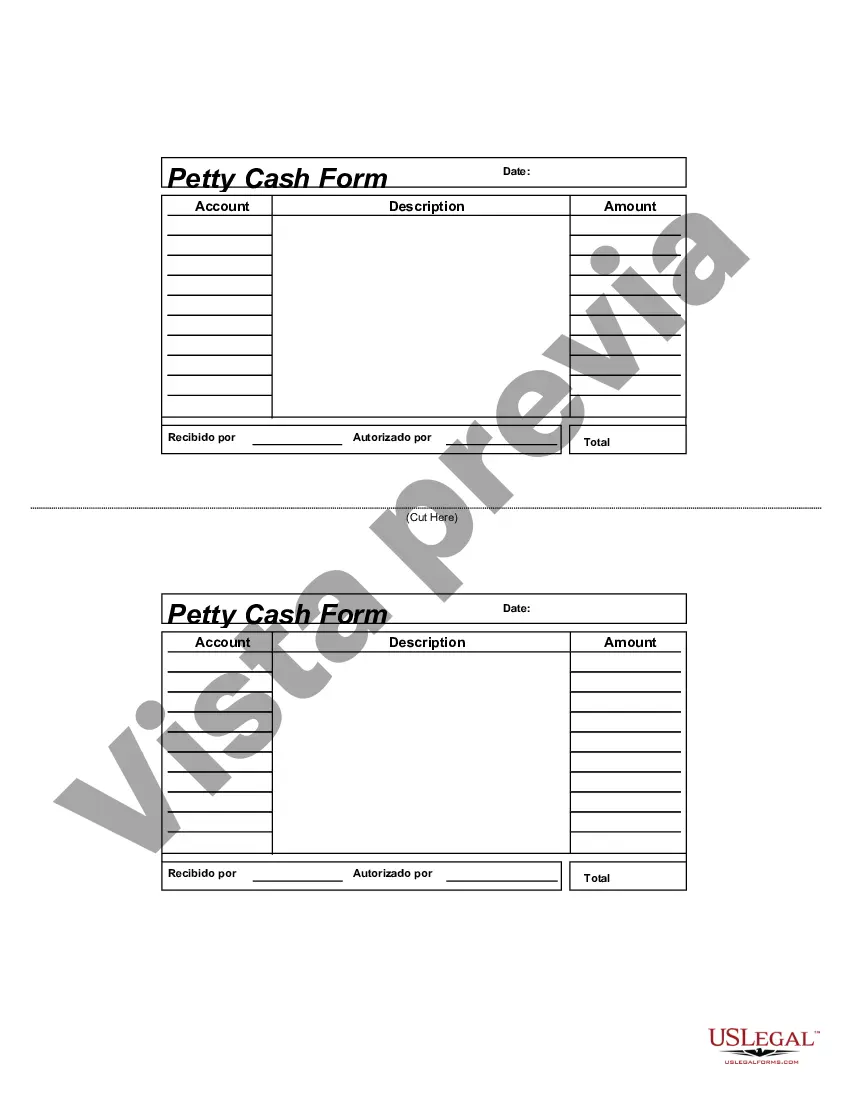

San Antonio, Texas Petty Cash Form: A Comprehensive Guide When it comes to managing petty cash in San Antonio, Texas, having a thorough understanding of the San Antonio Texas Petty Cash Form is essential. This form serves as a vital tool for recording petty cash transactions, ensuring transparency, and maintaining accurate financial records. The San Antonio Texas Petty Cash Form is designed to facilitate the tracking of small, everyday expenses that occur in various departments or organizations. It helps maintain a clear record of petty cash disbursements and serves as a means of controlling and monitoring these expenditures. Outlined below are the key components of the San Antonio Texas Petty Cash Form: 1. Form Header: The top of the form typically includes the organization's name, address, contact information, and the form's title for easy identification. 2. Date and Reference Number: This section is crucial for recording the date the petty cash form is prepared and assigning a unique reference number to it. This helps in easy retrieval and cross-referencing. 3. Prepared By: The name and designation of the person responsible for preparing the form are mentioned in this portion. This information ensures accountability and helps in case of any discrepancies. 4. Purpose of Petty Cash: In this section, the purpose for which the petty cash is requested is mentioned. It could be for reimbursing small expenses like office supplies, minor repairs, or travel expenses, among others. 5. Amount Requested: The requested amount of petty cash is stated here. It is important to be precise and reasonable while requesting funds to avoid any misuse or unnecessary expenses. 6. Authorized Signatories: The San Antonio Texas Petty Cash Form should include spaces for authorized personnel to sign and approve the petty cash request. This ensures that the disbursement is authorized and in line with organizational policies. 7. Petty Cash Log: A designated area is provided to record each expenditure made from the petty cash fund. This includes fields such as date, description of the expense, amount disbursed, receipt reference (if applicable), and the person who received the funds. This log helps to maintain a clear record of all transactions. Types of San Antonio Texas Petty Cash Forms: While the core elements of the San Antonio Texas Petty Cash Form remain the same, there can be variations based on the specific needs of an organization. These variations might include: 1. Reimbursement Petty Cash Form: Used when employees need to be reimbursed for expenses made on behalf of the organization. This form focuses on recording individual expenses and facilitating prompt reimbursement. 2. Department-specific Petty Cash Form: Different departments within an organization may require separate petty cash forms to track expenses unique to their operations. This helps maintain transparency within each department's budget and facilitates accurate financial reporting. In conclusion, the San Antonio Texas Petty Cash Form is an indispensable document for monitoring and controlling petty cash expenditures. By adhering to its guidelines and utilizing the appropriate forms, organizations in San Antonio, Texas can maintain financial transparency and effectively manage their petty cash funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Formulario de caja chica - Petty Cash Form

Description

How to fill out San Antonio Texas Formulario De Caja Chica?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Antonio Petty Cash Form, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Antonio Petty Cash Form from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the San Antonio Petty Cash Form:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!