San Jose, California, is a vibrant city known for its thriving technology industry, pleasant climate, and diverse community. As with any city, residents and visitors alike encounter various yearly expenses to maintain a comfortable and fulfilling lifestyle in this bustling urban hub. Let's delve into a detailed description of some common San Jose California yearly expenses: 1. Housing Expenses: — Rent/Mortgage: San Jose is infamous for its high housing costs, with rental prices averaging around $2,800 per month for a one-bedroom apartment and $3,900 for a three-bedroom unit. Owning a home can result in monthly mortgage payments ranging from $3,500 to $6,000. — Property Taxes: Property owners in San Jose face an annual property tax, typically based on the value of their property. 2. Utilities: — Electricity and Gas: The average monthly bill for electricity and gas in San Jose hovers around $170, depending on usage and the size of the property. — Water and Sewage: Monthly water and sewage costs average approximately $70, which may vary based on consumption. 3. Transportation: — Vehicle Expenses: Owning a car comes with associated costs such as car payments (if financed), insurance (around $1,200 per year), registration fees, and maintenance expenses. — Public Transportation: If you rely on public transportation, consider expenses for bus or light rail passes, which range from $65 to $100 per month. 4. Food and Groceries: — Dining Out: San Jose offers an array of culinary options, from trendy eateries to ethnic delights. Individuals who enjoy dining out may allocate around $300 to $500 per month for restaurant bills. — Grocery Shopping: On average, a monthly grocery bill for a family of four can range from $500 to $700. 5. Healthcare: — Health Insurance: Depending on your age, health conditions, and coverage, health insurance costs in San Jose can vary significantly. On average, annual premiums for an individual amount to around $400 to $550 per month. — Medical Expenses: Consider out-of-pocket expenses for doctor visits, medications, and emergency care. Having an emergency fund to cover unexpected medical costs is crucial. 6. Education: — SchoolingWhereasts's private schools or college tuition, education expenses depend on the level of education and institution choices. Costs can range from a few thousand to tens of thousands of dollars per year. 7. Recreation and Entertainment: — San Jose offers an abundance of recreational activities and entertainment options such as sports, concerts, museums, and parks. Budgeting around $100 to $300 per month for leisure activities can ensure an enjoyable experience. It's essential to note that these San Jose California yearly expenses can vary based on personal lifestyle choices, family size, and individual circumstances. Planning and managing finances wisely can help residents navigate the cost of living in this vibrant city while enjoying all that San Jose has to offer.

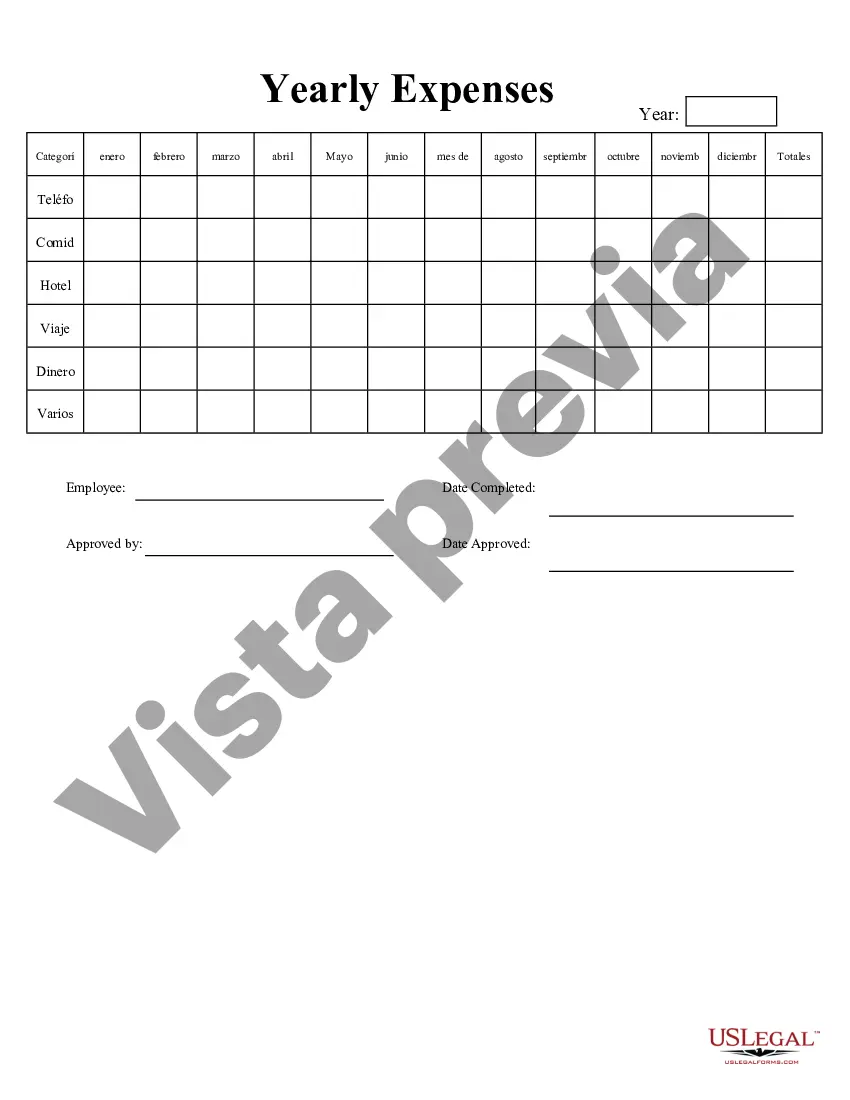

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Gastos Anuales - Yearly Expenses

Description

How to fill out San Jose California Gastos Anuales?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like San Jose Yearly Expenses is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the San Jose Yearly Expenses. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Yearly Expenses in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!