Harris County, Texas is one of the most populous counties in the United States and is known for its vibrant economy and numerous attractions. Understanding the yearly expenses in Harris County is crucial for residents and potential newcomers to plan their finances effectively. Here, we will provide a detailed description of the various types of Harris Texas yearly expenses, highlighting the relevant keywords to help you navigate this topic. 1. Property Taxes: One of the significant yearly expenses in Harris County is property taxes. Property owners are required to pay taxes based on the assessed value of their real estate holdings. These taxes fund various public services such as schools, law enforcement, infrastructure, and public amenities. The Harris County Appraisal District (HAD) determines property values and sends out tax bills annually. 2. Home Insurance: As a homeowner in Harris County, it is essential to safeguard your property against potential risks such as natural disasters, theft, or accidents. Home insurance policies cover these risks and are an important yearly expense. Keywords: home insurance, homeowners coverage, insurance premiums. 3. Utility Expenses: Electricity, water, gas, and sewer services are essential for a comfortable living in Harris County. Utility expenses can vary depending on factors such as the size of the property, usage, and provider. Keywords: utility bills, electricity costs, water and sewer expenses. 4. Transportation Costs: Harris County provides an extensive transportation network, including roadways, public transportation options, and toll roads. Commuters and residents may need to budget for gas or fuel expenses, vehicle maintenance, toll fees, and public transportation fares. Keywords: transportation costs, fuel expenses, toll fees. 5. Healthcare: Access to healthcare services is a significant part of the yearly expenses in Harris County. Residents must consider costs related to health insurance premiums, co-payments, prescriptions, and out-of-pocket expenses. Keywords: healthcare costs, health insurance, medical expenses. 6. Education: For families with children, education expenses play a vital role. Harris County offers various educational opportunities, including public schools, private institutions, and universities. While public schooling is generally funded through property taxes, private schools and higher education options may involve tuition and associated fees. Keywords: education expenses, tuition fees, school costs. 7. Groceries and Essential Goods: The cost of groceries and essential goods can vary depending on personal preferences, dietary needs, and shopping habits. These expenses are subjective, but some common keywords related to shopping in Harris County include grocery expenses, food costs, and essential goods expenditures. 8. Entertainment and Recreation: Harris County offers a wide array of entertainment and recreational activities, such as dining out, visiting parks, attending cultural events, or exploring the local attractions. These activities may involve expenses like dining expenses, event ticket prices, recreational facility fees, or outdoor equipment rentals. Keywords: entertainment costs, recreation expenses, leisure activities. Understanding and planning for these yearly expenses in Harris County, Texas, will help individuals and families effectively manage their budgets and enjoy a comfortable lifestyle in this dynamic region.

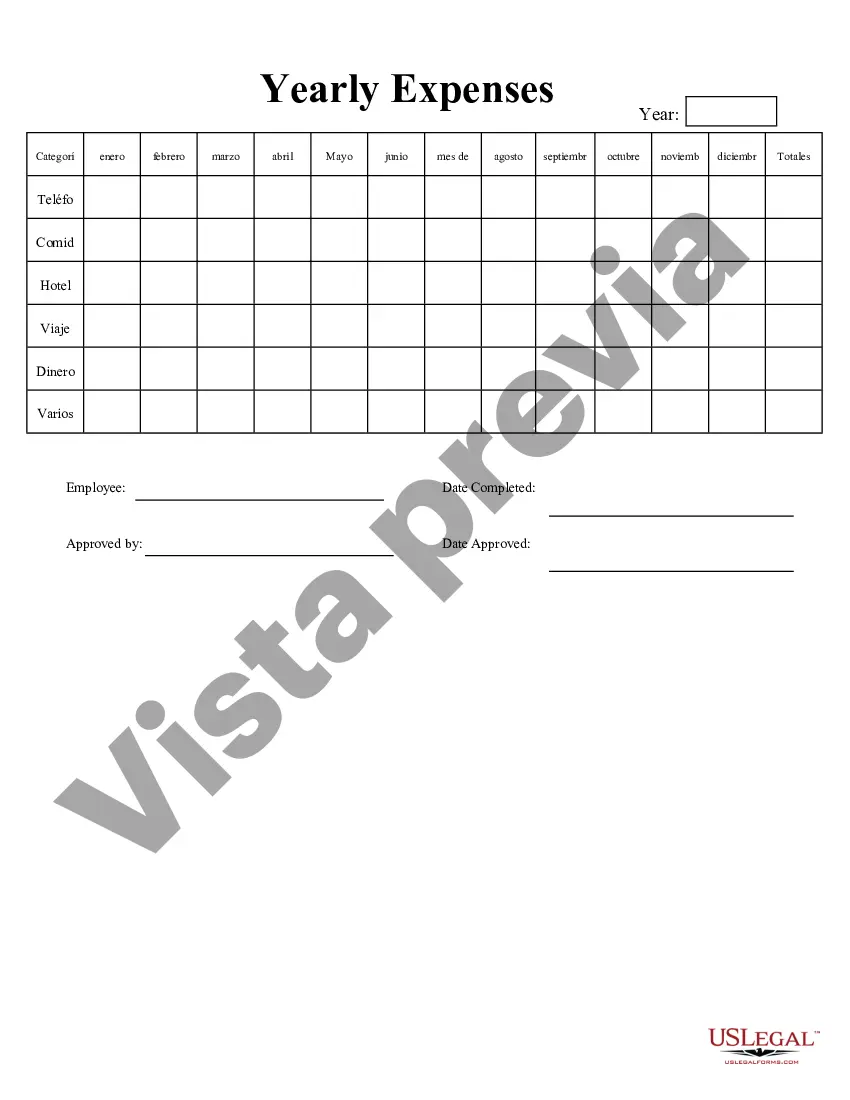

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Gastos Anuales - Yearly Expenses

Description

How to fill out Harris Texas Gastos Anuales?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Harris Yearly Expenses, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Harris Yearly Expenses, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Yearly Expenses:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Harris Yearly Expenses and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!