Mecklenburg County, located in the state of North Carolina, encompasses the vibrant city of Charlotte and its surrounding areas. Understanding Mecklenburg North Carolina's yearly expenses is crucial for residents or businesses planning their budgets. This detailed description explores various types of expenses one can expect in Mecklenburg County, incorporating relevant keywords to enhance its relevance. 1. Property Taxes: Mecklenburg County levies property taxes on real estate and personal property. The tax rate is expressed in cents per $100 of assessed value, and it varies depending on the property's location within the county. The North Carolina Property Tax Commission assesses these taxes annually, and property owners must consider this expense when planning their budget. 2. Sales Taxes: Sales taxes in Mecklenburg County consist of state, county, and local sales taxes. The current combined sales tax rate is 7.25%, with the county portion being 2.5%. This tax is applicable to various goods and services purchased within the county, and it contributes to the county's revenue. 3. Income Taxes: North Carolina imposes a state income tax on individuals. Mecklenburg County aligns with the state income tax rates ranging from 5.25% to 5.499% based on an individual's income bracket. These taxes are calculated annually based on an individual's earnings and are due to the state government. 4. Vehicle Taxes: Residents of Mecklenburg County must pay an annual vehicle tax based on the value of their registered vehicle. This tax is collected to support county operations and infrastructure development. The vehicle tax rate varies depending on the vehicle's value and the county tax rate. 5. Utilities Expenses: Mecklenburg County residents have utility expenses, which include electricity, water, gas, and sewage services. These costs vary depending on usage and specific providers chosen by the customer. It is important to consider these expenses in yearly budgeting. 6. Education Expenses: Families in Mecklenburg County bear education expenses for their children attending public or private schools. Public schools are funded by local, state, and federal resources, with some additional costs for extracurricular activities or specialized programs. Private schools typically have tuition fees that vary based on the institution. 7. Healthcare Expenses: Residents residing in Mecklenburg County need to consider healthcare expenses such as health insurance premiums, co-pays, deductibles, and out-of-pocket expenses. These costs vary depending on the chosen healthcare provider, insurance plan, and an individual's specific needs. 8. Housing Costs: Housing costs encompass rent or mortgage payments, property insurance, and maintenance fees. These costs vary depending on the property type, location, size, and market conditions. Mecklenburg County offers a diverse range of housing options, including apartments, condos, townhouses, and single-family homes. 9. Transportation Expenses: Transportation costs in Mecklenburg County include fuel expenses, vehicle maintenance and repairs, public transportation fees, tolls, and parking fees. The individual's transportation needs, vehicle type, and reliance on public transportation influence these expenses. 10. Entertainment and Recreation Expenses: Mecklenburg County offers a plethora of recreational activities and entertainment options, such as dining out, visiting museums, attending concerts or sports events, and exploring parks. These expenses vary based on personal preferences and leisure activities chosen by residents. By considering these Mecklenburg North Carolina yearly expenses, individuals and businesses can better plan their budgets in order to effectively allocate resources and meet their financial goals within the county.

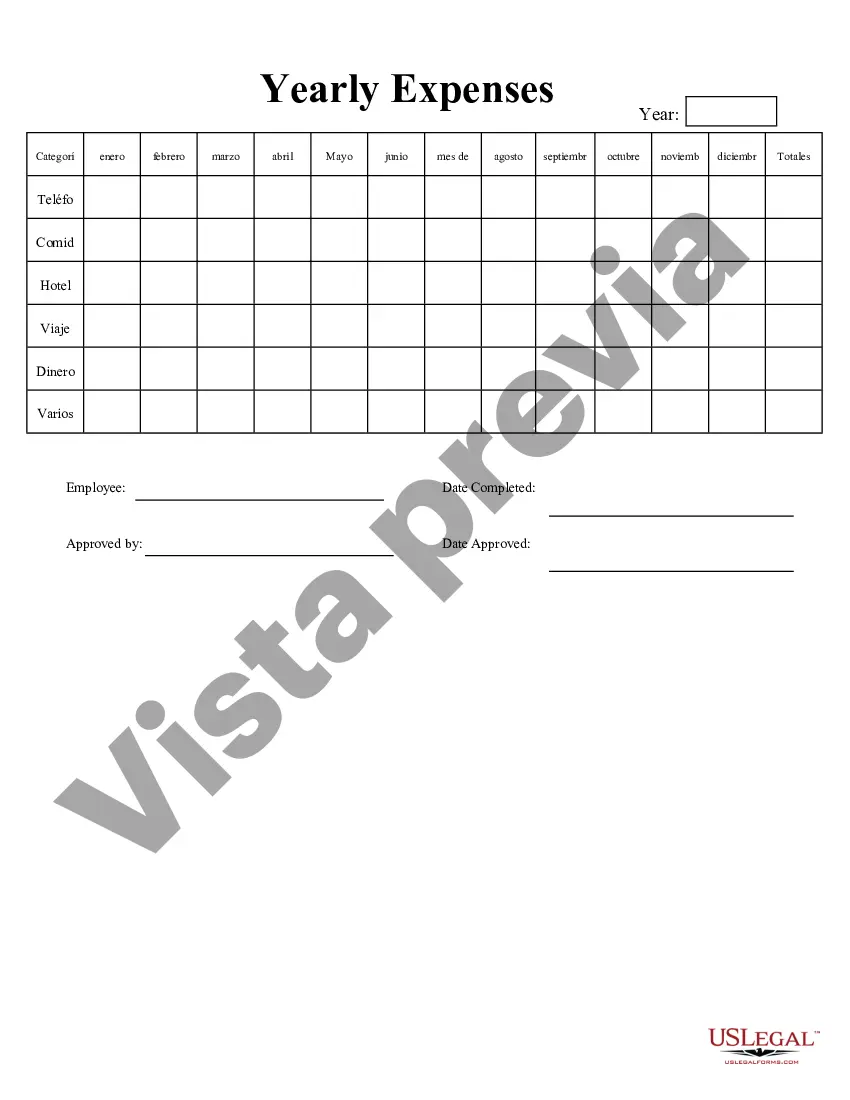

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Gastos Anuales - Yearly Expenses

Description

How to fill out Mecklenburg North Carolina Gastos Anuales?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Mecklenburg Yearly Expenses, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the Mecklenburg Yearly Expenses, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Yearly Expenses:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Mecklenburg Yearly Expenses and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!