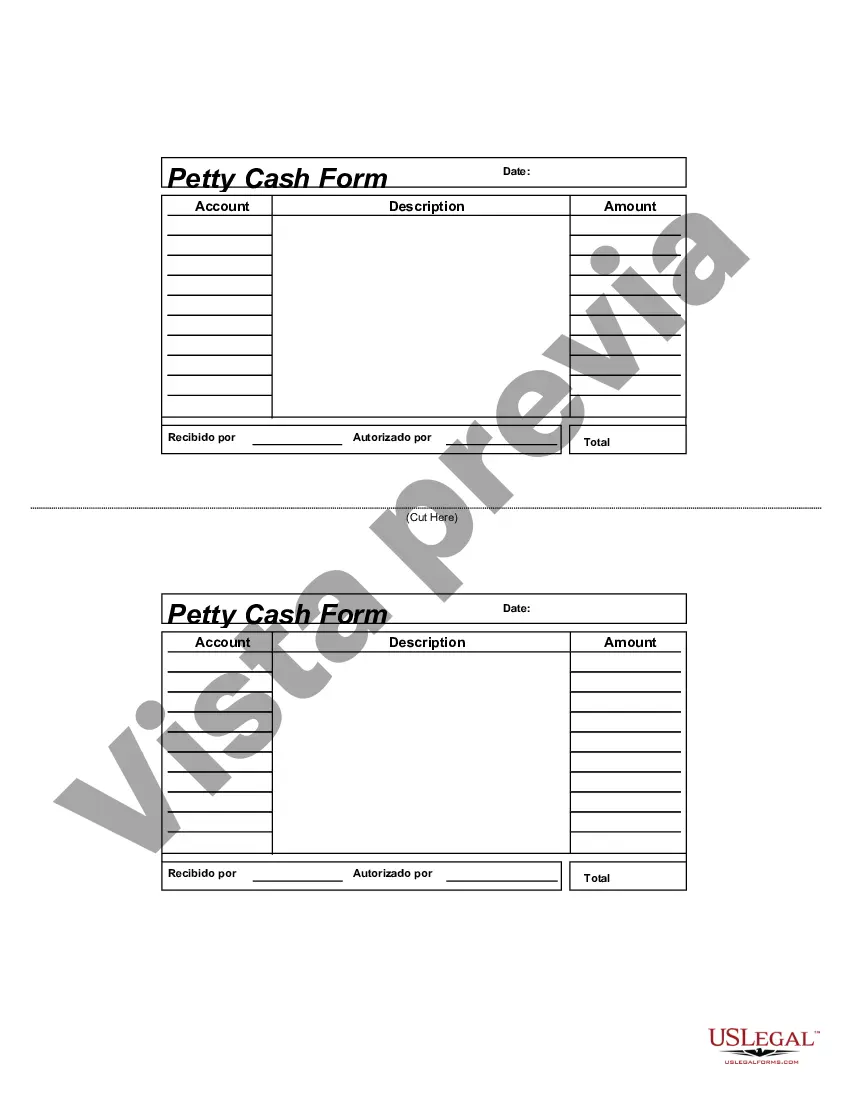

Houston Texas Petty Cash Form is a crucial tool used by businesses and institutions to manage small cash expenditures and track the usage of petty cash funds. This form typically includes various fields that need to be filled out accurately and thoroughly to ensure efficient financial record-keeping. The primary purpose of a Houston Texas Petty Cash Form is to document cash transactions and provide a paper trail for cash expenditures. It enables businesses to maintain accountability and control over petty cash funds, which are usually used for minor expenses such as office supplies, employee reimbursements, and occasional miscellaneous costs. A typical Houston Texas Petty Cash Form consists of the following key sections: 1. Date: The exact date when the petty cash transaction occurred. 2. Payee Name: The name of the individual or vendor receiving the cash payment. 3. Purpose/Description: A detailed explanation of the purpose of the cash disbursement, such as "office supplies purchase," "employee meal reimbursement," or "parking fees." 4. Amount: The exact amount of cash disbursed for the specified purpose. 5. Approved By: The authorized individual who approves the petty cash transaction, often a supervisor or manager. 6. Receipt: A spot for attaching the original receipt or supporting documents for the expenditure. 7. Account/Code: The specific account or cost code to which the expenditure should be allocated for proper financial tracking. 8. Cash Received By: The name of the person responsible for maintaining and distributing the petty cash funds. In addition to the standard Petty Cash Form, there may be variations or specialized forms used in Houston, Texas, based on specific organizational needs or industry requirements. These may include: 1. Employee Reimbursement Petty Cash Form: Designed specifically for employee reimbursements, this form may include additional fields such as employee ID, department, and any required supporting documentation. 2. Event Expense Petty Cash Form: Used for tracking and authorizing cash expenditures related to events or conferences held in Houston, Texas, this form may have sections for event details, vendor information, and specific event codes. 3. Travel Expense Petty Cash Form: This form caters to reimbursing employees for travel-related expenses incurred within Houston, Texas, and may include fields for travel dates, transportation costs, lodging expenses, and per diem allowances. By utilizing Houston Texas Petty Cash Forms, organizations can maintain accurate financial records, limit cash-related issues, and ensure transparency in cash management processes. These forms are essential for businesses to stay organized and compliant with financial regulations and policies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Formulario de caja chica - Petty Cash Form

Description

How to fill out Houston Texas Formulario De Caja Chica?

Preparing paperwork for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Houston Petty Cash Form without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Houston Petty Cash Form on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Houston Petty Cash Form:

- Look through the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!