintenance to ensure safe and reliable transportation. Yearly expenses related to vehicle maintenance include repairs, parts replacement, routine inspections, and general upkeep of the entire fleet. This expenditure ensures the safety and longevity of the vehicles. 3. Insurance Cost: As a transportation company, Cook Illinois needs to manage a comprehensive insurance policy to protect its assets and passengers. Yearly expenses include premiums for liability insurance, vehicle insurance, and workers' compensation insurance. Insurance costs are influenced by factors such as fleet size, claims history, and insurance coverage limits. 4. Employee Wages and Benefits: Cook Illinois employs a substantial number of skilled professionals, including drivers, mechanics, administrative staff, and customer service representatives. Yearly expenses encompass salaries, wages, benefits (health insurance, retirement plans, etc.), payroll taxes, and other related expenses associated with maintaining a dedicated workforce. 5. Administrative and Operational Expenses: Cook Illinois incurs various administrative and operational expenses throughout the year. These include office rent, utilities, office supplies, technology infrastructure, software subscriptions, communication systems, marketing expenses, and professional services such as legal and accounting fees. 6. Training and Development: Cook Illinois invests in training and development programs to ensure its employees are well-equipped with the necessary skills and knowledge. This expense covers employee training sessions, professional development courses, safety training, and certifications. 7. Depreciation: Cook Illinois depreciates its fleet over time to account for the wear and tear on the vehicles. Annual depreciation expenses are factored in to accurately reflect the decreasing value of the assets. 8. Taxes and Regulatory Fees: Operating a transportation company involves complying with various regulations and acquiring necessary permits and licenses. Cook Illinois incurs yearly expenses for taxes on income, property taxes, sales taxes, and other regulatory fees imposed by local, state, and federal authorities. It is important to note that the specific amounts and breakdowns of Cook Illinois' yearly expenses may vary from year to year, depending on factors such as economic conditions, fuel prices, fleet size, and company growth.

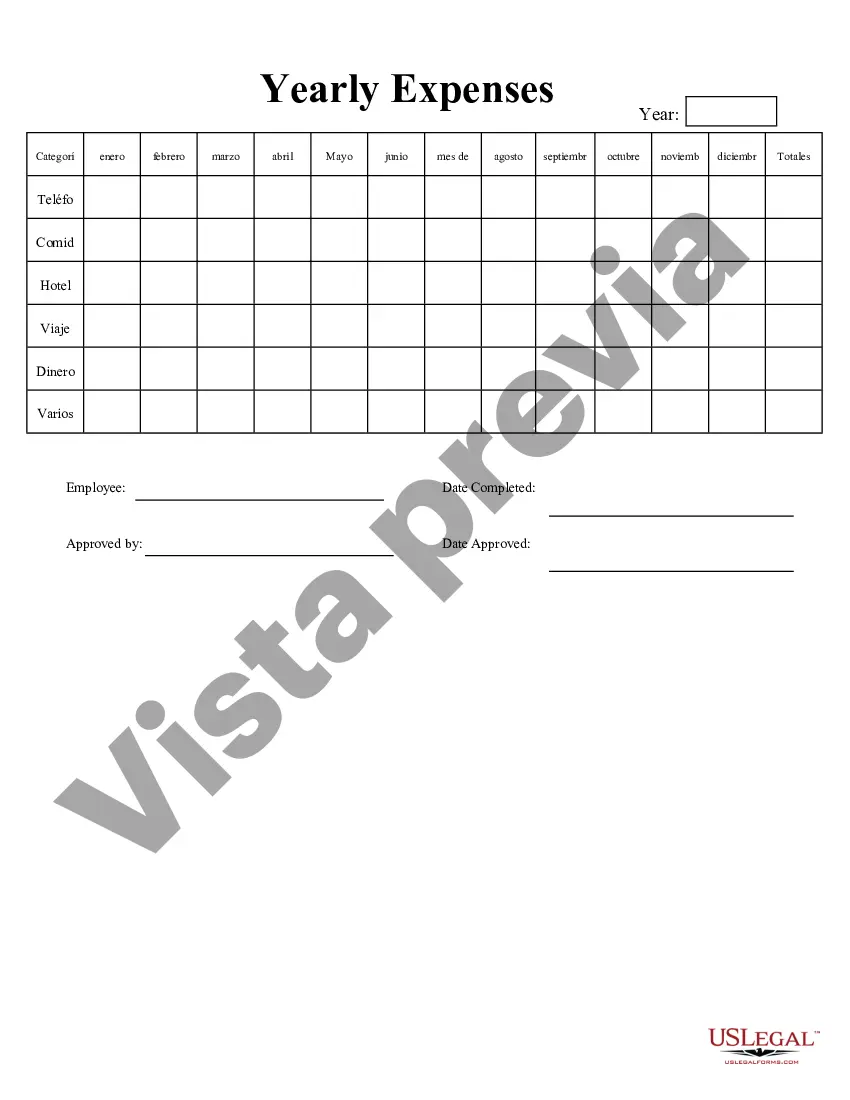

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Gastos Anuales - Yearly Expenses

Description

How to fill out Cook Illinois Gastos Anuales?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Yearly Expenses, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the latest version of the Cook Yearly Expenses, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Yearly Expenses:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cook Yearly Expenses and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!