Suffolk County, located in the state of New York, encompasses a diverse range of expenses that residents and businesses encounter on a yearly basis. From housing costs to transportation expenses, understanding the various types of Suffolk New York yearly expenses is essential for financial planning and decision-making. Here is a detailed description of some key expense categories and their associated keywords: 1. Housing Expenses: The cost of housing in Suffolk County can vary depending on location, property type, and size. Common housing expenses include mortgage or rent payments, property taxes, homeowners or renters insurance, and utility bills (electricity, gas, water, internet). 2. Transportation Expenses: Suffolk County offers a variety of transportation options, including private vehicles, public transportation, and ride-share services. Relevant yearly expenses may include car payments, auto insurance, gasoline, vehicle maintenance and repairs, tolls, parking fees, public transportation fares, and ride-share fees. 3. Education Expenses: Suffolk County boasts several quality educational institutions, making education expenses crucial for families. These can include tuition fees (for private schools or colleges), education supplies, textbooks, extracurricular activities, and school-related transportation costs. 4. Health Expenses: Maintaining good health is vital, and Suffolk County provides various healthcare facilities and services. Yearly health expenses may encompass health insurance premiums, co-pays for doctor visits and prescriptions, over-the-counter medications, dental and vision care, and contributions to health savings accounts. 5. Food Expenses: Suffolk County offers an impressive array of dining options, ranging from grocery stores to local eateries. Yearly food expenses might include groceries, dining out, meal delivery services, and occasional indulgences. 6. Entertainment Expenses: Residents of Suffolk County can enjoy a vibrant cultural scene and recreational opportunities. Entertainment expenses may consist of costs for movies, concerts, sporting events, museums, theme parks, memberships to recreational facilities, and other leisure activities. 7. Personal Expenses: Personal expenses relate to various aspects of daily life. This category can include clothing purchases, personal care products, fitness memberships or classes, hobbies, subscriptions (streaming platforms, magazines), and vacation expenses. 8. Taxes: Suffolk County residents are subject to different types of taxes. These include property taxes, income taxes, sales tax (on purchases), and potentially additional local taxes. Understanding and accounting for these various Suffolk New York yearly expenses is essential for creating an accurate and realistic budget. Prioritize tracking and managing these expenses to ensure a healthy financial balance and achieve your financial goals.

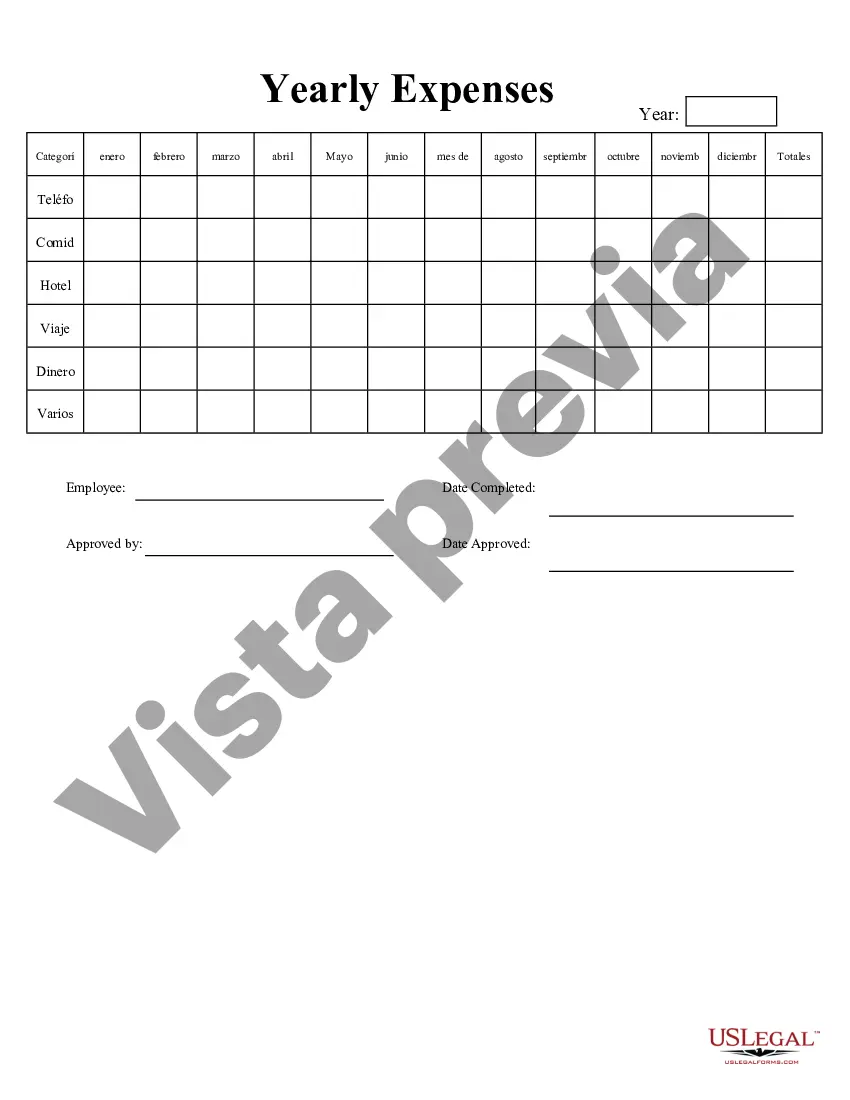

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Gastos Anuales - Yearly Expenses

Description

How to fill out Suffolk New York Gastos Anuales?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your county, including the Suffolk Yearly Expenses.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Suffolk Yearly Expenses will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Suffolk Yearly Expenses:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Suffolk Yearly Expenses on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!